- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One CURRENT ARTICLE

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

A business plan is a document that outlines a company's goals and the strategies to achieve them. It's valuable for both startups and established companies. For startups, a well-crafted business plan is crucial for attracting potential lenders and investors. Established businesses use business plans to stay on track and aligned with their growth objectives. This article will explain the key components of an effective business plan and guidance on how to write one.

Key Takeaways

- A business plan is a document detailing a company's business activities and strategies for achieving its goals.

- Startup companies use business plans to launch their venture and to attract outside investors.

- For established companies, a business plan helps keep the executive team focused on short- and long-term objectives.

- There's no single required format for a business plan, but certain key elements are essential for most companies.

Investopedia / Ryan Oakley

Any new business should have a business plan in place before beginning operations. Banks and venture capital firms often want to see a business plan before considering making a loan or providing capital to new businesses.

Even if a company doesn't need additional funding, having a business plan helps it stay focused on its goals. Research from the University of Oregon shows that businesses with a plan are significantly more likely to secure funding than those without one. Moreover, companies with a business plan grow 30% faster than those that don't plan. According to a Harvard Business Review article, entrepreneurs who write formal plans are 16% more likely to achieve viability than those who don't.

A business plan should ideally be reviewed and updated periodically to reflect achieved goals or changes in direction. An established business moving in a new direction might even create an entirely new plan.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. It allows for careful consideration of ideas before significant investment, highlights potential obstacles to success, and provides a tool for seeking objective feedback from trusted outsiders. A business plan may also help ensure that a company’s executive team remains aligned on strategic action items and priorities.

While business plans vary widely, even among competitors in the same industry, they often share basic elements detailed below.

A well-crafted business plan is essential for attracting investors and guiding a company's strategic growth. It should address market needs and investor requirements and provide clear financial projections.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

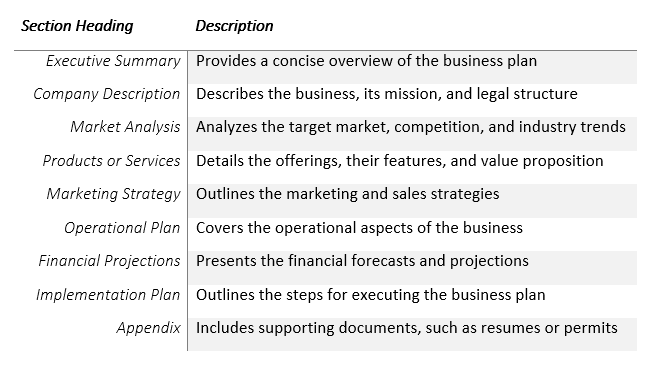

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, gathering the basic information into a 15- to 25-page document is best. Any additional crucial elements, such as patent applications, can be referenced in the main document and included as appendices.

Common elements in many business plans include:

- Executive summary : This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services : Describe the products and services the company offers or plans to introduce. Include details on pricing, product lifespan, and unique consumer benefits. Mention production and manufacturing processes, relevant patents , proprietary technology , and research and development (R&D) information.

- Market analysis : Explain the current state of the industry and the competition. Detail where the company fits in, the types of customers it plans to target, and how it plans to capture market share from competitors.

- Marketing strategy : Outline the company's plans to attract and retain customers, including anticipated advertising and marketing campaigns. Describe the distribution channels that will be used to deliver products or services to consumers.

- Financial plans and projections : Established businesses should include financial statements, balance sheets, and other relevant financial information. New businesses should provide financial targets and estimates for the first few years. This section may also include any funding requests.

Investors want to see a clear exit strategy, expected returns, and a timeline for cashing out. It's likely a good idea to provide five-year profitability forecasts and realistic financial estimates.

2 Types of Business Plans

Business plans can vary in format, often categorized into traditional and lean startup plans. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These are detailed and lengthy, requiring more effort to create but offering comprehensive information that can be persuasive to potential investors.

- Lean startup business plans : These are concise, sometimes just one page, and focus on key elements. While they save time, companies should be ready to provide additional details if requested by investors or lenders.

Why Do Business Plans Fail?

A business plan isn't a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections. Markets and the economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All this calls for building flexibility into your plan, so you can pivot to a new course if needed.

How Often Should a Business Plan Be Updated?

How frequently a business plan needs to be revised will depend on its nature. Updating your business plan is crucial due to changes in external factors (market trends, competition, and regulations) and internal developments (like employee growth and new products). While a well-established business might want to review its plan once a year and make changes if necessary, a new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is ideal for quickly explaining a business, especially for new companies that don't have much information yet. Key sections may include a value proposition , major activities and advantages, resources (staff, intellectual property, and capital), partnerships, customer segments, and revenue sources.

A well-crafted business plan is crucial for any company, whether it's a startup looking for investment or an established business wanting to stay on course. It outlines goals and strategies, boosting a company's chances of securing funding and achieving growth.

As your business and the market change, update your business plan regularly. This keeps it relevant and aligned with your current goals and conditions. Think of your business plan as a living document that evolves with your company, not something carved in stone.

University of Oregon Department of Economics. " Evaluation of the Effectiveness of Business Planning Using Palo Alto's Business Plan Pro ." Eason Ding & Tim Hursey.

Bplans. " Do You Need a Business Plan? Scientific Research Says Yes ."

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

Harvard Business Review. " How to Write a Winning Business Plan ."

U.S. Small Business Administration. " Write Your Business Plan ."

SCORE. " When and Why Should You Review Your Business Plan? "

:max_bytes(150000):strip_icc():format(webp)/INV_StockBrokerageFirms_GettyImages-1367390496-ec42699e206e4c8cab856297cdfe2099.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Management Resources

- Career Guides

- Interview Prep Guides

- Free Practice Tests

- Excel Cheatsheets

💡 Expert-Led Sessions 📊 Build Financial Models ⏳ 60+ Hours Learning

Business Plan

Publication Date :

17 Oct, 2023

Blog Author :

WallStreetMojo Team

Edited by :

Susmita Pathak

Reviewed by :

Dheeraj Vaidya, CFA, FRM

Table Of Contents

What Is A Business Plan?

A business plan is an executive document that acts as a blueprint or roadmap for a business. It is quite necessary for new ventures seeking capital, expansion activities, or projects requiring additional capital. It is also important to remind the management, employees, and partners of what they represent.

Creating a business plan is an indispensable part of any business. The main purpose of creating such a document is to attract prospective investors to provide capital to the enterprise. Therefore, the plan should cover all the important perspectives of a business - financial, operational, personnel, competition, etc.

