- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Creating Brand Value

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurial Marketing

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading Change and Organizational Renewal

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategic Financial Analysis

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

How to Effectively Pitch a Business Idea

- 27 Aug 2020

You’ve identified an underserved need and validated your startup idea . Now it’s time to talk about your business to potential investors. Yet, how do you effectively communicate your idea’s promise and possible impact on the market?

Pitching a business idea is one of the most nerve-wracking parts of any entrepreneur’s journey. It’s what stands in the way between your vision and the financing needed to turn it into a reality. Although daunting, there are steps you can take to ensure a greater chance of success.

Access your free e-book today.

What Makes a Great Pitch?

To make a successful pitch, entrepreneurs must exhibit several characteristics to convince investors to fund their innovative ideas .

Every entrepreneur needs an intricate understanding of their idea, target market, growth strategy, product-market fit , and overall business model . This differentiates your business concept and solidifies the steps needed to make it a reality. The perfect pitch shows investors your proof of concept and instills confidence that they can expect a return on investment .

Check out our video on pitching below, and subscribe to our YouTube channel for more explainer content!

Another crucial component of a successful pitch is understanding the venture capital (VC) ecosystem.

“It’s critical for entrepreneurs to understand the background and motivations of venture capitalists so when entrepreneurs seek them out to help fund their venture, they know what to prioritize in a firm and how to build a strong, trusting relationship,” says Harvard Business School Senior Lecturer Jeffrey Bussgang in the online course Launching Tech Ventures .

To secure funding and support, here are essential steps to ensure your pitch is effective.

How to Pitch a Business Idea

1. know who you’re pitching.

Some entrepreneurs try to get in front of every investor, despite their industry expertise or firm’s investment stage. Consider that, when you accept an investment, it’s about more than money; you enter a partnership. You must perform your due diligence and research potential investors before making your pitch.

When researching, ask yourself:

What industries do they invest in?

A VC firm’s industry focus depends on what the partners’ niche is and where their passions lie. Some firms specialize in a particular sector, such as financial technology (fintech) or education technology (edtech).

For example, Rethink Education is a venture capital fund that invests in early- and growth-stage edtech startups, while Blockchain Capital is dedicated to financing companies innovating in the crypto market. Others are generalists and span several industries.

Knowing the types of companies the firm invests in can help you tailor your pitch and zero in on their presumed priorities.

What stage do they invest in?

If you’re in the earliest stages of business development, you won’t receive growth equity, which is reserved for mature companies that need capital to expand operations, enter a new market, or acquire another business. Before making your pitch, have a rough estimate of the money and resources you need to launch, and then align yourself with investors who can help at that particular stage.

What’s the investor’s track record?

Dig deeper into the investor’s experience and investment history to determine the types of companies they typically finance, the background knowledge they might already have, and whether your personalities will mesh. This information will enable you to modify your pitch and determine if this is the right person or fund to partner with.

“The best venture capitalists become trusted partners and advisors to the founders and team,” says HBS Professor William Sahlman in the online course Entrepreneurship Essentials . “They help recruit key employees. They introduce the company to potential customers. They help raise subsequent rounds of capital. In some cases, they signal that the firm they've backed is a winner, which helps make that assertion true.”

Given the benefits and high stakes, the more you know going into a pitch, the better.

2. Consider How You Present Yourself, Not Simply Your Idea

Although your ideas and skills matter , your personality is equally as important. According to research published in the Harvard Business Review , venture capitalists’ interest in a startup “was driven less by judgments that the founder was competent than by perceptions about character and trustworthiness.”

Investors also want to know they’re entering a partnership with the right people. Jennifer Fonstad, co-founder of Aspect Ventures , acknowledges in Entrepreneurship Essentials that her investment firm “thinks about team and team dynamics as being very critical.”

Investors want to know whether the founders have worked together before, if your startup’s early hires have complementary skill sets, and whether you’ll be flexible, open-minded, and willing to embrace different perspectives.

Think about this as you prepare your pitch. If investors poke holes in your idea, will you get defensive? When they ask for financial projections, will you exaggerate the numbers? Hopefully, your answers are “no”—firms want to partner with founders they can trust who are open to guidance and mentorship—but if you’re second-guessing your reactions, consider what you might be asked and practice your responses.

As Sahlman reinforces in Entrepreneurship Essentials : “Most experienced investors look at the people first and the opportunity second. Even when a team is young and inexperienced, an investor depends on them to make the right decisions.”

3. Tell a Story

When describing your business idea, zero in on the problem you address for your target audience and how you solve it better than the competition. You could do this by presenting a real-life scenario in which you describe the pain point a current or prospective customer faced and how your product or service fixed the issue. This can help engage investors on a personal level and inspire them to see your idea’s potential.

By complementing your spreadsheets and charts with a compelling story, you can paint a fuller picture of your startup’s future and more effectively highlight its business opportunity.

4. Cover the Details

While it’s important to set the stage, you also need to cover the specifics. In your pitch deck, concisely define your value proposition and share a memorable tagline for investors to leave the meeting with.

According to Bussgang in Launching Tech Ventures , every pitch to an investor should contain the following:

- Intro: Focus on answering important questions like who you are, why you’re asking for funding, and what your founder-market fit is.

- Problem: Talk about your ideal customer’s pain point and how you plan to solve it.

- Solution: Explain how your idea is a compelling solution and why it’s better than existing solutions.

- Opportunity and Market Size: Provide your total addressable market (TAM), serviceable addressable market (SAM), and serviceable obtainable market (SOM) through research.

- Competitive Analysis: Understand your unique differences in the market that can help you sustain a competitive advantage.

- Go-to-Market Plan: Clarify how you’re going to reach your customers.

- Business Model: Describe how you’re going to make money.

- Financials: Define what your financial projections are and how you’re going to provide returns for investors.

- The Ask: Detail how much funding you need, how long it will last, and what milestones you hope to achieve.

“VCs will expect entrepreneurs to clearly define the milestones they need to achieve with each round of funding,” Bussgang continues. “Entrepreneurs should know what experiments they will run to reach these milestones and what they expect the results will be.”

5. Show the Roadmap

Although you’re in your business’s early stages, investors want to know how they’ll cash out in the end.

“To truly understand the motivations behind VC firms, remember that they are professional investors,” Bussgang explains in Launching Tech Ventures . “Their objective is to generate the maximum return for their limited partners with a dual fiduciary duty to their investors and the company.”

