An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock Locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Hurricanes Helene and Milton

Need help? Learn about SBA disaster assistance.

Write your business plan

Business plans help you run your business.

A good business plan guides you through each stage of starting and managing your business. You’ll use your business plan as a roadmap for how to structure, run, and grow your new business. It’s a way to think through the key elements of your business.

Business plans can help you get funding or bring on new business partners. Investors want to feel confident they’ll see a return on their investment. Your business plan is the tool you’ll use to convince people that working with you — or investing in your company — is a smart choice.

Pick a business plan format that works for you

There’s no right or wrong way to write a business plan. What’s important is that your plan meets your needs.

Most business plans fall into one of two common categories: traditional or lean startup.

Traditional business plans are more common, use a standard structure, and encourage you to go into detail in each section. They tend to require more work upfront and can be dozens of pages long.

Lean startup business plans are less common but still use a standard structure. They focus on summarizing only the most important points of the key elements of your plan. They can take as little as one hour to make and are typically only one page.

Traditional business plan

Lean startup plan

Traditional business plan format

You might prefer a traditional business plan format if you’re very detail-oriented, want a comprehensive plan, or plan to request financing from traditional sources.

When you write your business plan, you don’t have to stick to the exact business plan outline. Instead, use the sections that make the most sense for your business and your needs. Traditional business plans use some combination of these nine sections.

Executive summary

Briefly tell your reader what your company is and why it will be successful. Include your mission statement, your product or service, and basic information about your company’s leadership team, employees, and location. You should also include financial information and high-level growth plans if you plan to ask for financing.

Company description

Use your company description to provide detailed information about your company. Go into detail about the problems your business solves. Be specific, and list out the consumers, organization, or businesses your company plans to serve.

Explain the competitive advantages that will make your business a success. Are there experts on your team? Have you found the perfect location for your store? Your company description is the place to boast about your strengths.

Market analysis

You'll need a good understanding of your industry outlook and target market. Competitive research will show you what other businesses are doing and what their strengths are. In your market research, look for trends and themes. What do successful competitors do? Why does it work? Can you do it better? Now's the time to answer these questions.

Organization and management

Tell your reader how your company will be structured and who will run it.

Describe the legal structure of your business. State whether you have or intend to incorporate your business as a C or an S corporation, form a general or limited partnership, or if you're a sole proprietor or limited liability company (LLC).

Use an organizational chart to lay out who's in charge of what in your company. Show how each person's unique experience will contribute to the success of your venture. Consider including resumes and CVs of key members of your team.

Service or product line

Describe what you sell or what service you offer. Explain how it benefits your customers and what the product lifecycle looks like. Share your plans for intellectual property, like copyright or patent filings. If you're doing research and development for your service or product, explain it in detail.

Marketing and sales

There's no single way to approach a marketing strategy. Your strategy should evolve and change to fit your unique needs.

Your goal in this section is to describe how you'll attract and retain customers. You'll also describe how a sale will actually happen. You'll refer to this section later when you make financial projections, so make sure to thoroughly describe your complete marketing and sales strategies.

Funding request

If you're asking for funding, this is where you'll outline your funding requirements. Your goal is to clearly explain how much funding you’ll need over the next five years and what you'll use it for.

Specify whether you want debt or equity, the terms you'd like applied, and the length of time your request will cover. Give a detailed description of how you'll use your funds. Specify if you need funds to buy equipment or materials, pay salaries, or cover specific bills until revenue increases. Always include a description of your future strategic financial plans, like paying off debt or selling your business.

Financial projections

Supplement your funding request with financial projections. Your goal is to convince the reader that your business is stable and will be a financial success.

If your business is already established, include income statements, balance sheets, and cash flow statements for the last three to five years. If you have other collateral you could put against a loan, make sure to list it now.

Provide a prospective financial outlook for the next five years. Include forecasted income statements, balance sheets, cash flow statements, and capital expenditure budgets. For the first year, be even more specific and use quarterly — or even monthly — projections. Make sure to clearly explain your projections, and match them to your funding requests.

This is a great place to use graphs and charts to tell the financial story of your business.

Use your appendix to provide supporting documents or other materials were specially requested. Common items to include are credit histories, resumes, product pictures, letters of reference, licenses, permits, patents, legal documents, and other contracts.

Example traditional business plans

Before you write your business plan, read the following example business plans written by fictional business owners. Rebecca owns a consulting firm, and Andrew owns a toy company.

Lean startup format

You might prefer a lean startup format if you want to explain or start your business quickly, your business is relatively simple, or you plan to regularly change and refine your business plan.

Lean startup formats are charts that use only a handful of elements to describe your company’s value proposition, infrastructure, customers, and finances. They’re useful for visualizing tradeoffs and fundamental facts about your company.

There are different ways to develop a lean startup template. You can search the web to find free templates to build your business plan. We discuss nine components of a model business plan here:

Key partnerships

Note the other businesses or services you’ll work with to run your business. Think about suppliers, manufacturers, subcontractors, and similar strategic partners.

Key activities

List the ways your business will gain a competitive advantage. Highlight things like selling direct to consumers, or using technology to tap into the sharing economy.

Key resources

List any resource you’ll leverage to create value for your customer. Your most important assets could include staff, capital, or intellectual property. Don’t forget to leverage business resources that might be available to women , veterans , Native Americans , and HUBZone businesses .

Value proposition

Make a clear and compelling statement about the unique value your company brings to the market.

Customer relationships

Describe how customers will interact with your business. Is it automated or personal? In person or online? Think through the customer experience from start to finish.

Customer segments

Be specific when you name your target market. Your business won’t be for everybody, so it’s important to have a clear sense of whom your business will serve.

List the most important ways you’ll talk to your customers. Most businesses use a mix of channels and optimize them over time.

Cost structure

Will your company focus on reducing cost or maximizing value? Define your strategy, then list the most significant costs you’ll face pursuing it.

Revenue streams

Explain how your company will actually make money. Some examples are direct sales, memberships fees, and selling advertising space. If your company has multiple revenue streams, list them all.

Example lean business plan

Before you write your business plan, read this example business plan written by a fictional business owner, Andrew, who owns a toy company.