- A business plan is a critical document for any business – whether a start-up or a well-established one. It can be considered a self-written bible for the company.

- The purpose of this plan should not just be restricted to convincing investors, but it should also extend to the company's morals and ethics, and every stakeholder should be aware of it.

- It can communicate the business idea's viability and, most importantly, the entrepreneurs' dedication to the business. As this dedication keeps them going, the investors are generally motivated to approve a venture when it is evident from the plan.

Business Plan Explained

Business plan writers are responsible for crafting the face of a business organization they hope to build. It cannot be easy because a business plan should be a versatile document that covers various perspectives and aspects of the business that the readers might expect.

The business plan objective is to talk about the company's unique selling proposition ( USP ), business culture, and what the company is. Finally, and most importantly, it is not a static document. With the company's growth, it needs to change by incorporating more relevant information and goals.

The outline of a business plan should be prepared from three perspectives - first, the market; second, the investors; and finally, the company. However, most plans tend to become business-oriented rather than focusing on the market and the investors. This might create a negative impression on the investors.

First, the entrepreneurs must understand a demand-supply gap from the market's perspective. This gap can be the perfect opportunity for the company. Or maybe the company has an innovative product or service idea, which they believe will have a high demand. Either way, the market should accept the product.

According to the Massachusetts Institute of Technology (MIT) Enterprise Forum, 1978, investors are more likely to approve market-driven businesses rather than technology or service-driven ones.

Also, the plan should address the investors' needs. What is in it for the investor? Since they invest a lot of money, they expect higher returns. Of course, no investor would demand profits upfront. But it's important to tell them when they can expect returns and how much. So the business should provide them with the data on the estimated payback period .

There are many types of business plans based on the size of the document and its scope.

#1 - Size-based plans

First, depending on the size of the plan, there are traditional and lean start-up plans. The traditional plan is a lengthy document with more than 20 pages. It covers various facets of the business in such a way as to answer the different questions that may arise in the readers' minds. But the disadvantage of this plan is that it might hold the readers' concentration only for a limited time.

The lean start-up plan is a concise and brief version of an actual plan, usually consisting of a single page. The demerit of this plan is that it might be too small and not include all the important and relevant information. But the entrepreneurs must be ready to provide the investors with a detailed document if required.

#2 - Scope-based plans

The second classification is based on the scope of the plan. It can be a start-up plan for new businesses seeking capital or an internal plan to communicate with different departments on a new project. Other types based on scope include strategic, feasibility, operations, and growth.

A strategic plan can communicate how the business will achieve its goal, while a feasibility plan can focus on the feasibility of the company's offerings. For example, the operations plan focuses on production and supply operations. In contrast, a business prepares the growth plan for its aspiring expansion projects, focusing on additional investments and financial projections .

The outline of a business plan should be carefully designed to incorporate all the focus points deemed essential by the audience. The following are the elements of any business plan sample:

- Executive summary – Also known as the elevator pitch , the business plan executive summary is the most important element of any business plan, best fitted in a page or two. A business should draw its plan from the mission and vision, which are the founding principles of any business. Next, it provides an idea and an overview of the company. It also introduces the product or service the company aims to offer. Finally, it is a summary of the plan.

- Business description – This is an elaboration of the company goals and objectives. It includes the market or industry the business belongs to, its target audience, etc. It can also provide information on the company structure and how it operates.

- Market research and analysis – Market research is the concrete floor on which the business plan stands. It should include facts and figures and give the readers an understanding of the market, its preferences, classifications, and the number and size of competitors. Analyzing the market lets businesses identify a gap and fill it. The plan should also inform the market's acceptance of the product or service.

- Competitive analysis – Competitors can make or break any business. Therefore, before entering the market, the businesses must evaluate how the competitors operate, their profits and costs, their offerings, etc. This will give the enterprise an idea of what it can do differently from the competitors to have the edge over them. This should be effectively communicated to the investors, as it might convince them of the venture's success.

- Marketing and sales plan – The whole point of any business is to make sales. For this, they need marketing campaigns and strategies targeting the right audience with minimal cost but maximum returns. For example, a firm selling study tools and materials will target students, especially through social media. Like this, businesses should plan their campaigns and decide their advertising channels.

- Operating plan – As the term implies, it talks about how the business is operated. The manufacturing and supply patterns, strategies like agile or lean, inventory approach, etc., decided by the management come under this. In addition, the expected quantity to be produced and supplied in a given period and the reverse logistics plan are good additions to the operating plan .

- Organization description – This gives information on the total employees, departments, management qualifications, job description, and total skill set of the organization's human resources. The decided salary and wages, HR policies, etc., are also part of an organization's description.

- SWOT analysis – SWOT analysis helps the business identify its strengths, weaknesses, opportunities, and threats, which will help them choose the critical approach. The business should take advantage of its strengths and opportunities while simultaneously working on the weaknesses and finding the best strategy to deal with the threats. This will balance the company and its internal and external environment.

- Financials – These refer to the financial projections, including the budget , estimated costs , payments, expected break-even point, payback period, etc. Forecasts on expected revenue and costs for at least one year or until the business breaks will be necessary. Also, the net capital requirements with proper accounting calculations must be part of the plan.

- Appendices – This can include other important or relevant documents to prepare the plan. For example, financial documents, proof of people's acceptance of products, resumes of the management, study on competition, etc.

Presentation is as important as the content when firms draft the business plan. Therefore, it is best to add graphs, pie charts, 3D models, and other visuals, which will enhance the presentation and understandability of the plan. In addition, factual data and simple statistical tools can make the plan look genuine and instill investor confidence.

Let us consider the following instances to understand the concept better:

Jack wants to establish a toy manufacturing business for which he requires considerable funding. However, to make sure the business idea is convincing enough for investors for them to take interest in the project, he designs a business plan. In the plan, he includes everything from the requirements to the sales promotion measures he would be using to make people, especially parents and kids, be aware of the products.

As a special mention, he specified that the material that would be used for manufacturing the toys will be kids-friendly and will have no chemical included that could harm kids even in a minute way. Given the features of the business, Jack tries to mention the strongest points that could help him get the funding from investors.

Sixteen experts from Forbes Business Council collectively listed a few ways in which entrepreneurs can leverage their business plans for making expansion decisions. The main components of preparing such plans range from conducting thorough research to setting realistic standard and ensuring regular reviews to check the progress status from time to time.