To clinch your pitch, highlight your exit strategy and the options available.

The most common exit strategies include:

- Acquisition: When one company buys most or all of another company’s shares to gain control of it

- Merger: When two existing companies unite into one new company

- Initial Public Offering (IPO): When a private company issues its first sale of stocks to the public and can start raising capital from public investors

Related: What Are Mergers & Acquisitions? 4 Key Risks

3 Kinds of Pitches for Entrepreneurs

While all effective pitches share foundational elements, you should use different types depending on the scenario. To increase your chances of success, tailor your pitch to your audience and the available time frame.

1. The Elevator Pitch

This is one of the most popular pitches. Use this when you need to communicate their startup’s value in 60 seconds or less.

An effective elevator pitch should be concise, convincing, and convey your startup’s value proposition and differentiators. For tech business ideas, mention the innovative technology that sets your concept apart. At the end, include a call to action, such as the amount of capital required to launch.

2. The Short-Form Pitch

You should portray your business idea’s value to prospective clients and investors as efficiently as possible. This means summarizing the most important elements of your idea in a way that makes them want to hear more. Highlight the market size, how you’ll create barriers for competition, your plan to monetize the business, and how much financing you need.

Short-form pitches can run from three to 10 minutes; if you’re pitching in a competitive setting, note any length requirements. These shorter pitches can pique investors’ interest and earn you the chance to present a long-form pitch.

3. The Long-Form Pitch

Sometimes, you’re fortunate enough to have more than a few minutes to pitch your idea. If this opportunity presents itself, it’s crucial to make the most of your time and address every aspect of your business plan.

“You’re not just trying to start any business,” Bussgang says in Launching Tech Ventures . “You’re trying to create a business that’s profitable, sustainable, and valuable.

Zero in on your story and share a real-life scenario. Detail the market size to illustrate demand and clear examples of how you’ll attract and retain customers, particularly in light of competitors. This will show you’re planning for—and ahead of—future challenges.

You should also have a blueprint for testing product-market fit and early results, along with a detailed monetization plan. Lastly, share your exit strategy and the amount of capital needed to, one day, achieve it. Your long-form pitch should communicate your business concept clearly and concisely, open the possibility for follow-up questions, and capture the investors’ interest.

Consider preparing all three pitch lengths to be ready for any opportunity. It’s important to stay agile so you can modify your pitch to fit specific length requirements.

Landing the Pitch

Every investor prioritizes different data and information. Yet, if you start by choosing the right investor and then align their needs with your proposed market opportunity, value proposition, and exit strategy, you have a chance at landing the pitch.

“In some ways, startup success depends just as much on whether your hypothesis about the future is right, as it does on whether your idea is a good one,” Bussgang explains in Launching Tech Ventures .

As a result, it’s important for you to do your due diligence before pitching your business idea to investors.

If you’re interested in learning more about what investors look for and how you can create value, explore Entrepreneurship Essentials and Launching Tech Ventures , two of our entrepreneurship and innovation courses . Not sure which is the right fit? Download our free course flowchart to determine which best aligns with your goals.

This post was updated on July 28, 2023. It was originally published on August 27, 2020.

About the Author

- Starting a Business

- Growing a Business

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Tips White Papers

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- United Kingdom

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

The Secret to Pitching Your Business Plan in Just 10 Minutes This outline breaks down a business plan pitch minute by minute so you can stay on topic and build the necessary interest and excitement.

By Mike Moyer Edited by Chelsea Brown Apr 1, 2022

Opinions expressed by Entrepreneur contributors are their own.

Delivering a good pitch is as much about conveying emotion as conveying information. If you get the opportunity to pitch in front of a live audience , both of those objectives should be top of mind. The phrase, "They don't care what you know until they know that you care," is sage advice and is the basis for starting a 10-minute pitch.

Startups are hard work. If you do not particularly care about the market or the problem you are solving, you may bail out when the going gets tough. Investors need to know this is more than just a business.

Related: 4 Powerful Communication Strategies to Win Any Sales Pitch

Minute 1: Personal Introduction

Let the audience know that you, personally, care about the people and the problem you are trying to solve. Use the word "I" instead of "we." I know you are representing your team and your company, but for now concentrate on establishing your passion and commitment. Tell a quick, personal story about how you stumbled upon the business you are pursuing and what made you realize it was where you wanted to focus most of your waking hours.

Your slide(s) should be simple. They are just there as a backdrop to your opening monologue and should make you look good. I, personally, like to show photos of me and/or customers experiencing the problem first-hand. The focus should be on you and your message.

Step forward to the audience, make gentle eye contact and engage them on a personal level as much as you can. The goal is for them to trust you, have confidence in you and to like you.

Transition out of the personal introduction into the overview of the problem you are trying to solve. Your job is to describe the problem as one that goes well beyond just you and your experience. A nice phrase is, "When I started looking around, I realized that I'm not the only one with X problem. Lots and lots of other people have it too!"

Minute 2: The Problem

Remember to keep an emotional appeal included in your description of the problem. People with this problem are: struggling, irritated, angry, disenfranchised? Keep human emotions real. Break down the problem into its component parts accompanied by a diagram.

Your slides during this minute are simply visual aids that help explain the problem. Like in the introduction, photos can express the human factor, but diagrams can help explain how the problem is experienced by people.

Keep close to the audience and help them empathize with those who experience the problem. As you move into the solution, physically back away from the audience, smile and spread out your arms to make bigger gestures. Your job is to bring up the excitement level in the room.

Related: 4 Ways Emotional Intelligence Can Improve Your Sales

Minute 3: The Solution

At this point, you are going to maximize the crescendo. Show excitement and passion for your businesses solution. Transition to "we" instead of just "I." Walk the audience not only through how the solution works, but also through the great benefits of the solution.

You need to position your body in front of the room and make it as big and bright as you can with big arm movements, a bright smile, confident voice and lots of eye contact. The audience should begin to share your excitement for your business.

Your slides are visual aids and diagrams. They should contain little to no text. Keep them simple as possible as complexity will only suck the energy out of the room. You don't have to explain everything your company does, just the main points. Remember, you only have 10 minutes.

It's good to show images or screenshots of existing products or beta releases and other hard evidence of your execution, but overexplaining the solution will make the presentation less compelling, and it will take too long. You want to leave the audience wanting more.