Need help? Get free business counseling

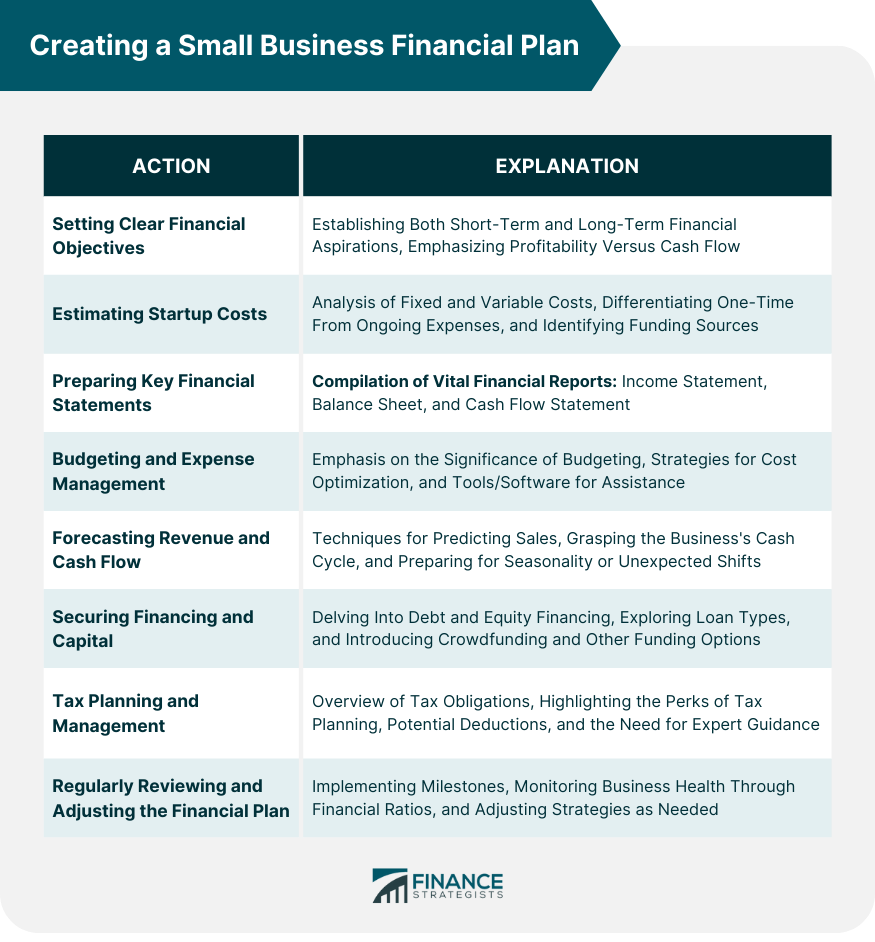

- Creating a Small Business Financial Plan

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on September 02, 2023

Are You Retirement Ready?

Table of contents, financial plan overview.

A financial plan is a comprehensive document that charts a business's monetary objectives and the strategies to achieve them. It encapsulates everything from budgeting and forecasting to investments and resource allocation.

For small businesses, a solid financial plan provides direction, helping them navigate economic challenges, capitalize on opportunities, and ensure sustainable growth.

The strength of a financial plan lies in its ability to offer a clear roadmap for businesses.

Especially for small businesses that may not have a vast reserve of resources, prioritizing financial goals and understanding where every dollar goes can be the difference between growth and stagnation.

It lends clarity, ensures informed decision-making, and sets the stage for profitability and success.

Understanding the Basics of Financial Planning for Small Businesses

Role of financial planning in business success.

Financial planning is the backbone of any successful business endeavor. It serves as a compass, guiding businesses toward profitability, stability, and growth.

With proper financial planning, businesses can anticipate potential cash shortfalls, make informed investment decisions, and ensure they have the capital needed to seize new opportunities.

For small businesses, in particular, tight financial planning can mean the difference between thriving and shuttering. Given the limited resources, it's vital to maximize every dollar and anticipate financial challenges.

Through diligent planning, small businesses can position themselves competitively, adapt to market changes, and drive consistent growth.

Core Components of a Financial Plan for Small Businesses

Every financial plan comprises several core components that, together, provide a holistic view of a business's financial health and direction. These include setting clear objectives, estimating costs , preparing financial statements , and considering sources of financing.

Each component plays a pivotal role in ensuring a thorough and actionable financial strategy .

For small businesses, these components often need a more granular approach. Given the scale of operations, even minor financial missteps can have significant repercussions.

As such, it's essential to tailor each component, ensuring they address specific challenges and opportunities that small businesses face, from initial startup costs to revenue forecasting and budgetary constraints.

Setting Clear Small Business Financial Objectives

Identifying business's short-term and long-term financial goals.

Every business venture starts with a vision. Translating this vision into actionable financial goals is the essence of effective planning.

Short-term goals could range from securing initial funding and achieving a set monthly revenue to covering startup costs. These targets, usually spanning a year or less, set the immediate direction for the business.

On the other hand, long-term financial goals delve into the broader horizon. They might encompass aspirations like expanding to new locations, diversifying product lines, or achieving a specific market share within a decade.

By segmenting goals into short-term and long-term, businesses can craft a step-by-step strategy, making the larger vision more attainable and manageable.

Understanding the Difference Between Profitability and Cash Flow

Profitability and cash flow, while closely linked, are distinct concepts in the financial realm. Profitability pertains to the ability of a business to generate a surplus after deducting all expenses.

It's a metric of success and indicates the viability of a business model . Simply put, it answers whether a business is making more than it spends.

In contrast, cash flow represents the inflow and outflow of cash within a business. A company might be profitable on paper yet struggle with cash flow if, for instance, clients delay payments or unexpected expenses arise.

For small businesses, maintaining positive cash flow is paramount. It ensures that they can cover operational costs, pay employees, and reinvest in growth, even if they're awaiting payments or navigating financial hiccups.

Estimating Small Business Startup Costs (for New Businesses)

Fixed vs variable costs.

When embarking on a new business venture, understanding costs is paramount. Fixed costs remain consistent regardless of production levels. They include expenses like rent, salaries, and insurance . These are predictable outlays that don't fluctuate with business performance.

Variable costs , conversely, change in direct proportion to production or business activity. Think of costs associated with materials for manufacturing or commission for sales .

For a startup, delineating between fixed and variable costs aids in crafting a more dynamic budget, allowing for adaptability as the business scales and evolves.

One-Time Expenditures vs Ongoing Expenses

Startups often grapple with numerous upfront costs. From purchasing equipment and setting up a workspace to initial marketing campaigns, these one-time expenditures lay the foundation for business operations.

They differ from ongoing expenses like utility bills, raw materials, or employee wages that recur monthly or annually.

For a small business owner, distinguishing between these costs is critical. One-time expenditures often demand a larger chunk of initial capital, while ongoing expenses shape the monthly and annual budget.

By categorizing them separately, businesses can strategize funding needs more effectively, ensuring they're equipped to meet both immediate and recurrent financial obligations.