This example guides the entrepreneurs with no prior experience of how to write a business plan to understand the basics and accordingly present their ideas to the authorities/investors.

Creating a business plan is more important due to the negative impression its absence can cause rather than the benefits it might provide. The impression is what matters when it comes to a plan. So, let's understand the importance of making a good impression.

Perhaps the reason why most businesses make a plan is for the investors. These investors can be venture capitalists or financial institutions . For these investors, new ventures are like investments. Hence, before putting in money, they want to be sure if the investment will be worth it.

Therefore, presenting all the important details in an understandable format helps them realize the clarity and the level of commitment the entrepreneurs have towards their business. The business plan writer should also give due to the executive summary and financials while creating the plan.

Secondly, every business needs a blueprint based on which it operates. It should govern the functions of a business and especially in decision-making. Usually, when a plan is created before the enterprise starts functioning, it speaks about the business and what it stands for. Even after the business takes off and expands, it should stick to its roots, which would evolve with the company's growth.

Making every stakeholder – employees, partners, suppliers, investors, etc. - aware of the plan would increase commitment and sense of belonging to the enterprise. This, too, is important to improve the productivity and contribution of everyone.

Business Plan vs Business Model

Business plan and business model are terms that are considered to be similar, but then, they differ in various aspects from what the emphasis is on to who they target.

Let us have a look at the differences between the two below:

- While a business plan is the document that details every aspect of the business to give investors or readers a complete and clear picture of what the business is or would be all about, a business model defines and describes the channel to be adopted to deliver products and services to consumers.

- The focus of the former is to cover information about every department, section, and services of the business and specify the functions, including sales and marketing, advertising, revenue predictions, etc. On the contrary, the business model emphasize sales funnels, marketing approach to be used, etc.

- Business plans are formulated for investors and other stakeholders of the business, while business models are created for the internal members of the business who have to take care of the distribution of products and services to customers.

- The plans of a business focus on defining and describing the products and services that a company is aiming to produce. On the other hand, the models discuss the ways in which the products and services can be delivered to consumers.

Frequently Asked Questions (FAQs)

The elements of a business plan comprise an executive summary, company description, market research, competitive analysis, SWOT analysis, marketing strategy, operating plan, financial projections, etc.

Businesses create plans on their own by putting relevant content on paper and using their basic computer skills to make it look attractive. Ideally, plans are not expenses. Instead, they are created from the effort of the entrepreneurs.

All plans need not be highly visual. However, adequate data charts, graphs, 3-D models, etc., can make the document look attractive and creates an impression about the effort that has gone into furnishing the plan. It also increases the understandability of the document.

Businesses can draft plans for any period - maybe a year, three years, or just three months. Some plans are also created until the payback period. But it doesn't mean that the plan is rendered useless after the expiry of the period. On the contrary, a company should always have a constantly updated plan better suited to evolving needs.

Recommended Articles

This article is a guide to what is a Business Plan. Here, we explain the concept along with examples, components, importance, types, and vs business model. You can also go through our recommended articles on corporate finance –

- Business Strategy

- Business Plan Template

- Business Continuity Planning

🎧 Real entrepreneurs. Real stories.

Subscribe to The Hurdle podcast today!

What is a Business Plan? Definition and Resources

9 min. read

Updated July 29, 2024

If you’ve ever jotted down a business idea on a napkin with a few tasks you need to accomplish, you’ve written a business plan — or at least the very basic components of one.

The origin of formal business plans is murky. But they certainly go back centuries. And when you consider that 20% of new businesses fail in year 1 , and half fail within 5 years, the importance of thorough planning and research should be clear.

But just what is a business plan? And what’s required to move from a series of ideas to a formal plan? Here we’ll answer that question and explain why you need one to be a successful business owner.

- What is a business plan?

A business plan lays out a strategic roadmap for any new or growing business.

Any entrepreneur with a great idea for a business needs to conduct market research , analyze their competitors , validate their idea by talking to potential customers, and define their unique value proposition .

The business plan captures that opportunity you see for your company: it describes your product or service and business model , and the target market you’ll serve.

It also includes details on how you’ll execute your plan: how you’ll price and market your solution and your financial projections .

Reasons for writing a business plan

If you’re asking yourself, ‘Do I really need to write a business plan?’ consider this fact:

Companies that commit to planning grow 30% faster than those that don’t.

Creating a business plan is crucial for businesses of any size or stage. It helps you develop a working business and avoid consequences that could stop you before you ever start.

If you plan to raise funds for your business through a traditional bank loan or SBA loan , none of them will want to move forward without seeing your business plan. Venture capital firms may or may not ask for one, but you’ll still need to do thorough planning to create a pitch that makes them want to invest.

But it’s more than just a means of getting your business funded . The plan is also your roadmap to identify and address potential risks.

It’s not a one-time document. Your business plan is a living guide to ensure your business stays on course.

Related: 14 of the top reasons why you need a business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

What research shows about business plans

Numerous studies have established that planning improves business performance:

- 71% of fast-growing companies have business plans that include budgets, sales goals, and marketing and sales strategies.

- Companies that clearly define their value proposition are more successful than those that can’t.

- Companies or startups with a business plan are more likely to get funding than those without one.

- Starting the business planning process before investing in marketing reduces the likelihood of business failure.

The planning process significantly impacts business growth for existing companies and startups alike.

Read More: Research-backed reasons why writing a business plan matters

When should you write a business plan?

No two business plans are alike.

Yet there are similar questions for anyone considering writing a plan to answer. One basic but important question is when to start writing it.

A Harvard Business Review study found that the ideal time to write a business plan is between 6 and 12 months after deciding to start a business.

But the reality can be more nuanced – it depends on the stage a business is in, or the type of business plan being written.

Ideal times to write a business plan include:

- When you have an idea for a business

- When you’re starting a business

- When you’re preparing to buy (or sell)

- When you’re trying to get funding

- When business conditions change

- When you’re growing or scaling your business

Read More: The best times to write or update your business plan

How often should you update your business plan?

As is often the case, how often a business plan should be updated depends on your circumstances.

A business plan isn’t a homework assignment to complete and forget about. At the same time, no one wants to get so bogged down in the details that they lose sight of day-to-day goals.

But it should cover new opportunities and threats that a business owner surfaces, and incorporate feedback they get from customers. So it can’t be a static document.

Related Reading: 5 fundamental principles of business planning

For an entrepreneur at the ideation stage, writing and checking back on their business plan will help them determine if they can turn that idea into a profitable business .