Once you have your audience feeling great about the solution, it is time to talk money.

Minute 4: Business Model

There are several money-related topics you'll need to touch on during your pitch, including how you'll make money, how much money you will make and how much money you will need. Keep these parts separate so they are easier to digest.

Now is the time to tell the audience how you will make money. There are literally dozens of possible business models, including selling the product, selling a subscription, taking a processing fee, licensing and so on. Explain how you are going to charge people for the solution you are offering.

On your slide is an outline of the customer unit economics for your chosen business model — the price they will pay and basic terms of a typical contract. Explain how you will "do the deal" with customers. Whenever you show numbers, stand close to your presentation screen and point to the numbers you are talking about. Numbers are hard to follow. Pointing as you talk will help people stay engaged.

If the business model is attractive, as it should be, you will have to explain who else is going after the customer's money.

Related: Tips to Follow When Re-Fitting Your Business Model to the New Normal

Minute 5: The Competition

There's no such thing as a business without competition, and implying that you have none is a major red flag for investors and even potential partners or customers. Whatever problem you are going after is being addressed somehow, maybe not very well, but people experiencing the problem are trying to solve it, and the resources they access to cobble together a solution is where you will define your competition.

The key here is not to avoid the notion that competition exists, but how your company is different . The existence of competition validates the market. Do not talk about how you are "better," focus on "different." Your attitude towards the competition gives the audience a peek into your business soul. Are you dutifully respectful of their presences and power or are you arrogant and naïve enough to think your little startup will have no problem beating them? Err on the side of humility.

Your slides should depict your differences from the main competitors. Feature comparisons or positioning charts , for instance, can be effective tools. Many of the questions you will get from the audience will stem from what you say during this minute of your pitch.

Be clear and respectful before you transition to your sales and marketing plan.

Minute 6: Sales and Marketing

During you description of the competition, you struck a respectful tone. It's now time to amp up the room again as you talk about how many potential customers are out there and how you're going to get them. Show excitement and confidence as you walk the audience through the market data, your chosen point of entry and your communication strategy.

Slides will depict data, charts, and graphs which you will want to point to as you explain. Images of web sites, brochures, trade show booths in action, etc. are fair game here, too, and will help build excitement in room.

It is important to tie your sales and marketing plans together so it doesn't look like you are shooting a scatter gun of one-off tactics. Show the logic and flow of lead generation to final sale and how your team plans to take the prospects through the buying process and into the customer experience.

End this minute by translating the marketing sizzle into numbers. It is time to talk about money again!

Minute 7: Money

Earlier, you explained how the business is going to make money. Now, it's time to tell the audience how much money you are going to make. This is the good part. Your description of the deal shows the unit economics of a single customer (price), and your market description shows how many potential deals are out there (quantity). Armed with this information, you can describe how revenue builds over time.

Break it down for the audience. Show income and expenses in graphical format. Nothing beats a good bar chart, and pretty much anything beats a screenshot of a spreadsheet. Back up to your presentation slide and point to information like the weatherperson points to a weather map on TV.

Keep the tone upbeat and engaging. You'll want to exude as much confidence as you can. To this end, avoid showing different scenarios in your forecast. Pick the scenario that you think is most likely to happen, and be prepared to defend your assumptions.

To make the business believable, the audience will now need to meet your team.

Minute 8: The Team

It may seem a little strange to wait until towards the end of your pitch to introduce your team, but waiting has benefits. It's important to introduce your team in the context of the business so the audience understands why it is what it is. If you introduce the team upfront, you will have to circle back to describe their roles later, which wastes time and can get redundant. A 10-minute pitch must eliminate redundancy.

As you introduce the key players on the team, you can highlight what function they will perform and brag (yes, brag) about how great they are at their function and how lucky you are to be working with them. Talk about yourself with humility, and talk about your team like they are the best team in the world.

Rather than showing headshots and bullet points, show images of the team in action or in a group. You want to make sure the audience sees a team , not a collection of individuals.

Next, you will explain the great work this great team has accomplished!

Minute 9: Proof of Concept/Traction

A team without results isn't much more than a cocktail party. To get investors or customers, you need to show results. What has the team accomplished? Have they launched an MVP? Does the company have revenue? Are the customers happy?

The more traction you can show, the better. This, more than just about any other minute of your pitch, will demonstrate your team's ability to pull off this business in the real world. Display customer testimonials and read them out loud. Show pictures of your solutions in action. Maximize the excitement in your voice and facial expression. You're almost at the end of your pitch, so be sure leave it on a high note!

You have one minute left. It's time to ask for the money.

Minute 10: Ask

Assuming you are pitching your business for the purpose of raising money, you will spend the last minute asking for it. By now, your audience has everything they need to know if they are interested, or not, in working with you. You must paint a clear picture of what you need from the audience and what investing with you will look like.

Investors want their money to be used for growth, not exploration. Show them that everything is in place to grow, you just need to fan the flames.

Many founders aren't sure how much money they will need and to what terms they will be willing to accept. They are keen to keep things open-ended. In my experience, however, investors want a starting point. Give it to them.

You already showed them how much you are expecting to make. This financial objective is based on many assumptions, not the least of which is how much outside funding will be required to execute the plan. Break it down for the investor. Do you want one main investor or a number of smaller investors?

If, for instance, you are raising $1 million, you could break it into 10 chunks of $100,000 each and say, "We are raising $1 million from up to ten investors in $100,000 units in exchange for a convertible note. How many units do you want?" Your slides can show the breakdown and the high-level terms of the note. This makes the deal easy to understand. An interested investor will not walk away from the deal based on your initial offer, they will counteroffer, and you'll be off to the negotiating table — mission accomplished!

Express enthusiasm for their participation in your business. Keep the energy levels high.

The trick to delivering a compelling 10-minute pitch is to let the story flow logically and to avoid repeating yourself. It's not logical, for instance, to introduce the team before anyone knows what kind of team is needed. Likewise, it's not logical to talk about progress and traction before talking about how the business works.

Each topic in the above outline neatly flows into the next, allowing you to build your story and maintain the energy level in the room. A good pitch lets the story unfold naturally and doesn't force things together. In this pitch, you may notice that there is no "money" or "financial" section. Making money is simply part of the flow of the story, so it is touched on multiple times during the pitch.

