Tata Starbucks Ltd A Strategic Analysis

This document provides a strategic analysis of the joint venture between Tata Global Beverages and Starbucks Coffee Company to operate Starbucks cafes in India under the name "TATA Starbucks Limited". It includes a situational analysis of the Indian coffee market opportunity, Starbucks' strategic intent to replicate success in China. A SWOT analysis, PESTEL analysis, Porter's Five Forces analysis, market analysis using Aaker's 7 dimensions, and analysis of competitors like Cafe Coffee Day are also provided. The executive summary evaluates the viability of the strategic alliance between the two companies. Read less

More Related Content

- 1. AMITY BUSINESS SCHOOL NOIDA, UTTAR PRADESH 201303 TATA STARBUCKS LTD. A STRATEGIC ANALYSIS

- 2. TABLE OF CONTENTS INTRODUCTION................................................................................................................................... 4 SITUATIONAL ANALYSIS .................................................................................................................. 4 STRATEGIC INTENT ............................................................................................................................ 5 Starbucks Mission Statement................................................................................................................ 5 SWOT ANALYSIS ................................................................................................................................. 8 Internal Factor Analysis Summary (IFAS) ........................................................................................... 8 External Factor Analysis Summary (EFAS).......................................................................................... 9 Strategic Factors Analysis Summary (SFAS) ...................................................................................... 10 Strengths ........................................................................................................................................... 11 Weaknesses ....................................................................................................................................... 11 Opportunities .................................................................................................................................... 11 Threats .............................................................................................................................................. 12 SCANNING THE ENVIRONMENT - PESTEL ANALYSIS ................................................................ 13 Political Factors ................................................................................................................................ 13 Economic Factors.............................................................................................................................. 13 Socio-Cultural Factors ...................................................................................................................... 13 Technological Factors ....................................................................................................................... 14 Environmental Factors ...................................................................................................................... 14 Legal Factors .................................................................................................................................... 15 INDUSTRY ANALYSIS – PORTER’S FIVE FORCES FRAMEWORK .............................................. 16 Industry Rivalry ................................................................................................................................. 17 Potential for New Entrants ................................................................................................................ 17 Threat of Substitute Products ............................................................................................................. 18 Bargaining Power of Suppliers .......................................................................................................... 18 Bargaining Power of Buyers .............................................................................................................. 18 MARKET ANALYSIS - DAVID AAKER'S 7 DIMENSIONS OF MARKET FORCES........................ 19 Market Size........................................................................................................................................ 19 2 Market Growth Rate .......................................................................................................................... 19 Market Profitability ........................................................................................................................... 19 Industry Cost Structure ...................................................................................................................... 20 Distribution Channel ......................................................................................................................... 20

- 3. Market Trends ................................................................................................................................... 21 Key Success Factors .......................................................................................................................... 22 COMPETITOR ANALYSIS - PORTER'S 4-CORNER ANALYSIS ..................................................... 23 Market Share of Major Coffee Retail Chains in India, FY’2010 ......................................................... 23 Café Coffee Day ................................................................................................................................ 24 Barista .............................................................................................................................................. 25 Costa Coffee ...................................................................................................................................... 26 Quiky's .............................................................................................................................................. 26 EXECUTIVE SUMMARY ................................................................................................................... 27 REFERENCES...................................................................................................................................... 28 3

- 4. INTRODUCTION Tata Global Beverages Limited and Starbucks Coffee Company launched a joint venture between the iconic international coffee brand and the 2nd largest branded tea company in the world. The 50/50 joint venture, named TATA Starbucks Limited, owns and operates Starbucks cafés, branded as Starbucks Coffee “A Tata Alliance.” The first store has already opened and subsequent stores are in line to be opened at Mumbai in India at the end of October, 2012. The alliance is expected to be very fruitful to both the companies in the long run. The report seeks to strategically assess the viability of this strategic alliance by peeping into its myriads of dimensions. SITUATIONAL ANALYSIS India and China are the world‘s two fastest growing economies. Starbucks had already ventured into the Chinese market and not surprisingly, their Chinese venture turned out to be much profitable than that of their US business. Thus, they want to replicate their success in Chinese mainland in India. Also, the Indian market is heavily driven by the upcoming youth culture which is totally driven by the western trends. With the growing disposable income of Indians, people tend to spend more towards apparels and fast foods. With the success of Indian owned Café Coffee Day and Barista Coffee, it is a widely proven fact that there is lot of scope for the development of coffee café culture in India. Thus, Starbucks want to capitalize on this particular opportunity. They are planning to start with targeting the niche upper class segment by opening their outlets in TAJ Hotels and Resorts. Their primary target market is the younger generation of age 16-40years. They will also target the tourists who will be visiting India. Since, most of the tourists coming to India are from the countries of U.S., England, Germany, and Japan who are well aware of Starbucks brand name. Thus, there will not be the problem of brand name recognition among them. 4