And for owners of up-and-running businesses, updating the plan (or rewriting it) will help them respond to market shifts they wouldn’t be prepared for otherwise.

It also lets them compare their forecasts and budgets to actual financial results. This invaluable process surfaces where a business might be out-performing expectations and where weak performance may require a prompt strategy change.

The planning process is what uncovers those insights.

Related Reading: 10 prompts to help you write a business plan with AI

- How long should your business plan be?

Thinking about a business plan strictly in terms of page length can risk overlooking more important factors, like the level of detail or clarity in the plan.

Not all of the plan consists of writing – there are also financial tables, graphs, and product illustrations to include.

But there are a few general rules to consider about a plan’s length:

- Your business plan shouldn’t take more than 15 minutes to skim.

- Business plans for internal use (not for a bank loan or outside investment) can be as short as 5 to 10 pages.

A good practice is to write your business plan to match the expectations of your audience.

If you’re walking into a bank looking for a loan, your plan should match the formal, professional style that a loan officer would expect . But if you’re writing it for stakeholders on your own team—shorter and less formal (even just a few pages) could be the better way to go.

The length of your plan may also depend on the stage your business is in.

For instance, a startup plan won’t have nearly as much financial information to include as a plan written for an established company will.

Read More: How long should your business plan be?

What information is included in a business plan?

The contents of a plan business plan will vary depending on the industry the business is in.

After all, someone opening a new restaurant will have different customers, inventory needs, and marketing tactics to consider than someone bringing a new medical device to the market.

But there are some common elements that most business plans include:

- Executive summary: An overview of the business operation, strategy, and goals. The executive summary should be written last, despite being the first thing anyone will read.

- Products and services: A description of the solution that a business is bringing to the market, emphasizing how it solves the problem customers are facing.

- Market analysis: An examination of the demographic and psychographic attributes of likely customers, resulting in the profile of an ideal customer for the business.

- Competitive analysis: Documenting the competitors a business will face in the market, and their strengths and weaknesses relative to those competitors.

- Marketing and sales plan: Summarizing a business’s tactics to position their product or service favorably in the market, attract customers, and generate revenue.

- Operational plan: Detailing the requirements to run the business day-to-day, including staffing, equipment, inventory, and facility needs.

- Organization and management structure: A listing of the departments and position breakdown of the business, as well as descriptions of the backgrounds and qualifications of the leadership team.

- Key milestones: Laying out the key dates that a business is projected to reach certain milestones , such as revenue, break-even, or customer acquisition goals.

- Financial plan: Balance sheets, cash flow forecast , and sales and expense forecasts with forward-looking financial projections, listing assumptions and potential risks that could affect the accuracy of the plan.

- Appendix: All of the supporting information that doesn’t fit into specific sections of the business plan, such as data and charts.

Read More: Use this business plan outline to organize your plan

- Different types of business plans

A business plan isn’t a one-size-fits-all document. There are numerous ways to create an effective business plan that fits entrepreneurs’ or established business owners’ needs.

Here are a few of the most common types of business plans for small businesses:

- One-page plan : Outlining all of the most important information about a business into an adaptable one-page plan.

- Growth plan : An ongoing business management plan that ensures business tactics and strategies are aligned as a business scales up.

- Internal plan : A shorter version of a full business plan to be shared with internal stakeholders – ideal for established companies considering strategic shifts.

Business plan vs. operational plan vs. strategic plan

- What questions are you trying to answer?

- Are you trying to lay out a plan for the actual running of your business?

- Is your focus on how you will meet short or long-term goals?

Since your objective will ultimately inform your plan, you need to know what you’re trying to accomplish before you start writing.

While a business plan provides the foundation for a business, other types of plans support this guiding document.

An operational plan sets short-term goals for the business by laying out where it plans to focus energy and investments and when it plans to hit key milestones.

Then there is the strategic plan , which examines longer-range opportunities for the business, and how to meet those larger goals over time.

Read More: How to use a business plan for strategic development and operations

- Business plan vs. business model

If a business plan describes the tactics an entrepreneur will use to succeed in the market, then the business model represents how they will make money.

The difference may seem subtle, but it’s important.

Think of a business plan as the roadmap for how to exploit market opportunities and reach a state of sustainable growth. By contrast, the business model lays out how a business will operate and what it will look like once it has reached that growth phase.

Learn More: The differences between a business model and business plan

- Moving from idea to business plan

Now that you understand what a business plan is, the next step is to start writing your business plan .

The best way to start is by reviewing examples and downloading a business plan template . These resources will provide you with guidance and inspiration to help you write a plan.

We recommend starting with a simple one-page plan ; it streamlines the planning process and helps you organize your ideas. However, if one page doesn’t fit your needs, there are plenty of other great templates available that will put you well on your way to writing a useful business plan.

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

- Reasons to write a business plan

- Business planning research

- When to write a business plan

- When to update a business plan

- Information to include

- Business vs. operational vs. strategic plans

Related Articles

15 Min. Read

How to Write a Business Plan for an Outpatient Medical Practice

7 Min. Read

How to Write a Bakery Business Plan + Sample

3 Min. Read

11 Key Components of a Business Plan

5 Min. Read

Business Plan Vs Strategic Plan Vs Operational Plan—Differences Explained

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Starting a Business

- Growing a Business

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Tips White Papers

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- United Kingdom

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

Business Plan

By Entrepreneur Staff

Business Plan Definition:

A written document describing the nature of the business, the sales and marketing strategy, and the financial background, and containing a projected profit and loss statement

A business plan is also a road map that provides directions so a business can plan its future and helps it avoid bumps in the road. The time you spend making your business plan thorough and accurate, and keeping it up-to-date, is an investment that pays big dividends in the long term.

Your business plan should conform to generally accepted guidelines regarding form and content. Each section should include specific elements and address relevant questions that the people who read your plan will most likely ask. Generally, a business plan has the following components:

Title Page and Contents A business plan should be presented in a binder with a cover listing the name of the business, the name(s) of the principal(s), address, phone number, e-mail and website addresses, and the date. You don't have to spend a lot of money on a fancy binder or cover. Your readers want a plan that looks professional, is easy to read and is well-put-together.

Include the same information on the title page. If you have a logo, you can use it, too. A table of contents follows the executive summary or statement of purpose, so that readers can quickly find the information or financial data they need.