Perfecting the pitch means practicing the pitch. It's much more than what you say. It's also about when you say it and how you say it.

Related: Why You Need a Million-Dollar Pitch Before Your Start a Business

Inventor of Slicing Pie

Want to be an Entrepreneur Leadership Network contributor? Apply now to join.

Editor's Pick Red Arrow

- Lock I Started a Business to Streamline the $90 Trillion Wealth Transfer From Boomers to Younger Generations — Here's How It Helps People Receive Inheritances Faster

- Is ChatGPT Search Better Than Google? I Tried the New Search Engine to Find Out.

- This Couple Wanted to Make an Everyday Household Product 'Unquestionably Better.' Now Their Business Sees Over $200 Million Annual Revenue : 'Obliterated Our Goals.'

- Lock AI Could Ruin Your Life or Business — Unless You Take These Critical Steps

- Taco Bell Is Launching Chicken Nuggets — Here's When and Where to Get Yours

- Lock After This 26-Year-Old Got Hooked on ChatGPT, He Built a 'Simple' Side Hustle Around the Bot That Brings In $4,000 a Month

Most Popular Red Arrow

This ai is the key to unlocking explosive sales growth in 2025.

Tired of the hustle? Discover a free, hidden AI from Google that helped me double sales and triple leads in a month. Learn how this tool can analyze campaigns and uncover insights most marketers miss.

63 Small Business Ideas to Start in 2024

We put together a list of the best, most profitable small business ideas for entrepreneurs to pursue in 2024.

50 Franchise CMOs Who Are Changing the Game

Get to know the industry's most influential marketing power players.

Is Your Business Healthy? Why Every Entrepreneur Needs To Do These 3 Checkups Every Year

You can't plan for the new year until you complete these checkups.

A New Hampshire City Was Named the Hottest Housing Market in the U.S. This Year. Here's the Top 10 for 2024.

Zillow released its annual lists featuring the top housing markets, small towns, coastal cities, and geographic regions. Here's a look at the top real estate markets and towns in 2024.

Expand Your Global Reach with Access to More Than 150 Languages for Life

Unlock global markets with this language-learning platform.

Successfully copied link

👀 Turn any prompt into captivating visuals in seconds with our AI-powered design generator ✨ Try Piktochart AI!

How to Make a Successful Business Pitch: 9 Tips From Experts

You’ve just had your lunch, and you’re about to get back to work.

While making your post-lunch tea (or coffee), you can’t stop thinking about being your own boss.

You wonder if it’s about time for you to turn your side hustle into a full-time business and become an entrepreneur.

Or perhaps you want to propose the idea of a four-day workweek to your CEO.

If you want to introduce investors and prospects to your business idea and convince them to take the plunge with you, you need a strong and persuasive business pitch.

How to create a persuasive business pitch according to experts

The good news — it’s possible to craft a convincing and successful business pitch.

Even better news: This Piktochart business pitch guide shows you how.

Grab your drink of choice and take notes as we explore the different ways to pitch business ideas (from a sales-style elevator pitch to an innovative workplace pitch), as well as understand what makes a great business pitch. You’ll also get a glimpse into our business pitch templates, and learn expert advice from those who have pitched their way to success (and failure too).

Want to hop into the fast lane and get started? Let us give you a headstart with our AI presentation maker . You can share what type of slide deck you want to create, pick from dozens of appropriate gorgeous templates, then tweak the most suitable one in our editor. In minutes, you’ll have a slide deck ready to go.

To get the most out of your editing and to make your business pitch stellar, we recommend checking out the rest of the article!

You can also watch the video below if you don’t have time to go over this guide. It’s also easier to follow along if you sign up for a free Piktochart account and edit the templates yourself (learning by doing).

What is a business pitch?

A business pitch is a presentation of a business idea to a group of people who can help turn your idea into a reality.

You can pitch to:

- Investors who can help fund your idea

- Potential customers who will pay for your product or service

- Advocates who will support your idea

In some cases, a business pitch doesn’t have to be all about presenting a new idea. You could be asking for more funding or continued support for an already established business venture.

Whether through an investment, purchase, or advocacy, a business pitch becomes successful if you can convince people to believe in your idea or pique their interest and get them to learn more.

Now that you understand what a business pitch is, let’s take a closer look at the different types of business pitches.

Types of pitches in business

Your business pitch can be narrowed down to the following five types of presentations:

1. Investor pitch

In this type of business pitch, you present a persuasive presentation or pitch deck to a group of potential business partners and/or investors.

Sign up for a free Piktochart account to get started on creating professional-looking pitch deck templates that you can edit in minutes.

An investor business pitch should typically last for 45 minutes . The best practice for this type of pitch is 20-30 minutes of presentation followed by discussion or a Q&A afterward.

Alternatively, business pitch competitions follow a different best practice. These presentations should last around five to 10 minutes and focus on pitching to investors.

Lastly, the most stringent type of business pitch is most commonly referred to as an ‘elevator pitch’, and should only last around 30-60 seconds.

Let’s dive in so you can learn how to make the perfect pitch for your business!

2. Sales pitch

The goal of a sales pitch is to answer the question “What’s in it for me?” from the lens of the potential customer.

The best and most effective salespeople can make a sales pitch in as short as one minute. Also known as the ‘ elevator pitch ‘, this type of business pitch should be able to be delivered in a single elevator ride (30-60 seconds on average). In this format, a short sales pitch should include four key components:

- Your unique product name and category

- The specific problem you are trying to solve

- The innovative solution you offer

- the unique selling point of benefit to your solution

3. Product pitch

A product pitch is similar to a sales pitch, however, the spotlight should be on the product and/or solution itself.

For example, a sales pitch for an email automation software will highlight one or two of its benefits. Meanwhile, a product pitch of the same automation software will focus more on its features, how it works, and how you can integrate the software into your existing setup.

In a product pitch, you should aim to:

- Explain your product or offering clearly and concisely

- Identify and address the target audience and/or industry your product supports

- Specify the problem the aforementioned faces and how your solution can solve it

- Provide a realistic example of your solution in action

- Make sure to use accurate facts backed up by relevant and recent data

4. Job pitch

If you’re applying for a job or internship and you’re wondering how you can stand out from the crowd (consisting of your peers and other qualified applicants), consider pitching yourself to a prospective employer.

Applying the same logic used for a sales or product pitch deck; sell yourself!