Funding Sources for Small Businesses

Personal savings.

This is often the most straightforward way to fund a startup. Entrepreneurs tap into their personal savings accounts to jumpstart their business.

While this method has the benefit of not incurring debt or diluting company ownership, it intertwines the individual's personal financial security with the business's fate.

The entrepreneur must be prepared for potential losses, and there's the evident psychological strain of putting one's hard-earned money on the line.

Loans can be sourced from various institutions, from traditional banks to credit unions . They offer a substantial sum of money that can be paid back over time, usually with interest .

The main advantage of taking a loan is that the entrepreneur retains full ownership and control of the business.

However, there's the obligation of monthly repayments, which can strain a business's cash flow, especially in its early days. Additionally, securing a loan often requires collateral and a sound credit history.

Investors, including angel investors and venture capitalists , offer capital in exchange for equity or a stake in the company.

Angel investors are typically high-net-worth individuals who provide funding in the initial stages, while venture capitalists come in when there's proven business potential, often injecting larger sums. The advantage is substantial funding without the immediate pressure of repayments.

However, in exchange for their investment, they often seek a say in business decisions, which might mean compromising on some aspects of the original business vision.

Grants are essentially 'free money' often provided by government programs, non-profit organizations, or corporations to promote innovation and support businesses in specific sectors.

The primary advantage of grants is that they don't need to be repaid, nor do they dilute company ownership. However, they can be highly competitive and might come with stipulations on how the funds should be used.

Moreover, the application process can be lengthy and requires showcasing the business's potential or alignment with the specific goals or missions of the granting institution.

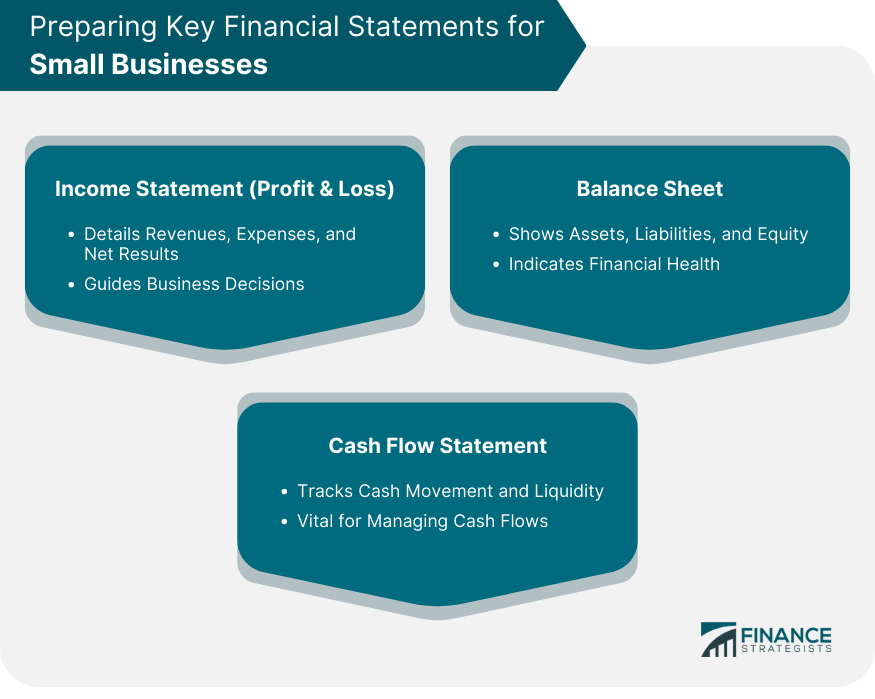

Preparing Key Financial Statements for Small Businesses

Income statement (profit & loss).

An Income Statement , often termed as the Profit & Loss statement , showcases a business's financial performance over a specific time frame. It details revenues , expenses, and ultimately, profits or losses.

By analyzing this statement, business owners can pinpoint revenue drivers, identify exorbitant costs, and understand the net result of their operations.

For small businesses, this document is instrumental in making informed decisions. For instance, if a certain product line is consistently unprofitable, it might be prudent to discontinue it. Conversely, if another segment is thriving, it might warrant further investment.

The Income Statement, thus, serves as a financial mirror, reflecting the outcomes of business strategies and decisions.

Balance Sheet

The Balance Sheet offers a snapshot of a company's assets , liabilities , and equity at a specific point in time.

Assets include everything the business owns, from physical items like equipment to intangible assets like patents .

Liabilities, on the other hand, encompass what the company owes, be it bank loans or unpaid bills.

Equity represents the owner's stake in the business, calculated as assets minus liabilities.

This statement is crucial for small businesses as it offers insights into their financial health. A robust asset base, minimal liabilities, and growing equity signify a thriving enterprise.

In contrast, mounting liabilities or dwindling assets could be red flags, signaling the need for intervention and strategy recalibration.

Cash Flow Statement

While the Income Statement reveals profitability, the Cash Flow Statement tracks the actual movement of money.

It categorizes cash flows into operating (day-to-day business), investing (buying/selling assets), and financing (loans or equity transactions) activities. This statement unveils the liquidity of a business, indicating whether it has sufficient cash to meet immediate obligations.

For small businesses, maintaining positive cash flow is often more vital than showcasing profitability.

After all, a business might be profitable on paper yet struggle if clients delay payments or unforeseen expenses emerge.

By regularly reviewing the Cash Flow Statement, small business owners can anticipate cash crunches and strategize accordingly, ensuring seamless operations irrespective of revenue cycles.

Small Business Budgeting and Expense Management

Importance of budgeting for a small business.

Budgeting is the financial blueprint for any business, detailing anticipated revenues and expenses for a forthcoming period. It's a proactive approach, enabling businesses to allocate resources efficiently, plan for investments, and prepare for potential financial challenges.

For small businesses, a meticulous budget is often the linchpin of stability, ensuring they operate within their means and avoid financial pitfalls.

Having a well-defined budget also fosters discipline. It curtails frivolous spending, emphasizes cost-efficiency, and sets clear financial boundaries.

For small businesses, where every dollar counts, a stringent budget is the gateway to financial prudence, ensuring that funds are utilized judiciously, fostering growth, and minimizing wastage.