Executive Summary The executive summary, or statement of purpose, succinctly encapsulates your reason for writing the business plan. It tells the reader what you want and why, right up front. Are you looking for a $10,000 loan to remodel and refurbish your factory? A loan of $25,000 to expand your product line or buy new equipment? How will you repay your loan, and over what term? Would you like to find a partner to whom you'd sell 25 percent of the business? What's in it for him or her? The questions that pertain to your situation should be addressed here clearly and succinctly.

The summary or statement should be no more than half a page in length and should touch on the following key elements:

- Business concept describes the business, its product, the market it serves and the business' competitive advantage.

- Financial features include financial highlights, such as sales and profits.

- Financial requirements state how much capital is needed for startup or expansion, how it will be used and what collateral is available.

- Current business position furnishes relevant information about the company, its legal form of operation, when it was founded, the principal owners and key personnel.

- Major achievements points out anything noteworthy, such as patents, prototypes, important contracts regarding product development, or results from test marketing that have been conducted.

Description of the Business The business description usually begins with a short explanation of the industry. When describing the industry, discuss what's going on now as well as the outlook for the future. Do the necessary research so you can provide information on all the various markets within the industry, including references to new products or developments that could benefit or hinder your business. Base your observations on reliable data and be sure to footnote and cite your sources of information when necessary. Remember that bankers and investors want to know hard facts--they won't risk money on assumptions or conjecture.

When describing your business, say which sector it falls into (wholesale, retail, food service, manufacturing, hospitality and so on), and whether the business is new or established. Then say whether the business is a sole proprietorship, partnership, C or Sub chapter S corporation. Next, list the business' principals and state what they bring to the business. Continue with information on who the business' customers are, how big the market is, and how the product or service is distributed and marketed.

Description of the Product or Service The business description can be a few paragraphs to a few pages in length, depending on the complexity of your plan. If your plan isn't too complicated, keep your business description short, describing the industry in one paragraph, the product in another, and the business and its success factors in two or three more paragraphs.

When you describe your product or service, make sure your reader has a clear idea of what you're talking about. Explain how people use your product or service and talk about what makes your product or service different from others available in the market. Be specific about what sets your business apart from those of your competitors.

Then explain how your business will gain a competitive edge and why your business will be profitable. Describe the factors you think will make it successful. If your business plan will be used as a financing proposal, explain why the additional equity or debt will make your business more profitable. Give hard facts, such as "new equipment will create an income stream of $10,000 per year" and briefly describe how.

Other information to address here is a description of the experience of the other key people in the business. Whoever reads your business plan will want to know what suppliers or experts you've spoken to about your business and their response to your idea. They may even ask you to clarify your choice of location or reasons for selling this particular product.

Market Analysis A thorough market analysis will help you define your prospects as well as help you establish pricing, distribution, and promotional strategies that will allow your company to be successful vis-à-vis your competition, both in the short and long term.

Begin your market analysis by defining the market in terms of size, demographics, structure, growth prospects, trends, and sales potential. Next, determine how often your product or service will be purchased by your target market. Then figure out the potential annual purchase. Then figure out what percentage of this annual sum you either have or can attain. Keep in mind that no one gets 100 percent market share, and that a something as small as 25 percent is considered a dominant share. Your market share will be a benchmark that tells you how well you're doing in light of your market-planning projections.

You'll also have to describe your positioning strategy. How you differentiate your product or service from that of your competitors and then determine which market niche to fill is called "positioning." Positioning helps establish your product or service's identity within the eyes of the purchaser. A positioning statement for a business plan doesn't have to be long or elaborate, but it does need to point out who your target market is, how you'll reach them, what they're really buying from you, who your competitors are, and what your USP (unique selling proposition) is.

How you price your product or service is perhaps your most important marketing decision. It's also one of the most difficult to make for most small business owners, because there are no instant formulas. Many methods of establishing prices are available to you, but these are among the most common.

- Cost-plus pricing is used mainly by manufacturers to assure that all costs, both fixed and variable, are covered and the desired profit percentage is attained.

- Demand pricing is used by companies that sell their products through a variety of sources at differing prices based on demand.

- Competitive pricing is used by companies that are entering a market where there's already an established price and it's difficult to differentiate one product from another.

- Markup pricing is used mainly by retailers and is calculated by adding your desired profit to the cost of the product.

You'll also have to determine distribution, which includes the entire process of moving the product from the factory to the end user. Make sure to analyze your competitors' distribution channels before deciding whether to use the same type of channel or an alternative that may provide you with a strategic advantage.

Finally, your promotion strategy should include all the ways you communicate with your markets to make them aware of your products or services. To be successful, your promotion strategy should address advertising, packaging, public relations, sales promotions and personal sales.

Competitive Analysis The purpose of the competitive analysis is to determine:

- the strengths and weaknesses of the competitors within your market.

- strategies that will provide you with a distinct advantage.

- barriers that can be developed to prevent competition from entering your market.

- any weaknesses that can be exploited in the product development cycle.

The first step in a competitor analysis is to identify both direct and indirect competition for your business, both now and in the future. Once you've grouped your competitors, start analyzing their marketing strategies and identifying their vulnerable areas by examining their strengths and weaknesses. This will help you determine your distinct competitive advantage.

Whoever reads your business plan should be very clear on who your target market is, what your market niche is, exactly how you'll stand apart from your competitors, and why you'll be successful doing so.

Operations and Management The operations and management component of your plan is designed to describe how the business functions on a continuing basis. The operations plan highlights the logistics of the organization, such as the responsibilities of the management team, the tasks assigned to each division within the company, and capital and expense requirements related to the operations of the business.

Financial Components of Your Business Plan After defining the product, market and operations, the next area to turn your attention to are the three financial statements that form the backbone of your business plan: the income statement, cash flow statement, and balance sheet.

The income statement is a simple and straightforward report on the business' cash-generating ability. It is a scorecard on the financial performance of your business that reflects when sales are made and when expenses are incurred. It draws information from the various financial models developed earlier such as revenue, expenses, capital (in the form of depreciation), and cost of goods. By combining these elements, the income statement illustrates just how much your company makes or loses during the year by subtracting cost of goods and expenses from revenue to arrive at a net result, which is either a profit or loss. In addition to the income statements, include a note analyzing the results. The analysis should be very short, emphasizing the key points of the income statement. Your CPA can help you craft this.

The cash flow statement is one of the most critical information tools for your business, since it shows how much cash you'll need to meet obligations, when you'll require it and where it will come from. The result is the profit or loss at the end of each month and year. The cash flow statement carries both profits and losses over to the next month to also show the cumulative amount. Running a loss on your cash flow statement is a major red flag that indicates not having enough cash to meet expenses-something that demands immediate attention and action.