A great pitch for a potential job opportunity or personal summary pitch should be concise, personalized, and consistent. In a job pitch you should include:

- A brief introduction to you

- An explanation as to why you’re a great fit for the company and role

- Relevant experience and achievements

- Your goals and career aspirations

“It’s not about bragging or showing off — it’s about giving the other person evidence that you can actually do what you say you can do,” assures Starla Sampaco , TV news anchor at KCTS 9 and founder of Career Survival Guide .

5. Workplace pitching

Do you have an idea or initiative that will help your colleagues and help boost the company’s profitability? Pitch it internally within your workplace, to your team or boss!

For example, you can pitch a remote-first culture or the four-day workweek to your HR, and/or the rest of the leadership team.

Another workplace pitch example? Maybe you might want to propose the creation of a new role in your team which can help advance your career and address a challenge in the organization at the same time.

To do this, simply create a pitch deck including your main points, the benefits, and proposed next steps to turn your idea into a reality. Piktochart’s workplace pitch decks can help you get your point across through our workplace templates.

The structure of a successful business pitch

If creating a business pitch sounds intimidating, the team at Piktochart has your back.

You can address this worry by making sure that you have a business pitch structure that is sure to succeed, using our tips & templates.

When you have a formulated pitch deck structure, template, and agenda, you’ll know exactly what you’re going to say next, taking the bulk of the stress out of presenting. Additionally, these best practice presentation structures make your business pitch more memorable to your audience and leave a lasting impression. Statistically, it turns out that people retain structured information up to 40 percent more accurately than information presented in freeform.

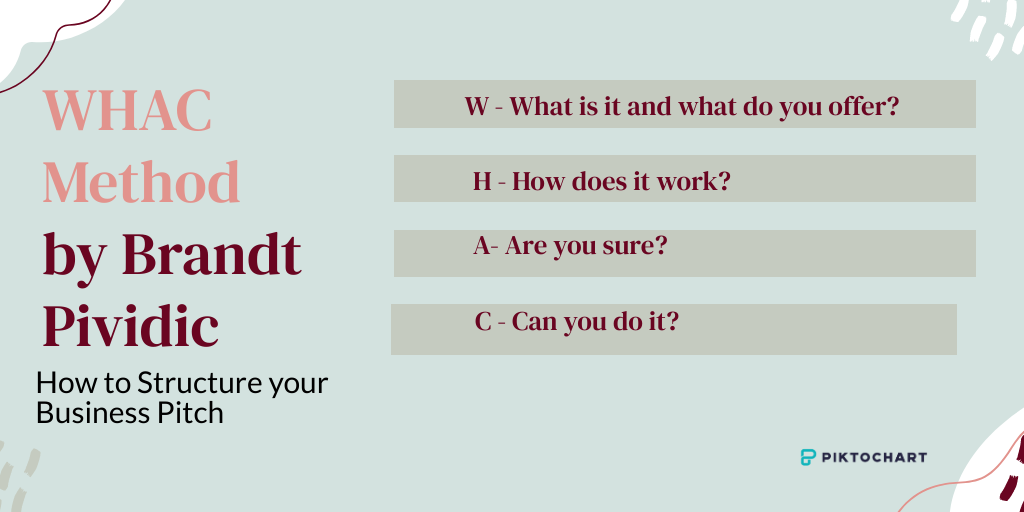

The WHAC Method

Whether you’re pitching to a group of potential investors or you’re selling real estate, use the WHAC method when structuring your perfect business pitch.

The WHAC method is introduced in The 3 Minute Rule by Brandt Pividic, an award-winning film director and television producer. He wrote the book to detail his experience and tips as he made hundreds of pitches in Hollywood.

This well-known WHAC method stands for:

What is it and what do you offer?

You start your business pitch by answering the questions: what is it, and what do you offer? This information is often found in the executive summary of business plan templates .

At this point, you share your business plan and quickly outline the problem and solution you offer. For example, let’s say that you want to pitch the idea of having a UX researcher on your product team.

You list down existing problems and challenges that your team and/or organization are currently experiencing without a dedicated UX researcher. Afterward, you propose your solution — hiring someone who can step in and do user research.

How does it work?

Next, explain your proposal. Provide a quick summary of the benefits of your solution. In our example, share how the UX researcher will help the product team accomplish its objectives.

It can be tricky explaining how your business idea works. Figuring out how to deliver this information in an entertaining and simple manner can turn potential investors into partners, as we’ve seen from some of the best startup pitch decks .

Since you don’t have much time and attention spans are short, the key is to boil down how your idea works into a few key points. Explain how it works from a high-level overview and weave this in as part of your compelling story.

Are you sure?

Once you have provided the solution, the people listening to your elevator pitch are likely saying to themselves, “will it really work?”

This is the point where you have to provide solid proof in your pitch. You can use testimonials, a short case study, or statistics.

You should also mention financial projections in order to leave a positive impression. If your manager or potential investors will provide funding for your idea, they’ll want to know what the ROI is.

Can you do it?

The final part of your pitch should answer this question.

Now that your audience has heard you talk about the problem, solution, and proof that it works, you need to show them how you’re going to implement the solution. Think of this point as the “actionable” part of your pitch. You can even provide steps to break down how this can be achieved in a certain timeframe.

“Show how you have thought about how to turn your idea into a commercial outcome or true partnership. This is really an opportunity to start or continue building trust and showing that you care about creating real value for the people in the room is the best way to put you on the right foot,” shares Michael Rosenbaum , CEO of Spacer , one of the biggest parking marketplaces in the U.S.

Like any good sales pitch, you need to show how achievable the results are. At this particular stage, you need to tie in any additional information to show what resources or specific and unique skills are required to make it happen.

Being transparent about what’s required can build trust with potential investors.

How to persuade your audience with your business pitch

Now that you know the best practice structure of a successful business pitch, take note of the following tips to help make your business pitch more interesting, relatable, and most of all, convince your audience to say “yes”.

1. Understand what your audience wants from you

It’s standard advice across all facets of industry to “know your audience”.

However, if you’d like to become better at your business pitches, go the extra mile by understanding what your audience wants from you.

There’s a difference between understanding and knowing your audience. Instead of just knowing where your client comes from, try to understand their pain points, goals, and motivation.

How do you do this?

Talk to them in advance, read about the things they publish online (tweets, blog posts), and understand what excites them. By doing so, you’ll be able to tailor your business pitch to their needs, wants, and preferences.