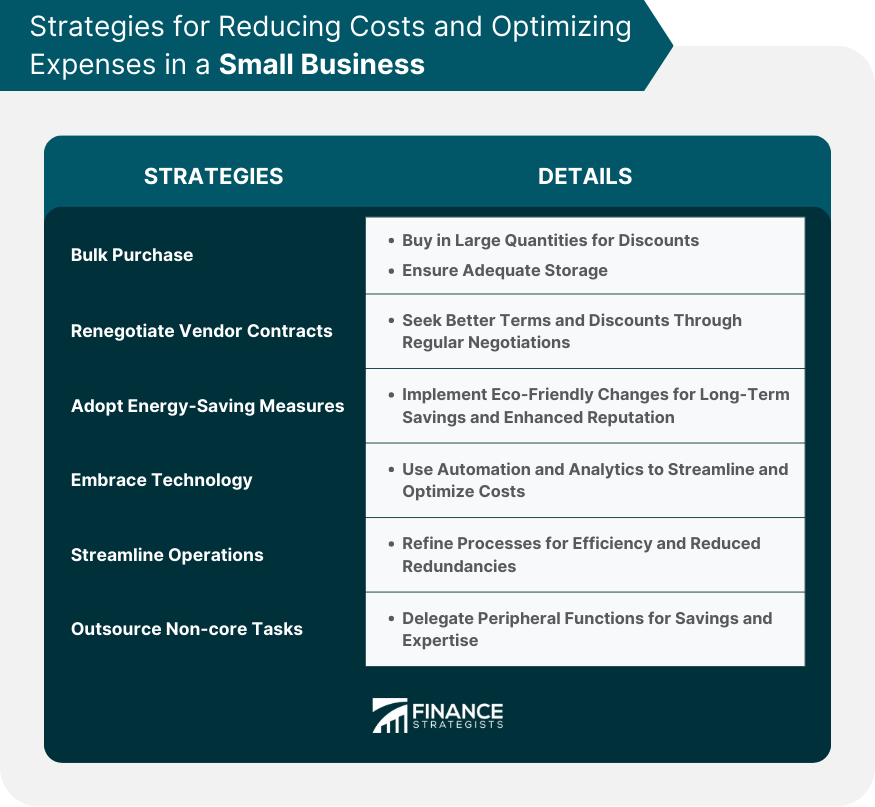

Strategies for Reducing Costs and Optimizing Expenses

Bulk purchasing.

When businesses buy supplies in large quantities, they often benefit from discounts due to economies of scale . This can significantly reduce per-unit costs.

However, while bulk purchasing leads to immediate savings, businesses must ensure they have adequate storage and that the products won't expire or become obsolete before they're used.

Renegotiating Vendor Contracts

Regularly reviewing and renegotiating contracts with suppliers or service providers can lead to better terms and lower costs. This might involve exploring volume discounts, longer payment terms, or even bartering services.

Building strong relationships with vendors often paves the way for such negotiations.

Adopting Energy-Saving Measures

Simple changes, like switching to LED lighting or investing in energy-efficient appliances, can lead to long-term savings in utility bills. Moreover, energy conservation not only reduces costs but also minimizes the environmental footprint, which can enhance the business's reputation.

Embracing Technology

Modern software and technology can streamline business processes. Automation tools can handle repetitive tasks, reducing labor costs.

Meanwhile, data analytics tools can provide insights into customer preferences and behavior, ensuring that marketing budgets are used effectively and target the right audience.

Streamlining Operations

Regularly reviewing and refining business processes can eliminate redundancies and improve efficiency. This might mean merging roles, cutting down on unnecessary meetings, or simplifying supply chains. A leaner operation often translates to reduced expenses.

Outsourcing Non-core Tasks

Instead of maintaining an in-house team for every function, businesses can outsource tasks that aren't central to their operations.

For instance, functions like accounting , IT support, or digital marketing can be outsourced to specialized agencies, often leading to cost savings and access to expert skills.

Cultivating a Culture of Frugality

Encouraging employees to adopt a cost-conscious mindset can lead to collective savings. This can be fostered through incentives, regular training, or even simple practices like recycling and reusing office supplies.

When everyone in the organization is attuned to the importance of cost savings, the cumulative effect can be substantial.

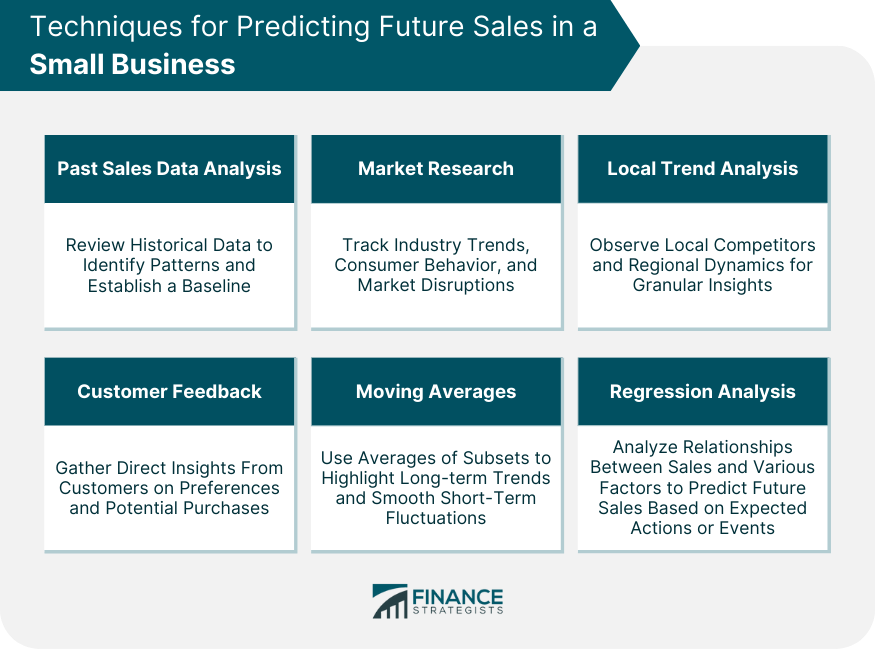

Forecasting Small Business Revenue and Cash Flow

Techniques for predicting future sales in a small business, past sales data analysis.

Historical sales data is a foundational element in any forecasting effort. By reviewing previous sales figures, businesses can identify patterns, understand seasonal fluctuations, and recognize the effects of past initiatives.

This information offers a baseline upon which to build future projections, accounting for known recurring variables in the business cycle .

Market Research

Understanding the larger market dynamics is crucial for accurate forecasting. This involves tracking industry trends, monitoring shifts in consumer behavior, and being aware of potential market disruptions.

For instance, a sudden technological advancement can change consumer preferences or regulatory changes might impact an industry.

Local Trend Analysis

For small businesses, localized insights can be especially impactful. Observing local competitors, understanding regional consumer preferences, or noting shifts in the local economy can offer precise data points.