The cash flow statement should be prepared on a monthly basis during the first year, on a quarterly basis for the second year, and annually for the third year. The following 17 items are listed in the order they need to appear on your cash flow statement. As with the income statement, you'll need to analyze the cash flow statement in a short summary in the business plan. Once again, the analysis doesn't have to be long and should cover highlights only. Ask your CPA for help.

The last financial statement you'll need is a balance sheet. Unlike the previous financial statements, the balance sheet is generated annually for the business plan and is, more or less, a summary of all the preceding financial information broken down into three areas: assets, liabilities and equity.

Balance sheets are used to calculate the net worth of a business or individual by measuring assets against liabilities. If your business plan is for an existing business, the balance sheet from your last reporting period should be included. If the business plan is for a new business, try to project what your assets and liabilities will be over the course of the business plan to determine what equity you may accumulate in the business. To obtain financing for a new business, you'll need to include a personal financial statement or balance sheet.

In the business plan, you'll need to create an analysis for the balance sheet just as you need to do for the income and cash flow statements. The analysis of the balance sheet should be kept short and cover key points.

Supporting Documents In this section, include any other documents that are of interest to your reader, such as your resume; contracts with suppliers, customers, or clients, letters of reference, letters of intent, copy of your lease and any other legal documents, tax returns for the previous three years, and anything else relevant to your business plan.

Some people think you don't need a business plan unless you're trying to borrow money. Of course, it's true that you do need a good plan if you intend to approach a lender--whether a banker, a venture capitalist or any number of other sources--for startup capital. But a business plan is more than a pitch for financing; it's a guide to help you define and meet your business goals.

Just as you wouldn't start off on a cross-country drive without a road map, you should not embark on your new business without a business plan to guide you. A business plan won't automatically make you a success, but it will help you avoid some common causes of business failure, such as under-capitalization or lack of an adequate market.

As you research and prepare your business plan, you'll find weak spots in your business idea that you'll be able to repair. You'll also discover areas with potential you may not have thought about before--and ways to profit from them. Only by putting together a business plan can you decide whether your great idea is really worth your time and investment.

More from Business Plans

Financial projections.

Estimates of the future financial performance of a business

Financial Statement

A written report of the financial condition of a firm. Financial statements include the balance sheet, income statement, statement of changes in net worth and statement of cash flow.

Executive Summary

A nontechnical summary statement at the beginning of a business plan that's designed to encapsulate your reason for writing the plan

Latest Articles

This ai is the key to unlocking explosive sales growth in 2025.

Tired of the hustle? Discover a free, hidden AI from Google that helped me double sales and triple leads in a month. Learn how this tool can analyze campaigns and uncover insights most marketers miss.

'We're Not Allowed to Own Bitcoin': Crypto Price Drops After U.S. Federal Reserve Head Makes Surprising Statement

Fed Chair Jerome Powell's comments on Bitcoin and rate cuts have rattled cryptocurrency investors.

63 Small Business Ideas to Start in 2024

We put together a list of the best, most profitable small business ideas for entrepreneurs to pursue in 2024.

Like this content? Sign up to receive more!

Subscribe for tips and guidance to help you grow a better, smarter business.

We care about your privacy. See our Privacy Policy .

🎧 Real entrepreneurs. Real stories.

Subscribe to The Hurdle podcast

You can do this! Tour LivePlan to see how simple business planning can be.

Have an expert write your plan, build your forecast, and so much more.

Integrations

For Small Businesses

For Advisors & Mentors

What Is a Business Plan? Definition and Planning Essentials Explained

11 min. read

Updated November 22, 2024

What is a business plan? It’s the roadmap for your business. The outline of your goals, objectives, and the steps you’ll take to get there. It describes the structure of your organization, how it operates, as well as the financial expectations and actual performance.

A business plan can help you explore ideas, successfully start a business, manage operations, and pursue growth. In short, a business plan is a lot of different things. It’s more than just a stack of paper and can be one of your most effective tools as a business owner.

Let’s explore the basics of business planning, the structure of a traditional plan, your planning options, and how you can use your plan to succeed.

What is a business plan?

A business plan is a document that explains how your business operates. It summarizes your business structure, objectives, milestones, and financial performance. Again, it’s a guide that helps you, and anyone else, better understand how your business will succeed.

Why do you need a business plan?

The primary purpose of a business plan is to help you understand the direction of your business and the steps it will take to get there. Having a solid business plan can help you grow up to 30% faster , and according to our own 2021 Small Business research working on a business plan increases confidence regarding business health—even in the midst of a crisis.

These benefits are directly connected to how writing a business plan makes you more informed and better prepares you for entrepreneurship. It helps you reduce risk and avoid pursuing potentially poor ideas. You’ll also be able to more easily uncover your business’s potential.

The biggest mistake you can make is not writing a business plan, and the second is never updating it. By regularly reviewing your plan, you can understand what parts of your strategy are working and those that are not.

That just scratches the surface of why having a plan is valuable. Check out our full write-up for fifteen more reasons why you need a business plan .

What can you do with your plan?

So what can you do with a business plan once you’ve created it? It can be all too easy to write a plan and just let it be. Here are just a few ways you can leverage your plan to benefit your business.

Test an idea

Writing a plan isn’t just for those who are ready to start a business. It’s just as valuable for those who have an idea and want to determine whether it’s actually possible. By writing a plan to explore the validity of an idea, you are working through the process of understanding what it would take to be successful.

Market and competitive research alone can tell you a lot about your idea.

- • Is the marketplace too crowded?

- • Is the solution you have in mind not really needed?

Add in the exploration of milestones, potential expenses, and the sales needed to attain profitability, and you can paint a pretty clear picture of your business’s potential.

Document your strategy and goals

Understanding where you’re going and how you’re going to get there is vital for those starting or managing a business. Writing your plan helps you do that. It ensures that you consider all aspects of your business, know what milestones you need to hit, and can effectively make adjustments if that doesn’t happen.

With a plan in place, you’ll know where you want your business to go and how you’ve performed in the past. This alone prepares you to take on challenges, review what you’ve done before, and make the right adjustments.

Pursue funding

Even if you do not intend to pursue funding right away, having a business plan will prepare you for it. It will ensure that you have all of the information necessary to submit a loan application and pitch to investors.

So, rather than scrambling to gather documentation and write a cohesive plan once it’s relevant, you can keep it up-to-date and attempt to attain funding. Just add a use of funds report to your financial plan and you’ll be ready to go.