For example, if you’re pitching to potential clients and investors who are eco-conscious at the same time, it makes sense to highlight how your idea can positively impact the environment.

Stephen Keighery , CEO of Home Buyer Louisiana and Founder of Bald Eagle Investments USA, shares this tip when it comes to customizing your pitch to your audience:

“Learn ahead and research about the company or the client you’ll be pitching to, just be sure that every information you obtain is for public knowledge. You can also observe their behavior and their words during the transaction; and perhaps while pitching, use the jargon they use to establish connection and a favorable impression to them.”

2. Have your elevator pitch ready

Imagine this. You just bumped into Mark Cuban of Shark Tank at the airport lounge, and you can’t believe that you’re sitting next to him! He looks at you and asks you about yourself and what you do.

This is when you need your elevator pitch handy!

The Asana team recommends the following elements of a good elevator pitch :

- Introduction

- Value proposition

- CTA (call to action)

You don’t have to follow the exact formula. You can mix it up based on the situation, your personality, and the audience you’re pitching to.

It’s also worth noting that you might not immediately notice the benefit of your elevator pitch. Think of it as an opportunity for you to make a great first impression.

3. Use visual aids

If you have the chance to present beyond the elevator pitch, you should never pitch with a presentation that’s filled with texts, numbers, or endless rows of data.

As humans, our brains are hardwired to love visuals — from photographs to infographics to icons.

When pitching an idea, product, or service, get your audience’s attention (and support!) by telling a story visually and adding a bit of creativity to your PowerPoint slides.

Images trigger empathy which in turn can make your audience understand your pitch better.

The more they understand your idea, the greater the likelihood of angel investors, venture capitalists, and potential customers supporting or advocating for you.

Another added benefit is that visuals can elicit emotions and emotions play an important role in decision-making.

Consider incorporating business infographics to present complex data or processes in an easily digestible format.

Watch these 10 legendary pitch decks for visual inspiration.

4. Explain your business model clearly

When pitching to investors, imagine them asking, “what’s in it for me?”.

After learning about how your idea can help solve a problem, they’re interested in how you’re going to advertise to your target market and generate revenue consistently.

Johannes Larsson , CEO of Financer.com explains that being able to articulate their business model was what made them successful in getting business partners on board.

“We were relatively unknown in the industry, so it took us quite a few tries before we signed our first deal. After that, however, things became much easier — not just because we were building up a name for ourselves but also because we improved our approach. We learned that being able to clearly explain our business model was the key to earning potential partners’ trust. Once we mastered that, we focused on providing proof of fruitful partnerships. It was obvious that this information was what our affiliates cared about, so we made sure to gather evidence of our success and present it in every pitch.”

5. Weave your passion or story with your pitch

Your business pitch doesn’t have to sound like you’re reading it straight from a script that someone else wrote for you.

When appropriate, add a bit of your personal touch. In short, humanize your pitch and slide deck.

It will not only improve your relatability factor but also make you feel less nervous. After all, you’re talking about something that you’re passionate about.

Take it from Debbie Chew, an SEO Specialist at Dialpad .

“As part of my hiring process, I had to pitch a marketing campaign idea. I started brainstorming a list of potential ideas and their projected impact to decide which one to go with. While doing this, one idea kept coming back to me, and I realized I was most passionate about pitching a campaign related to video meetings. People now spend so much of their time in video meetings, but how much time? And how can we have better meetings? So I built my pitch around this concept and really enjoyed pitching my idea (which also helped me feel less nervous),” shares Chew. If you can share a personal story or something you’re passionate about in your pitch — while also tying it back to your audience — they won’t forget it. And yes, I got the job!”

6. Put the spotlight on benefits

Once you have your audience’s attention, circle back to how your product or service will address customer needs and benefit business partners.

For Carsten Schaefer of Trust.io , it boils down to being able to share the benefits of your product or service from the get-go.

“When I first had to get funding for my product, I had to deliver a sales pitch in front of a board of investors. It didn’t succeed, and I learned a lot from it. “Investors want cold, hard facts and the benefits to the end-user. In the end, they want to see if it makes money for them or not. I’m glad I failed because I learned that for an effective sales pitch, you really need to put yourself in the shoes of someone thinking about profit and pure common sense from a business perspective.

Create a successful business pitch

Select a template that sparks your imagination. Clone, add or delete blocks. Visualize concepts, processes, lists, timelines and data. Use charts and graphs. Sync them with spreadsheets. Export the visual in PDF or PNG format. Start for free.

7. Highlight why you’re different from the competition

Your business pitch is also an opportunity for you to explain what sets you apart from other businesses or organizations, and essentially explain your unique selling point. What makes your idea different? Why is your business model unique?

It also helps to address relevant competition head-on in your pitch. For Brogan Renshaw of Firewire Digital, this tactic shows clients and investors that you’re an expert on what you are talking about, giving them confidence in your offering.

“I notice that this is a part of my business pitches that completely wins the client over because it answers their questions and concerns on the market position of competitors,” says Renshaw.

8. Share the story behind your team

Investors and business partners are also curious about the people, employees, as well as the team behind your idea. When creating this presentation slide in your pitch deck, don’t forget to include information highlighting your team and each team member’s relevant skills.

“Investors want to know whether the founders have worked together before, if your startup’s early hires have complementary skill sets, and whether you’ll be flexible, open-minded, and willing to embrace different perspectives, “ writes Lauren Landry , associate director of marketing and communications for Harvard Business School Online.

9. Have an impressive one-pager

As its name implies, a one-pager is a one-page document outlining your business plan and mission. Think of it as a business brochure . With Piktochart’s online brochure maker , you can easily create one within minutes.

Imagine that an investor or client is too busy to listen to your pitch, you can simply email or hand out your one-pager; your entire business pitch in an easy-to-digest format.

According to Greg Cullen , Sr. Account Executive at Dialpad, your one-pager should have these three components:

- What is the business pain?

- How the solution you’re positioning can solve said business pain

- The value of the solution accompanied by the resulting positive impact by moving forward with the platform

“This one-pager condenses everything that is important succinctly into an easy-to-digest easy to digest format for everyone to read – and it ensures that all parties are on the same page. And most importantly, this can be used by the champion you’re working with to sell this internally, whether it’s to the CEO, procurement, etc. The better you make this one-pager, the better the result you’ll have,” recommends Cullen.