These granular details, when integrated into a larger forecasting model, can enhance prediction accuracy.

Customer Feedback

Direct feedback from customers is an invaluable source of insights. Surveys, focus groups, or even informal chats can reveal customer sentiments, preferences, and potential future purchasing behavior.

For instance, if a majority of loyal customers express interest in a new product or service, it can be indicative of future sales potential.

Moving Averages

This technique involves analyzing a series of data points (like monthly sales) by creating averages from different subsets of the full data set.

For yearly forecasting, a 12-month moving average can be used to smooth out short-term fluctuations and highlight longer-term trends or cycles.

Regression Analysis

Regression analysis is a statistical tool used to identify relationships between variables. In sales forecasting, it can help understand how different factors (like marketing spend, seasonal variations, or competitor actions) relate to sales figures.

Once these relationships are understood, businesses can predict future sales based on planned actions or expected external events.

Understanding the Cash Cycle of Business

The cash cycle encompasses the time it takes for a business to convert resource investments, often in the form of inventory, back into cash.

This involves the processes of purchasing inventory, selling it, and subsequently collecting payment. A shorter cycle implies quicker cash turnarounds, which are vital for liquidity.

For small businesses, a firm grasp of the cash cycle can aid in managing cash flow more effectively.

By identifying bottlenecks or delays, businesses can strategize to expedite processes. This might involve renegotiating payment terms with suppliers, offering discounts for prompt customer payments, or optimizing inventory levels to prevent overstocking.

Ultimately, understanding and optimizing the cash cycle ensures that a business remains liquid and agile.

Preparing for Seasonality and Unexpected Changes

Seasonality affects many businesses, from the ice cream vendor witnessing summer surges to the retailer bracing for holiday shopping frenzies.

By analyzing historical data and market trends, businesses can prepare for these cyclical shifts, ensuring they stock up, staff appropriately, and market effectively.

Small businesses, often operating on tighter margins , need to be especially vigilant. Beyond seasonality, they must also brace for unexpected changes – a local construction project obstructing store access, a sudden competitor emergence, or unforeseen regulatory changes.

Building a financial buffer, diversifying product or service lines, and maintaining flexible operational strategies can equip small businesses to weather these unforeseen challenges with resilience.

Securing Small Business Financing and Capital

Role of debt and equity financing.

When businesses seek external funding, they often grapple with the debt vs. equity conundrum. Debt financing involves borrowing money, typically via loans. While it doesn't dilute ownership, it necessitates regular interest payments, potentially impacting cash flow.

Equity financing, on the other hand, entails selling a stake in the business to investors. It might not demand regular repayments, but it dilutes ownership and might influence business decisions.

Small businesses must weigh these options carefully. While loans offer a structured repayment plan and retained control, they might strain finances if the business hits a rough patch.

Equity financing, although relinquishing some control, might bring aboard strategic partners, offering expertise and networks in addition to funds.

The optimal choice hinges on the business's financial health, growth aspirations, and the founder's comfort with sharing control.

Choosing Between Different Types of Loans

A staple in the lending arena, term loans offer businesses a fixed amount of capital that is paid back over a specified period with interest. They're often used for significant one-time expenses, such as purchasing machinery, real estate , or even business expansion.

With predictable monthly payments, businesses can plan their budgets accordingly. However, they might require collateral and a robust credit history for approval.

Lines of Credit

Unlike term loans that provide funds in a lump sum, a line of credit grants businesses access to a pool of funds up to a certain limit.

Businesses can draw from this line as needed, only paying interest on the amount they use. This makes it a versatile tool, especially for managing cash flow fluctuations or unexpected expenses. It serves as a financial safety net, ready for use whenever required.

As the name suggests, microloans are smaller loans designed to cater to businesses that might not need substantial amounts of capital. They're particularly beneficial for startups, businesses with limited credit histories, or those in need of a quick, small financial boost.

Since they are of a smaller denomination, the approval process might be more lenient than traditional loans.

Peer-To-Peer Lending

A contemporary twist to the traditional lending model, peer-to-peer (P2P) platforms connect borrowers directly with individual lenders or investor groups.

This direct model often translates to quicker approvals and competitive interest rates as the overheads of traditional banking structures are removed. With technology at its core, P2P lending can offer a more user-friendly, streamlined process.

However, creditworthiness still plays a pivotal role in determining interest rates and loan amounts.

Crowdfunding and Alternative Financing Options

In an increasingly digital age, crowdfunding platforms like Kickstarter or Indiegogo have emerged as viable financing avenues.

These platforms enable businesses to raise small amounts from a large number of people, often in exchange for product discounts, early access, or other perks. This not only secures funds but also validates the business idea and fosters a community of supporters.

Other alternatives include invoice financing, where businesses get an advance on pending invoices, or merchant cash advances tailored for businesses with significant credit card sales.

Each financing mode offers unique advantages and constraints. Small businesses must meticulously evaluate their financial landscape, growth trajectories, and risk appetite to harness the most suitable option.

Small Business Tax Planning and Management

Basic tax obligations for small businesses.

Navigating the maze of taxation can be daunting, especially for small businesses. Yet, understanding and fulfilling tax obligations is crucial.

Depending on the business structure—whether sole proprietorship , partnership , LLC , or corporation—different tax rules apply. For instance, while corporations are taxed on their earnings, sole proprietors report business income and expenses on their personal tax returns.

In addition to income taxes, small businesses may also be responsible for employment taxes if they have employees. This covers Social Security , Medicare , federal unemployment, and sometimes state-specific taxes.

There might also be sales taxes, property taxes, or special state-specific levies to consider.

Consistently maintaining accurate financial records, being aware of filing deadlines, and setting aside funds for tax obligations are essential practices to avoid penalties and ensure compliance.

Advantages of Tax Planning and Potential Deductions

Tax planning is the strategic approach to minimizing tax liability through the best use of available allowances, deductions, exclusions, and breaks.

For small businesses, effective tax planning can lead to significant savings.

This might involve strategies like deferring income to a later tax year, choosing the optimal time to purchase equipment, or taking advantage of specific credits available to businesses in certain sectors or regions.

Several potential deductions can reduce taxable income for small businesses. These include expenses like rent, utilities, business travel, employee wages, and even certain meals.

By keeping abreast of tax law changes and actively seeking out eligible deductions, small businesses can optimize their financial landscape, ensuring they're not paying more in taxes than necessary.

Importance of Hiring a Tax Professional or Accountant

While it's feasible for small business owners to manage their taxes, the intricate nuances of tax laws make it beneficial to consult professionals.