The benefits of having a plan don’t stop there. You can then use your business plan to help you manage the funding you receive. You’ll not only be able to easily track and forecast how you’ll use your funds but also easily report on how it’s been used.

Better manage your business

A solid business plan isn’t meant to be something you do once and forget about. Instead, it should be a useful tool that you can regularly use to analyze performance, make strategic decisions, and anticipate future scenarios. It’s a document that you should regularly update and adjust as you go to better fit the actual state of your business.

Doing so makes it easier to understand what’s working and what’s not. It helps you understand if you’re truly reaching your goals or if you need to make further adjustments. Having your plan in place makes that process quicker, more informative, and leaves you with far more time to actually spend running your business.

What should your business plan include?

The content and structure of your business plan should include anything that will help you use it effectively. That being said, there are some key elements that you should cover and that investors will expect to see.

Executive summary

The executive summary is a simple overview of your business and your overall plan. It should serve as a standalone document that provides enough detail for anyone—including yourself, team members, or investors—to fully understand your business strategy. Make sure to cover:

- • The problem you’re solving

- • A description of your product or service

- • Your target market

- • Organizational structure

- • A financial summary

- • Necessary funding requirements.

This will be the first part of your plan, but it’s easiest to write it after you’ve created your full plan.

Products & Services

When describing your products or services, you need to start by outlining the problem you’re solving and why what you offer is valuable. This is where you’ll also address current competition in the market and any competitive advantages your products or services bring to the table.

Lastly, outline the steps or milestones you’ll need to hit to launch your business successfully. If you’ve already achieved some initial milestones, like taking pre-orders or early funding, be sure to include them here to further prove your business’s validity.

Market analysis

A market analysis is a qualitative and quantitative assessment of the current market you’re entering or competing in. It helps you understand the industry’s overall state and potential, who your ideal customers are, the positioning of your competition, and how you intend to position your own business.

This helps you better explore the market’s long-term trends, what challenges to expect, and how you will need to introduce and even price your products or services.

Check out our full guide for how to conduct a market analysis in just four easy steps.

Marketing & sales

Here you detail how you intend to reach your target market. This includes your sales activities, general pricing plan, and the beginnings of your marketing strategy. If you have any branding elements, sample marketing campaigns, or messaging available—this is the place to add them.

Additionally, it may be wise to include a SWOT analysis that demonstrates your business or specific product/service position. This will showcase how you intend to leverage sales and marketing channels to deal with competitive threats and take advantage of any opportunities.

Check out our full write-up to learn how to create a cohesive marketing strategy for your business.

Organization & management

This section addresses the legal structure of your business, your current team, and any gaps that need to be filled. Depending on your business type and longevity, you’ll also need to include your location, ownership information, and business history.

Basically, add any information that helps explain your organizational structure and how you operate. This section is particularly important for pitching to investors but should be included even if attempted funding is not in your immediate future.

Financial projections

Possibly the most important piece of your plan, your financials section is vital for showcasing your business’s viability. It also helps you establish a baseline to measure against and makes it easier to make ongoing strategic decisions as your business grows. This may seem complex, but it can be far easier than you think.

Focus on building solid forecasts, keep your categories simple, and lean on assumptions. You can always return to this section to add more details and refine your financial statements as you operate.

Here are the statements you should include in your financial plan:

- • Sales and revenue projections

- • Profit and loss statement

- • Cash flow statement

- • Balance sheet

The appendix is where you add additional detail, documentation, or extended notes that support the other sections of your plan. Don’t worry about adding this section at first; only add documentation that you think will benefit anyone reading your plan.

Types of business plans explained

While all business plans cover similar categories, the style and function depend on how you intend to use your business plan . So, to get the most out of your plan, it’s best to find a format that suits your needs. Here are a few common business plan types worth considering.

Traditional business plan

The tried-and-true traditional business plan (sometimes called a detailed business plan ) is a formal document meant for external purposes. It is typically required when applying for a business loan or pitching to investors.

It can also be used when training or hiring employees, working with vendors, or any other situation where the full details of your business must be understood by another individual.

A traditional business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix. We recommend only starting with this business plan format if you plan to immediately pursue funding and already have a solid handle on your business information.

Business model canvas

The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

The structure ditches a linear structure in favor of a cell-based template. It encourages you to build connections between every element of your business. It’s faster to write out and update and much easier for you, your team, and anyone else to visualize your business operations.

The business model canvas is really best for those exploring their business idea for the first time, but keep in mind that it can be difficult to actually validate your idea this way as well as adapt it into a full plan.

One-page business plan

The true middle ground between the business model canvas and a traditional business plan is the one-page business plan . Sometimes referred to as a lean plan, this format is a simplified version of the traditional plan that focuses on the core aspects of your business. It basically serves as a beefed-up pitch document and can be finished as quickly as the business model canvas.

By starting with a one-page plan, you give yourself a minimal document to build from. You’ll typically stick with bullet points and single sentences making it much easier to elaborate or expand sections into a longer-form business plan.

A one-page business plan is useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Growth plan

Now, the option that we here at LivePlan recommend is a growth plan . However, growth planning is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance.

It holds all of the benefits of the single-page plan, including the potential to complete it in as little as 27-minutes .

However, it’s even easier to convert into a more detailed business plan thanks to how heavily it’s tied to your financials. The overall goal of growth planning isn’t to just produce documents that you use once and shelve. Instead, the growth planning process helps you build a healthier company that thrives in times of growth and stable through times of crisis.

It’s faster, concise, more focused on financial performance, and ensures that your plan is always up-to-date.

How can you write your own business plan?

Now that you know the definition of a business plan, it’s time to write your own.

Get started by downloading our free business plan template or try a business plan builder like LivePlan for a fully guided experience and an AI-powered Assistant to help you write, generate ideas, and analyze your business performance.

No matter which option you choose, writing a business plan will set you up for success. You can use it to test an idea, figure out how you’ll start, and pursue funding. And if you review and revise your plan regularly, it can turn into your best business management tool.

Like this post? Share with a friend!

Kody currently works as the Inbound and Content Marketing Specialist at Palo Alto Software and runs editorial for both LivePlan and Bplans, working with various freelance specialists and in-house writers. A graduate of the University of Oregon, he specializes in SEO research, content writing, and branding.

Table of Contents

Related articles.