Get funding, win clients, and gain support with Piktochart’s pitch deck creator

While it may be nerve-wracking, particularly if it’s the first time that you’re creating a business pitch, use the expert tips above as your guideposts for a successful pitch.

You’ll eventually find your very own unique style and approach to business pitching as you do it more frequently.

If you need help creating any type of business or personal pitch deck, create your pitch deck quickly with Piktochart’s pitch deck creator. The first step is to get your free Piktochart account .

Want additional insight on how to better prepare and deliver a business pitch that you’ll be presenting online? Go to our guide to stress-free, engaging Zoom presentations .

We’re rooting for you and your business!

Other Posts

How to Write a Case Study

How to Write a Business Proposal in 2024 (Tips, Examples, and Template Included)

Competitor Insights 101: The Best Template for Mapping Industry Players

- Who we invest in

- Our portfolio

- Our partnerships

- Gen F Venture Studio

- The Entrepreneur Academy

- News & resources

- Meet our team

How to Pitch Your Business Effectively: 2024's Top 6 Tips

Having a brilliant business idea isn’t enough to guarantee success in the tech industry; you need funding. However, securing that funding isn’t easy. That’s where learning how to pitch your business to potential investors comes in. But how do you pitch effectively when you’re unsure where to start or the right steps to take?

In this article, we’ll share six of the top tips on how to pitch your business and cover other success strategies including the different types of pitches, writing an effective pitch, and all the essential details to include.

We’ll also cover common mistakes to avoid when pitching your business idea and strategies to safeguard it.

Let’s get started!

What is a business pitch?

A business pitch is a succinct presentation of a business idea, product, or service to convince people to support and fund it.

Your pitch is what gets investors to pay attention to your business.

Imagine you have only 30 seconds to captivate a potential investor with your business idea. What would you say to convince them to buy into your vision? This is what makes a business pitch important.

Sometimes, it could also be used to get continued support and funding, not only when presenting an idea.

You can pitch your business idea and get funding from:

- Family and friends

- Angel investors

- Peer-to-peer lender

- Venture capitalists.

However, this article’s main focus would be on showing you how to pitch your business idea to venture capitalists.

According to the 2022 Venture Capital in Africa Report (AVCA) , West Africa saw the largest proportion of venture capital deal volume across the African continent, capturing 30% of the market. Nigeria stood out as the most active country in terms of volume, contributing 22% to the total.

The 3 major types of pitches

Every entrepreneur will have to make a pitch at some point. The type of pitch you sell will depend on the audience, purpose, method of delivery, and goals.

The Elevator Pitch

This is a summary of your business idea that you can convey in the time it takes for an elevator ride.

A great elevator pitch is:

- Short : lasts between 30-45 seconds

- Bold : shows confidence, not arrogance

- Connects : tells a story, is emotion-driven, and is interesting

- Audience-focused : focused on catering to the needs of an audience

- Simple : straight to the point, succinct, and easy to understand

A great elevator pitch must include:

- An introduction: Start with a concise and attention-grabbing introduction that identifies who you are and the purpose of your pitch. Hook your audience with a compelling opening statement or question that piques their interest and encourages them to listen further.

- A problem statement: Define the problem or pain point your business addresses clearly and concisely. Use statistics or real-life examples to illustrate the impact of the problem and the need for a solution.

- A solution: Present your solution or value proposition, emphasising how your product or service addresses the identified problem.

- A unique selling proposition: Highlight your business’s value proposition and why stakeholders should choose your solution over alternatives.

- A call-to-action(CTA): Close your elevator pitch with a clear and compelling CTA that prompts your audience to take the next step. Keep the CTA simple and actionable, ensuring it aligns with the objective of your pitch and motivates an immediate response.

The short pitch:

This pitch lasts three to ten minutes. You summarise the important parts of your idea in a way that grabs the investors’ attention. Here, you’ll provide market and competitive analysis, your financial projections, and how you intend to market the business.

The long pitch

This pitch requires a longer period and a more comprehensive presentation than the other two. If you get this opportunity, ensure you have a blueprint for testing product-market fit and initial results, a monetisation plan, and an exit strategy.

In summary, understanding the three major types of pitches — the elevator, short, and long pitches — will help you effectively pitch your business idea across several contexts and keep your audience interested.

How to pitch your business to investors: Top 6 tips of 2024

Crafting a perfect pitch requires planning and effective communication. Here are the top six tips on how to pitch your business idea to venture capitalists:

- Know who you’re pitching to

- Connect with a story

Define the problem.

- State your solution

- Give all the details

- State your exit strategy

Learn these six tips to secure investment and succeed.

Know who you’re pitching to.

Before pitching your business, carry out your due diligence on the investors by researching who they are, the industries they invest in, the due process they follow, and their track record.

Just as you would want them to know more about you and your business, you should also know more about them so it will be easier to connect and respond to basic questions and possible objections correctly. The more you know about your potential investors, the better your chance of success.

Connect with a story.

Think back to those stories you were told as a child and how deeply you connected with them. If asked, you might be able to tell the story exactly how you were told then.

That’s how you should connect with the investors — by telling them the story behind your business idea, which helps boost their interest. Using a compelling story humanises your pitch. Make use of personal stories or case studies to illustrate the problem your business solves.

Bill Gurley , a general partner at Benchmark stated, “Investors are not solely evaluating your company’s story; they are also evaluating your ability to convey that story.”

As you pitch your business, clearly state the problem it addresses. Provide real-life examples to show the urgency of a solution.

State your solution.

When you identify a problem, you’re expected to propose a possible solution. What competitive advantage would your solution provide in the market? Is it really what people need? This should be your emphasis.

Give all the details.

No information should be left out. 99% of venture capitalists expect the following details in your pitch deck. (aka, the presentation of your idea);

Who you are (executive summary): What’s your unique value proposition? What differentiates you from the competition? What’s the story behind the idea? What do you intend to achieve? What’s your business plan?

Your target audience: Who do you intend to reach? Why them? How do you identify them?

The problem and solution: What pain points are your target audience experiencing? What are the emotional costs involved? What’s missing in the current solution, if any? How do you intend to fill the gap? Is your solution worth it?

Financial projections and milestones: How much funding do you need? Why do you need funding now? What milestones or benchmarks have you achieved? What are your numbers? How are you going to make money?