An experienced accountant or tax consultant can not only ensure compliance but can proactively recommend strategies to reduce tax liability.

They can guide businesses on issues like whether to classify someone as an employee or a contractor, how to structure the business for optimal taxation, or when to make certain capital investments.

Beyond just annual tax filing, these professionals offer year-round counsel, helping businesses maintain clean financial records, stay updated on tax law changes, and plan for future financial moves.

The investment in professional advice often pays dividends , saving businesses from costly mistakes, penalties, or missed financial opportunities.

Regularly Reviewing and Adjusting the Small Business Financial Plan

Setting checkpoints and milestones.

Like any strategic blueprint, a financial plan isn't static. It serves as a guiding framework but should be flexible enough to adapt to evolving business realities.

Setting regular checkpoints— quarterly , half-yearly, or annually—can help businesses assess whether they're on track to meet their financial objectives.

Milestones, such as reaching a specific sales target, launching a new product, or expanding into a new market, offer tangible markers of progress. Celebrating these victories can bolster morale, while any shortfalls can serve as lessons, prompting strategy tweaks. F

or small businesses, where agility is an asset, regularly revisiting the financial plan ensures that the business remains aligned with its overarching financial goals while being responsive to the dynamic marketplace.

Using Financial Ratios to Monitor Business Health

Financial ratios offer a distilled snapshot of a business's health. Ratios like the current ratio ( current assets divided by current liabilities ) can shed light on liquidity, indicating whether a business can meet short-term obligations.

The debt-to-equity ratio , contrasting borrowed funds with owner's equity, offers insights into the business's leverage and potential financial risk.

Profit margin , depicting profitability relative to sales, can highlight operational efficiency. By consistently monitoring these and other pertinent ratios, small businesses can glean actionable insights, understanding their financial strengths and areas needing attention.

In a realm where early intervention can stave off major financial setbacks, these ratios serve as vital diagnostic tools, guiding informed decision-making.

Pivoting Strategies Based on Financial Performance

In the ever-evolving world of business, flexibility is paramount. If financial reviews indicate that certain strategies aren't yielding anticipated results, it might be time to pivot.

This could involve tweaking product offerings, revising pricing strategies, targeting a different customer segment, or even overhauling the business model.

For small businesses, the ability to pivot can be a lifeline. It allows them to respond swiftly to market changes, customer feedback, or internal challenges.

A robust financial plan, while offering direction, should also be pliable, accommodating shifts in strategy based on real-world performance. After all, in the business arena, adaptability often spells the difference between stagnation and growth.

Bottom Line

Financial foresight is integral for the stability and growth of small businesses. Effective revenue and cash flow forecasting, anchored by historical sales data and enhanced by market research, local trends, and customer feedback, ensures businesses are prepared for future demands.

With the unpredictability of the business environment, understanding the cash cycle and preparing for unforeseen challenges is essential.

As businesses contemplate external financing, the decision between debt and equity and the myriad of loan types, should be made judiciously, keeping in mind the business's health, growth aspirations, and risk appetite.

Furthermore, diligent tax planning, with professional guidance, can lead to significant financial benefits. Regular reviews using financial ratios allow businesses to gauge their performance, adapt strategies, and pivot when necessary.

Ultimately, the agility to adapt, guided by a well-structured financial plan, is pivotal for businesses to thrive in a dynamic marketplace.

Creating a Small Business Financial Plan FAQs

What is the importance of a financial plan for small businesses.

A financial plan offers a structured roadmap, guiding businesses in making informed decisions, ensuring growth, and navigating financial challenges.

How do forecasting revenue and understanding cash cycles aid in financial planning?

Forecasting provides insights into expected income, aiding in budget allocation, while understanding cash cycles ensures effective liquidity management.

What are the core components of a financial plan for small businesses?

Core components include setting objectives, estimating startup costs, preparing financial statements, budgeting, forecasting, securing financing, and tax management.

Why is tax planning vital for small businesses?

Tax planning ensures compliance, optimizes tax liabilities through available deductions, and helps businesses save money and avoid penalties.

How often should a small business review its financial plan?

Regular reviews, ideally quarterly or half-yearly, ensure alignment with business goals and allow for strategy adjustments based on real-world performance.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Average Cost of a Certified Financial Planner

- Benefits of Having a Financial Planner

- Cash Flow Management

- Charitable Financial Planning

- Debt Reduction Strategies

- Disadvantages of Not Having a Financial Plan

- Divorce Financial Planning

- Education Planning

- Fee-Only Financial Planning

- Financial Contingency Planning

- Financial Planner Fee Structure

- Financial Planner for Retirement

- Financial Planning Pyramid

- Financial Planning and Analysis

- Financial Planning and Investment

- Financial Planning for Allied Health Professionals

- Financial Planning for Married Couples

- Financial Planning for Military Families

- Financial Planning for Retirement

- Financial Planning for Startups

- Financial Planning in Your 20s

- Financial Planning vs Budgeting

- Financial Planning vs Financial Management

- Financial Tips for Young Adults

- How to Build a 5-Year Financial Plan

- Limitations of Financial Planning

- Military Spouse Financial Planning

- The Function of a Financial Planner

- When Do You Need a Financial Planner?

Ask a Financial Professional Any Question

Meet top certified financial advisors near you.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

To ensure one vote per person, please include the following info, great thank you for voting., get in touch with a financial advisor, submit your info below and someone will get back to you shortly..

🎧 Real entrepreneurs. Real stories.

Subscribe to The Hurdle podcast today!

How to Write a Financial Plan for a Business Plan

Noah Parsons

4 min. read

Updated July 11, 2024

Creating a financial plan for a business plan is often the most intimidating part for small business owners.

It’s also one of the most vital. Businesses with well-structured and accurate financial statements are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully create your budget and forecasts.

Here is everything you need to include in your business plan’s financial plan, along with optional performance metrics, funding specifics, mistakes to avoid , and free templates.

- Key components of a financial plan in business plans

A sound financial plan for a business plan is made up of six key components that help you easily track and forecast your business financials. They include your:

Sales forecast

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

How to forecast personnel costs

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

Profit and loss forecast

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

Cash flow forecast

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

Balance sheet

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, you’ll need to include a few additional pieces of information as part of your business plan’s financial plan example.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios.

While including these metrics in your financial plan for a business plan is entirely optional, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Key financial terms you should know

It’s not hard. Anybody who can run a business can understand these key financial terms. And every business owner and entrepreneur should know them.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- How to improve your financial plan

Your financial statements are the core part of your business plan’s financial plan that you’ll revisit most often. Instead of worrying about getting it perfect the first time, check out the following resources to learn how to improve your projections over time.