Noah Parsons

November 23, 2024

Cash Flow Statement: Definition + How to Create and Read it

November 22, 2024

What is Cash Runway + How to Calculate it

How to Do a Sales Forecast for Your Business the Right Way

The Leading Source of Insights On Business Model Strategy & Tech Business Models

A business plan is a document that details key operational and financial goals for a business and how they will be achieved in the future. Essentially, a business plan is an exercise in due diligence. While no business plan can accurately predict the future, they do demonstrate and give insight into the likelihood of eventual profitability. This in turn removes some of the entrepreneurial risk associated with investing large amounts of time and capital into a new venture.

What Is A Business Plan And Why It Matters In Business

Table of Contents

A typical business plan structure

Business plan structure varies considerably across industries, but most incorporate these parts as a part of a 10 to 20-page document.

Business concept

What is the nature of the industry the business intends to operate in?

What is the structure of the business and what are the products or services it will offer? How will it achieve success?

Marketplace analysis

Who is the potential target audience and why are they motivated to buy? Is there an existing demand for the product or service? In this part, it’s crucial to be as detailed as possible.

Develop a target demographic and associated buyer persona through in-depth research.

Market development is a growth-centric strategy that businesses use to identify or develop new market segments for existing products. Companies utilize the market development strategy to discover new potential buyers of their products or services.

Competitive analysis

Who are the main competitors and what are their strengths and weaknesses? Is the market saturated or impenetrable?

If the market does have established players, then strategies must be devised to acquire market share.

Direct competitors are companies that offer the same product or service and that might have the same business and financial profile. Indirect competitors, on the other hand, are companies whose products or services while different could potentially satisfy the same customer needs. Competition in the digital era has become way more fluid, thus it’s important to take into account various overlapping factors to assess the competitive landscape.

Financial plan

If financing is required, then a sound financial plan will be key in attracting capital from banks, investors, or venture capitalists.

As best as possible, develop income and cash flow statements, balance sheets, and break-even analyses.

The goal here is to convince interested parties that the business has a realistic chance of success.

Management and legal structure

How will the company be structured and who will lead it? What skills do management bring to the table and how will they contribute to success?

A sound business plan should also define the intended legal structure, whether that be incorporated, partnership, sole proprietor, or LLC.

The four main categories of business plans

Business plans usually fall under one of four main categories:

The mini-plan

Used to quickly test a concept or gauge the interest of a prospective investment partner. Mini-plans are typically short at 1-10 pages in length.

The working plan

Used to describe how a business could operate once established.

The working plan is primarily an internal document; it does not need to look attractive with supporting photography, formatting, and appendices.

The presentation plan

Or a working plan submitted to interested external parties. Industry jargon and slang should be removed in favor of standard business language.

The presentation plan should incorporate all aspects of a typical business plan structure.

Attention to detail is also a must. Figures must be correct and words free of typing errors. The plan should also be professionally bound and printed.

The electronic plan

In the digital age, many organizations find it useful to keep electronic copies of their business plans.

These are useful for savvy investors who want to delve into complex spreadsheets for analysis . They are also ideal for presentations and virtual meetings.

How to build an effective business plan according to Peter Thiel

No matter which industry you’re in. There are seven questions to answer according to Peter Thiel. If you nail all seven you’ll master fortune and succeed.

According to Pether Thiel, former CEO of PayPal and founder of the software company Palantir, there are seven questions to answer if you want to create a company that will go from Zero to One.

Those questions are critical to building a business that will be able to capture value in the long run. In fact, according to Peter Thiel the value of a business isn’t to go from 1 to n but to real value is to go from Zero to One.

In short, build a company that creates new things, rather than building a business based on the existing “best practices,” which according to Peter Thiel, leads to dead ends.

This framework of going from Zero to One can be summarised in seven questions to answer if you want to have a great business plan.

In fact, you don’t need complicated Excel models or reasonings. You only need to address now these seven questions.

Indeed, that is how Peter Thiel puts it in Zero to One:

Whatever your industry, any great business plan must address every one of them.If you don’t have good answers to these questions, you’ll run into lots of “bad luck” and your business will fail. If you nail all seven you’ll master fortune and succeed.

The Engineering Question

Can you create breakthrough technology instead of incremental improvements?

The Timing Question

Is now the right time to start your particular business?

The Monopoly Question

Are you starting with a big share of a small market?

The People Question

Do you have the right team?

The Distribution Question

Do you have a way to not just create but deliver your product?

The Durability Question

Will your market position be defensible 10 and 20 years into the future?

The Secret Question

Have you identified a unique opportunity that others don’t see?

Key takeaways

- A business plan is a comprehensive document that highlights the goals of a business and how it plans to achieve them.

- A business plan is essential for new businesses where due diligence is crucial in attracting external investment or predicting long-term viability. All businesses – regardless of maturity – should use and adhere to such a plan.

- There are four main categories of business plans, with each category suited to a particular stage of the business life cycle.

Key Highlights:

- Business Plan Definition: A business plan is a detailed document outlining a business ’s operational and financial goals, along with strategies for achieving them. It serves as a tool for due diligence, demonstrating the potential profitability of a venture and reducing entrepreneurial risk.

- Business Concept: Describes the industry, business structure, products/services, and success strategies.

- Marketplace Analysis: Identifies the target audience, demand, and buyer persona through detailed research.

- Competitive Analysis: Assesses main competitors, their strengths and weaknesses, and market saturation.

- Financial Plan: Presents income statements, cash flow projections, balance sheets, and break-even analyses.

- Management and Legal Structure: Defines the company’s structure, leadership, and legal status.

- Mini-Plan: Brief, used to test concepts or attract investment partners.

- Working Plan: Describes how a business will operate, primarily for internal use.

- Presentation Plan: Tailored for external parties, incorporates all aspects of a typical plan.

- Electronic Plan: Digital copies useful for analysis , presentations, and virtual meetings.

- Peter Thiel, co-founder of PayPal, outlines seven critical questions to address in a business plan.

- These questions guide businesses to create new value and avoid dead-end practices.

- The seven questions include: Engineering Question, Timing Question, Monopoly Question, People Question, Distribution Question, Durability Question, and Secret Question.

- Addressing these questions enhances a company’s chances of success by creating breakthrough technology, timing the market entry, targeting a niche market, forming the right team, ensuring product delivery, building defensible market positions, and identifying unique opportunities.

- A business plan outlines a business ’s goals and strategies for achieving them.

- It is essential for attracting investment, reducing risk, and guiding business operations.

- The plan’s components include business concept, marketplace analysis , competitive analysis , financial plan, and management structure.

- Business plans can fall into four categories: mini-plan, working plan, presentation plan, and electronic plan.