- 5. STRATEGIC INTENT Starbucks Corp. is aiming India as its next major hub for development. Starbucks want to replicate the success they had in USA and more recently, in china. Surprisingly, their venture in China proved to be more profitable than that of US. Here in India, Starbucks entered into a deal with TATA Coffee Ltd, Asia's largest publicly traded coffee grower. This is, in particular, a non- binding agreement between two giants. There are plans to combine the trust and legacy of TATA coffee with the iconic brand image of Starbucks which can move on to development of Starbucks retail coffee chains in other parts of Asia. In addition to sourcing coffee beans from TATA‘s Indian facilities, the companies will also work towards developing Starbucks stores in retail outlets and hotels. Starbucks Mission Statement “To inspire and nurture the human spirit – one person, one cup and one neighborhood at a time.” Starbucks is very quality driven organization and is passionate about ethically sourcing the finest coffee beans, roasting them with great care and improving the lives of people who grow them. They call their employees as their partners and treat each other with respect and dignity. They believe in getting engaged with their customers and make connect with them so as to laugh with them, uplift customers' lives even if it is just for moments. They believe in human connection and developing the sense of belonging. They believe in creating good neighborhood and each store is nourished as a community. Tata has made the cultural fit for Starbucks which will help in building core competencies of each other. (Tata has met all the stringent standards and conditions followed by Starbucks such as quality, soil, water, pest, waste and energy management, forest and biodiversity conservation to workers’ welfare, wages and benefits, living conditions, health, safety, etc.) 5 Starbucks is committed to a role of environmental leadership in all facets of their business. They strive to fulfill this mission by a commitment to:

- 6. Understanding of environmental issues and sharing information with their partners Developing innovative and flexible solutions to bring about change Striving to buy, sell and use environmentally friendly products. Recognizing that financial responsibility is essential to their environmental future Instilling environmental responsibility as a corporate value Measuring and monitoring their progress for each project. Encouraging all partners to share in their mission Objective of Tata Coffee behind this Alliance: The agreement will allow Tata coffee to provide roast coffee bean to Starbucks in India. Get opportunity to jointly invest in additional facility for export to other markets. Starbucks will help by providing new technologies for the promotion of responsible agronomy practices. A long term relationship will be formed with this Memorandum of Understanding with Starbucks. After this deal, Tata Coffee is poised to become Asia’s biggest publicly traded coffee grower. Objective of Starbucks Corporation: To tap huge emerging market of India. Help increase its profitability due to its declining market and over dependence on US market. To have access to the high quality Arabica coffee. John Culver, president, Starbucks China and Asia Pacific on opening up of the first store in India at Mumbai states, “This is the first step Starbucks and Tata Coffee Limited are taking toward developing and improving the profile of Indian-grown Arabica coffees around the world by elevating the stature of Indian coffee, as well as improving the quality of coffee through 6 sustainable practices.” “Tata Global Beverages is a company known for bringing memorable tea consumption moments to consumers in India," stated Harish Bhatt, CEO, Tata Global Beverages. “The joint

- 7. venture is in line with Tata Global Beverages’ strategy of growing through strategic alliances in addition to organic growth. We are excited about the opportunity to innovate in the retail space and bring new beverage moments to more consumers.” As part of the agreement, Starbucks and Tata Coffee Limited will work toward developing and improving the profile of Indian-grown Arabica coffees around the world by elevating the stature of Indian coffee, as well as improving the quality of coffee through sustainable practices and advanced agronomy solutions. Espresso sourced from India will be a hallmark feature of all Starbucks stores in the market, highlighting the quality espresso available in India and Tata Starbucks Limited’s commitment is to deliver a truly unique and authentic Starbucks Experience to customers throughout India. Deepening its commitment to community, Tata Starbucks Limited will work to improve the lives of coffee growing communities in the State of Karnataka. The joint venture, through an initial financial commitment, will work to support 'SWASTHA,' a school for children with special needs (in partnership with the COORG Foundation). Additionally, Tata Starbucks Limited will work on initiatives including the promotion of responsible agronomy practices and training of local farmers, technicians and agronomists to improve their coffee-growing and milling skills. 7