Common mistakes with business forecasts

I was glad to be asked about common mistakes with startup financial projections. I read about 100 business plans per year, and I have this list of mistakes.

How to improve your financial projections

Learn how to improve your business financial projections by following these five basic guidelines.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Financial plan templates and tools

Download and use these free financial templates and calculators to easily create your own financial plan.

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- What to include for funding

Related Articles

10 Min. Read

How to Write a Competitive Analysis for Your Business Plan

How to Set and Use Milestones in Your Business Plan

6 Min. Read

How to Write Your Business Plan Cover Page + Template

How to Write the Company Overview for a Business Plan

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Free Financial Templates for a Business Plan

By Andy Marker | July 29, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up expert-tested financial templates for your business plan, all of which are free to download in Excel, Google Sheets, and PDF formats.

Included on this page, you’ll find the essential financial statement templates, including income statement templates , cash flow statement templates , and balance sheet templates . Plus, we cover the key elements of the financial section of a business plan .

Financial Plan Templates

Download and prepare these financial plan templates to include in your business plan. Use historical data and future projections to produce an overview of the financial health of your organization to support your business plan and gain buy-in from stakeholders

Business Financial Plan Template

Use this financial plan template to organize and prepare the financial section of your business plan. This customizable template has room to provide a financial overview, any important assumptions, key financial indicators and ratios, a break-even analysis, and pro forma financial statements to share key financial data with potential investors.

Download Financial Plan Template

Word | PDF | Smartsheet

Financial Plan Projections Template for Startups

This financial plan projections template comes as a set of pro forma templates designed to help startups. The template set includes a 12-month profit and loss statement, a balance sheet, and a cash flow statement for you to detail the current and projected financial position of a business.

Download Startup Financial Projections Template

Excel | Smartsheet

Income Statement Templates for Business Plan

Also called profit and loss statements , these income statement templates will empower you to make critical business decisions by providing insight into your company, as well as illustrating the projected profitability associated with business activities. The numbers prepared in your income statement directly influence the cash flow and balance sheet forecasts.

Pro Forma Income Statement/Profit and Loss Sample

Use this pro forma income statement template to project income and expenses over a three-year time period. Pro forma income statements consider historical or market analysis data to calculate the estimated sales, cost of sales, profits, and more.

Download Pro Forma Income Statement Sample - Excel

Small Business Profit and Loss Statement

Small businesses can use this simple profit and loss statement template to project income and expenses for a specific time period. Enter expected income, cost of goods sold, and business expenses, and the built-in formulas will automatically calculate the net income.

Download Small Business Profit and Loss Template - Excel

3-Year Income Statement Template

Use this income statement template to calculate and assess the profit and loss generated by your business over three years. This template provides room to enter revenue and expenses associated with operating your business and allows you to track performance over time.

Download 3-Year Income Statement Template

For additional resources, including how to use profit and loss statements, visit “ Download Free Profit and Loss Templates .”

Cash Flow Statement Templates for Business Plan

Use these free cash flow statement templates to convey how efficiently your company manages the inflow and outflow of money. Use a cash flow statement to analyze the availability of liquid assets and your company’s ability to grow and sustain itself long term.

Simple Cash Flow Template

Use this basic cash flow template to compare your business cash flows against different time periods. Enter the beginning balance of cash on hand, and then detail itemized cash receipts, payments, costs of goods sold, and expenses. Once you enter those values, the built-in formulas will calculate total cash payments, net cash change, and the month ending cash position.

Download Simple Cash Flow Template

12-Month Cash Flow Forecast Template

Use this cash flow forecast template, also called a pro forma cash flow template, to track and compare expected and actual cash flow outcomes on a monthly and yearly basis. Enter the cash on hand at the beginning of each month, and then add the cash receipts (from customers, issuance of stock, and other operations). Finally, add the cash paid out (purchases made, wage expenses, and other cash outflow). Once you enter those values, the built-in formulas will calculate your cash position for each month with.

Download 12-Month Cash Flow Forecast

3-Year Cash Flow Statement Template Set

Use this cash flow statement template set to analyze the amount of cash your company has compared to its expenses and liabilities. This template set contains a tab to create a monthly cash flow statement, a yearly cash flow statement, and a three-year cash flow statement to track cash flow for the operating, investing, and financing activities of your business.

Download 3-Year Cash Flow Statement Template

For additional information on managing your cash flow, including how to create a cash flow forecast, visit “ Free Cash Flow Statement Templates .”

Balance Sheet Templates for a Business Plan

Use these free balance sheet templates to convey the financial position of your business during a specific time period to potential investors and stakeholders.

Small Business Pro Forma Balance Sheet

Small businesses can use this pro forma balance sheet template to project account balances for assets, liabilities, and equity for a designated period. Established businesses can use this template (and its built-in formulas) to calculate key financial ratios, including working capital.

Download Pro Forma Balance Sheet Template

Monthly and Quarterly Balance Sheet Template

Use this balance sheet template to evaluate your company’s financial health on a monthly, quarterly, and annual basis. You can also use this template to project your financial position for a specified time in the future. Once you complete the balance sheet, you can compare and analyze your assets, liabilities, and equity on a quarter-over-quarter or year-over-year basis.

Download Monthly/Quarterly Balance Sheet Template - Excel

Yearly Balance Sheet Template

Use this balance sheet template to compare your company’s short and long-term assets, liabilities, and equity year-over-year. This template also provides calculations for common financial ratios with built-in formulas, so you can use it to evaluate account balances annually.

Download Yearly Balance Sheet Template - Excel

For more downloadable resources for a wide range of organizations, visit “ Free Balance Sheet Templates .”

Sales Forecast Templates for Business Plan

Sales projections are a fundamental part of a business plan, and should support all other components of your plan, including your market analysis, product offerings, and marketing plan . Use these sales forecast templates to estimate future sales, and ensure the numbers align with the sales numbers provided in your income statement.

Basic Sales Forecast Sample Template

Use this basic forecast template to project the sales of a specific product. Gather historical and industry sales data to generate monthly and yearly estimates of the number of units sold and the price per unit. Then, the pre-built formulas will calculate percentages automatically. You’ll also find details about which months provide the highest sales percentage, and the percentage change in sales month-over-month.

Download Basic Sales Forecast Sample Template

12-Month Sales Forecast Template for Multiple Products

Use this sales forecast template to project the future sales of a business across multiple products or services over the course of a year. Enter your estimated monthly sales, and the built-in formulas will calculate annual totals. There is also space to record and track year-over-year sales, so you can pinpoint sales trends.