Business concept and model: What is your business model? How can you provide better delivery with more money? How are you going to scale your business?

Competition: Who are your competitors? What differentiates you from them? What similarities do you have? What’s the landscape like?

Market opportunity/ market potential: What need can you harness as an opportunity that is absent in the market? What are the reviews of your competitors’ products? Can you fill in the gap?

Marketing and sales strategy: What’s your campaign strategy? How do you intend to attract potential customers? Do you have a sales process and funnel in place?

Team: Who would be working with you? Why are they the only ones for the job?

With this, you will be able to anticipate the questions investors may ask and establish credibility and trust.

You can design a pitch deck using Canva , Google Slides, pitch.com, and PowerPoint. Whichever tool you decide to use, your goal should be to remain clear, engaging, and concise

State your exit strategy.

Your exit strategy is the plan for the eventual sale or dissolution of your business. It allows you to reduce or sell your share of the business to minimise losses if the business fails or gain profit if it succeeds. It can also help with financial forecasting and decision-making by providing insights into potential outcomes and the best course of action based on those predictions.

The exit strategy you choose depends on the level of control you want to retain in the business and whether or not you’d like changes to be made once you’ve acquired your stake.

Learning these six tips will help you secure investment and succeed.

Mistakes to avoid when pitching your business

While preparing your entire pitch, be mindful of common pitfalls that can undermine its effectiveness:

Lack of preparation

It takes preparation to stand a better chance of selling your pitch and winning over investors.

- Don’t prepare on the day of the pitch or leave out preparation because you think you know it all.

- Research the potential investors you’re meeting with to know what kind of businesses they invest in. If they invest only in larger companies and your business is a small one, you’d be wasting your time pitching to them.

- Prepare your pitch in advance and ensure you have all legal and pitch deck documents in place.

- Practice extensively and be prepared for possible objections and follow-up questions.

Oftentimes, when we’re so excited about an idea, we tend to forget what needs to be done and waste so much time on the joy of having an idea we believe in. Investors don’t just care about your belief in the idea; they want assurance that their money will be well-placed and yield maximum returns.

Lack of confidence

According to the GITNUX Marketdata report 2024 on self-confidence , people with low self-confidence earn, on average, $8000 less per year than people with high self-confidence, and 70% of people attribute part of their career success to self-confidence.

Your level of confidence will determine how much your audience trusts what you say. If confidence is all it takes to nail the pitch, why not go for it with all you’ve got?

Lack of clarity

Not being clear about your goals, funding needs, and how you intend to run the business will cost you time and money.

Be clear about who you are, your target market, your competition, and how your product or service differentiates you. Be specific about:

- Your numbers

- The needed capital

- The operating costs

- And every other expense required to start.

You can use examples or visual aids to enhance clarity.

Venture capitalists want to know every detail so they have a glimpse of what to expect in the future.

Being unprepared for investor responses

As you deliver your initial pitch, objections will surely arise. Prepare for them. Address the concerns or issues that come up as you pitch your business idea. Rather than disagreeing with or justifying everything they say that is wrong about your idea, try to see their perspective and reason with them.

Also, don’t withhold information on the possible deficiencies you’ve observed in your product or service. They may have already figured it out and are expecting you to say it. When you don’t, you leave a bad impression.

How to safeguard your idea during a business pitch

Protecting your intellectual property is important when pitching your business. Here are some strategies to safeguard your ideas:

Carry out due diligence.

It’s not just everyone that you should pitch your business idea. Get to know your potential investors better. Do they have a proven track record? If so, what do they seek in business owners or startups? Only work with those who have a good reputation.

Reveal only what you must.

Disclose information on a need-to-know basis, focusing on essential details that are relevant to the discussion. Avoid sharing trade secrets or sensitive data unless necessary.

Keep records of documents.

Maintain detailed records of meetings, presentations, and communications related to your business pitch. You can create a document folder where you upload all the files and also have a physical folder for paperwork.

Keeping paper trails helps you access documents easily when needed.

Incorporate non-disclosure agreements

NDAs outline the terms and conditions for handling confidential information. By signing a non-disclosure agreement (NDA), you have the legal right to take action against investors or buyers who use your idea without your consent.

However, ensure you exercise discretion, as some circumstances do not require using NDA.

Trademark your name.

When you register an idea as a trademark, you notify the public that it is yours. As a result, the law grants you and no one else the authority to use the mark in connection with any products or services described in the application.

In summary, avoiding these common pitfalls and implementing strategies to safeguard your intellectual property can enhance the effectiveness of your pitch, build investor confidence, and protect your business idea.

Learn how to pitch your business and win over investors.

A perfect business pitch is important to secure funding and push your business to success. By understanding the nuances of effective pitching, how to avoid common mistakes, and how to safeguard your idea during a pitch, you’ll be able to win over investors and hasten the growth of your business venture.

Are you ready to pitch your business to investors, especially venture capitalists? Learn more about securing funding for your business with FFA.

IMAGES

COMMENTS

Aug 27, 2020 · What Makes a Great Pitch? To make a successful pitch, entrepreneurs must exhibit several characteristics to convince investors to fund their innovative ideas. Every entrepreneur needs an intricate understanding of their idea, target market, growth strategy, product-market fit, and overall business model. This differentiates your business ...

Apr 1, 2022 · To make the business believable, the audience will now need to meet your team. Minute 8: The Team It may seem a little strange to wait until towards the end of your pitch to introduce your team ...

Dec 10, 2024 · Additionally, these best practice presentation structures make your business pitch more memorable to your audience and leave a lasting impression. Statistically, it turns out that people retain structured information up to 40 percent more accurately than information presented in freeform.

Mar 4, 2021 · In this guide, we’ll cover what exactly a business pitch looks like as well as 10 tips to create a successful pitch that gets you investors. Create a compelling pitch deck using our online presentation software. Or, browse through dozens of fully designed pitch deck templates inspired by companies like Airbnb, BuzzFeed, Uber and more.

The benefits of investing time into clarifying your business idea, your company’s story, your team’s traction, and the market potential extends beyond just impressing investors.

How to pitch your business to investors: Top 6 tips of 2024. Crafting a perfect pitch requires planning and effective communication. Here are the top six tips on how to pitch your business idea to venture capitalists: Know who you’re pitching to; Connect with a story; Define the problem. State your solution; Give all the details; State ...