- 8. SWOT ANALYSIS Internal Factor Analysis Summary (IFAS) Internal Strategic Weighted Weight Rating Comments Forces Score Strengths S1 - Brand Visibility 0.15 5 0.75 International popularity of the Starbucks Brand. S2 - Ethical and 0.10 3 0.30 Environmental Practices S3 – Marketing Skills 0.10 3 0.30 S4 – Access to High Quality 0.15 4 0.60 Sourcing Agreement. Arabica Coffee S5 – JV with Tata Coffee 0.15 4 0.60 Tata as a cultural fit for Starbucks will help in building core competencies of each other. Weaknesses W1 - Image of luxury coffee 0.10 4 0.40 outlets W2 – Premium Pricing 0.05 2 0.10 High price of coffee is felt as a barrier as per Policies capita income is low in India. W3 – Coffee Dominant 0.10 3 0.30 Need to diversify. Business They apply the same business models and W4 – Rigid Standards and 0.05 3 0.15 formulas, regardless of culture and values of Policies at Outlets the country. W5 – May affect JV between Tata Coffee and 0.05 2 0.10 Tata Coffee also has a JV with Barista. Barista TOTAL SCORES 1.00 3.60 8

- 9. External Factor Analysis Summary (EFAS) External Strategic Weighted Weight Rating Comments Forces Score Opportunities O1 – India Huge Market 0.15 4 0.60 India is the second most populated country in the world. O2 – English Speaking 0.08 3 0.24 Market O3 – Increasing Spending 0.15 4 0.60 Power O4 – Young Population 0.07 4 0.28 Younger generation is more prone to visit cafes. O5 – Out-of-home Coffee 0.05 3 0.15 Rating for coffee outside home is better than Drinking Culture catching tea outside home, specifically in the North O6 – Favorable Cost of 0.05 2 0.10 Labor O7 – Favorable 0.05 3 0.15 Infrastructure and Cost O8 – Skilled Manpower 0.02 3 0.06 Availability O9 – Opportunity to cater 0.03 2 0.06 Tea Drinking Segment Threats Most of the Indians consumed tea at least T1 – Tea Drinking Country 0.08 4 0.32 twice a day, in the morning and in the afternoon. Coffee Café Day (CCD) pioneered the T2 – Competition from 0.10 3 0.30 concept of specialty coffee in India followed Homegrown Brands by Qwiky’s and Barista Coffee. T3 – Low Per Capita Income 0.05 3 0.15 Immense need to offer products at locally competitive price. Campaign worldwide against the high- T4 – Health Consciousness 0.02 3 0.06 calorie and high fat products that Starbucks sells. T5 – Rare habit of Visiting 0.02 3 0.06 Cafes McDonalds, Dunkin Donuts, Burger King, T6 – Competition from 0.03 3 0.09 etc already have the infrastructure in place Other Fast Food Chains and are instead adding quality coffee to their 9 menus. T7 – Rising Prices of Coffee 0.05 4 0.20 Rising prices of coffee are putting pressure on the profit margins of the company. TOTAL SCORES 1.00 3.42

- 10. Strategic Factors Analysis Summary (SFAS) Weighted Strategic Factors Weight Rating Comments Score S1 - Brand Visibility 0.10 4 0.40 International popularity of the Starbucks Brand could be capitalized. S4 – Access to High Quality 0.08 4 0.32 Arabica Coffee is of very high quality and Arabica Coffee this could be hot selling products worldwide. In addition to sourcing coffee beans from S5 – JV with Tata Coffee 0.08 4 0.32 TATA‘s Indian facilities, the companies will also work towards developing Starbucks stores in retail outlets and hotels. W1 - Image of luxury coffee Starbucks Coffee outlets have the image of 0.12 4 0.48 high end luxury café and customers may not outlets turn. W3 – Coffee Dominant 0.10 3 0.30 Need to diversify well. Business O1 – India Huge Market 0.15 4 0.60 India is the second most populated country in the world. Increasing job opportunities and advances in O3 – Increasing Spending 0.07 5 0.35 services sector with globalization is raising Power standards of living in India. O4 – Young Population 0.08 5 0.40 Younger generation is more prone to visit cafes. Most of the Indians consumed tea at least T1 – Tea Drinking Country 0.07 4 0.28 twice a day, in the morning and in the afternoon. McDonalds, Dunkin Donuts, Burger King, T2 – Competition from 0.08 4 0.32 etc already have the infrastructure in place Homegrown Brands and are instead adding quality coffee to their menus. T7 – Rising Prices of Coffee 0.07 4 0.28 Rising prices of coffee are putting pressure on the profit margins of the company TOTAL SCORES 1.00 4.05 The Strategic Factors Summary shows that the most important factors overall received a score of 4.05 which is above average. This is positive for the company. They are responding well to their 10 strength, weaknesses, opportunities and threats. After some recent re purposing it is clear that the company is focusing on its core competencies but has room to improve.