Download 12-Month Sales Forecasting Template for Multiple Products

3-Year Sales Forecast Template for Multiple Products

Use this sales forecast template to estimate the monthly and yearly sales for multiple products over a three-year period. Enter the monthly units sold, unit costs, and unit price. Once you enter those values, built-in formulas will automatically calculate revenue, margin per unit, and gross profit. This template also provides bar charts and line graphs to visually display sales and gross profit year over year.

Download 3-Year Sales Forecast Template - Excel

For a wider selection of resources to project your sales, visit “ Free Sales Forecasting Templates .”

Break-Even Analysis Template for Business Plan

A break-even analysis will help you ascertain the point at which a business, product, or service will become profitable. This analysis uses a calculation to pinpoint the number of service or unit sales you need to make to cover costs and make a profit.

Break-Even Analysis Template

Use this break-even analysis template to calculate the number of sales needed to become profitable. Enter the product's selling price at the top of the template, and then add the fixed and variable costs. Once you enter those values, the built-in formulas will calculate the total variable cost, the contribution margin, and break-even units and sales values.

Download Break-Even Analysis Template

For additional resources, visit, “ Free Financial Planning Templates .”

Business Budget Templates for Business Plan

These business budget templates will help you track costs (e.g., fixed and variable) and expenses (e.g., one-time and recurring) associated with starting and running a business. Having a detailed budget enables you to make sound strategic decisions, and should align with the expense values listed on your income statement.

Startup Budget Template

Use this startup budget template to track estimated and actual costs and expenses for various business categories, including administrative, marketing, labor, and other office costs. There is also room to provide funding estimates from investors, banks, and other sources to get a detailed view of the resources you need to start and operate your business.

Download Startup Budget Template

Small Business Budget Template

This business budget template is ideal for small businesses that want to record estimated revenue and expenditures on a monthly and yearly basis. This customizable template comes with a tab to list income, expenses, and a cash flow recording to track cash transactions and balances.

Download Small Business Budget Template

Professional Business Budget Template

Established organizations will appreciate this customizable business budget template, which contains a separate tab to track projected business expenses, actual business expenses, variances, and an expense analysis. Once you enter projected and actual expenses, the built-in formulas will automatically calculate expense variances and populate the included visual charts.

Download Professional Business Budget Template

For additional resources to plan and track your business costs and expenses, visit “ Free Business Budget Templates for Any Company .”

Other Financial Templates for Business Plan

In this section, you’ll find additional financial templates that you may want to include as part of your larger business plan.

Startup Funding Requirements Template

This simple startup funding requirements template is useful for startups and small businesses that require funding to get business off the ground. The numbers generated in this template should align with those in your financial projections, and should detail the allocation of acquired capital to various startup expenses.

Download Startup Funding Requirements Template - Excel

Personnel Plan Template

Use this customizable personnel plan template to map out the current and future staff needed to get — and keep — the business running. This information belongs in the personnel section of a business plan, and details the job title, amount of pay, and hiring timeline for each position. This template calculates the monthly and yearly expenses associated with each role using built-in formulas. Additionally, you can add an organizational chart to provide a visual overview of the company’s structure.

Download Personnel Plan Template - Excel

Elements of the Financial Section of a Business Plan

Whether your organization is a startup, a small business, or an enterprise, the financial plan is the cornerstone of any business plan. The financial section should demonstrate the feasibility and profitability of your idea and should support all other aspects of the business plan.

Below, you’ll find a quick overview of the components of a solid financial plan.

- Financial Overview: This section provides a brief summary of the financial section, and includes key takeaways of the financial statements. If you prefer, you can also add a brief description of each statement in the respective statement’s section.

- Key Assumptions: This component details the basis for your financial projections, including tax and interest rates, economic climate, and other critical, underlying factors.

- Break-Even Analysis: This calculation helps establish the selling price of a product or service, and determines when a product or service should become profitable.

- Pro Forma Income Statement: Also known as a profit and loss statement, this section details the sales, cost of sales, profitability, and other vital financial information to stakeholders.

- Pro Forma Cash Flow Statement: This area outlines the projected cash inflows and outflows the business expects to generate from operating, financing, and investing activities during a specific timeframe.

- Pro Forma Balance Sheet: This document conveys how your business plans to manage assets, including receivables and inventory.

- Key Financial Indicators and Ratios: In this section, highlight key financial indicators and ratios extracted from financial statements that bankers, analysts, and investors can use to evaluate the financial health and position of your business.

Need help putting together the rest of your business plan? Check out our free simple business plan templates to get started. You can learn how to write a successful simple business plan here .

Visit this free non-profit business plan template roundup or download a fill-in-the-blank business plan template to make things easy. If you are looking for a business plan template by file type, visit our pages dedicated specifically to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates. Read our articles offering startup business plan templates or free 30-60-90-day business plan templates to find more tailored options.

Discover a Better Way to Manage Business Plan Financials and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

IMAGES

COMMENTS

Nov 1, 2024 · You might prefer a traditional business plan format if you’re very detail-oriented, want a comprehensive plan, or plan to request financing from traditional sources. When you write your business plan, you don’t have to stick to the exact business plan outline. Instead, use the sections that make the most sense for your business and your needs.

Apr 29, 2022 · Download Small Business Financial Plan Starter Kit. We’ve created this small business financial plan starter kit to help you get organized and complete your financial plan. In this kit, you will find a fully customizable income statement template, a balance sheet template, a cash flow statement template, and a dashboard template to display ...

Sep 2, 2023 · Core Components of a Financial Plan for Small Businesses. Every financial plan comprises several core components that, together, provide a holistic view of a business's financial health and direction. These include setting clear objectives, estimating costs, preparing financial statements, and considering sources of financing.

Jul 11, 2024 · Creating a financial plan for a business plan is often the most intimidating part for small business owners. It’s also one of the most vital. Businesses with well-structured and accurate financial statements are more prepared to pitch to investors, receive funding, and achieve long-term success.

Jul 26, 2024 · Three Questions Your Financial Plan Should Answer. A small business financial plan should be tailored to the needs and expectations of its intended audience, whether it is potential investors, lenders, partners or internal stakeholders. Once the plan is created, all parties should, at minimum, understand: How will the business make money?

Jul 29, 2020 · Use this financial plan template to organize and prepare the financial section of your business plan. This customizable template has room to provide a financial overview, any important assumptions, key financial indicators and ratios, a break-even analysis, and pro forma financial statements to share key financial data with potential investors.