- 11. Strengths High Brand Visibility. (International popularity of the Starbucks brand.) Ethical and Environmental Practices. Superb Marketing and positioning skills of Starbucks. Access to TATA's premium Robusta and Arabica coffees (Sourcing Agreement). Tata as a cultural fit for Starbucks will help in building core competencies of each other. (Tata has met all the stringent standards and conditions followed by Starbucks such as quality, soil, water, pest, waste and energy management, forest and biodiversity conservation to workers’ welfare, wages and benefits, living conditions, health, safety, etc.) Weaknesses Image of luxury coffee outlets. High price of coffee is felt as a barrier in the South and the North. (Starbucks products were priced at a premium and the per capita income in India is lower compared to other markets where it is already present, there is immense need to offer products at locally competitive price.) Coffee dominant business. (Need to diversify) Certain rigid standards and policies at outlets. (They apply the same business models and formulas, regardless of culture and values of the country they are operating in like no smoking policy, etc.) The entry of Starbucks is aimed at the out-of-home coffee consumption market and this may affect the alliance of Tata Coffee with Barista. Opportunities India is the second most populated country in the world. Huge Market. English speaking populations Growing Middle Class and increasing spending power of Indian Population. 11 Young Population (Consumers in the age group of 20–45 years were emerging as the fastest growing consumer group and the average age of an Indian in 2020 would be 29 years, compared to 37 years in China and the United States, 45 years in Western Europe, and 48 years in Japan. Younger generation is more prone to visit cafes as per a research)

- 12. Rating for coffee outside home is better than tea outside home, specifically in the North and the East. (The people in southern states of India largely consume coffee. The people in the northern states are generally not coffee drinkers, but drink coffee and experiment with various flavors as a fashion statement.) Favorable Cost of Labor Favorable cost and quality of telecom infrastructure Fair availability of workforce (Quantity as well as skilled) Tea-based culture of India could be used as opportunities by offering more tea-based drinks. Threats India is a tea-based culture. (The Indian hot-beverage market is dominated by tea. India was the largest producer and consumer of tea in the world and accounted for 29% of the total production and over 20% of the total consumption globally.60 Most of the Indians consumed tea at least twice a day, in the morning and in the afternoon.) Homegrown brands dominate the retail coffee market. Coffee Café Day (CCD) pioneered the concept of specialty coffee in India followed by Qwiky’s and Barista Coffee. Lower per capita income in India. High price of coffee is felt as a barrier in the South and the North. (Starbucks products were priced at a premium and the per capita income in India is lower compared to other markets where it is already present, there is immense need to offer products at locally competitive price.) Increasing Health Consciousness among consumers. (The increasing rate of obesity and obesity related diseases such as diabetes, high blood pressure, and heart diseases in India. Starbucks was said to have been on the target of many consumer health groups worldwide who planned to campaign against the high-calorie and high fat products that Starbucks sold and which could lead to increased obesity risk, heart diseases, and cancer.) Visiting cafes is not a frequent habit among most of the Indians. Other fast food chains like that of McDonalds, Dunkin Donuts, Burger King, etc., already 12 have the infrastructure in place and are instead adding quality coffee to their menus to compete with Starbucks. Rising prices of coffee are putting pressure on the profit margins of the company.

- 13. SCANNING THE ENVIRONMENT - PESTEL ANALYSIS Political Factors “India’s young are becoming world-class consumers, and multinationals are taking note,” reads the sub header for an article titled “Hey, Big Spenders!” in the August 2003 issue of TIME Magazine. This change can be attributed to many factors. For one, the Indian economy went through a massive liberalization under the new minority government of P.V. Narasimha Rao in 1991. Further, the current government’s reform measures like approval to FDI in multi brand retail for up to 51% will surely add up to these factors. Economic Factors The factors like inadequate infrastructure, bureaucracy, regulatory and foreign investment controls, the reservation of key products for small-scale industries, and high fiscal deficits are constraining economic growth of India. However, the liberalization measures taken in 1991 opened the economy to foreign investment and trade: it dismantled important controls, lowered customs duties, and devalued the currency: it virtually abolished licensing controls on private investment, dropped tax rates, and broke public sector monopolies. Further, reforms have been seen in retail industry with Indian government's approval on FDI up to 51% on multi brand retail. The country has recently become is a major exporter of software services and software workers, and the information technology sector leads the strong growth pattern. With a world changing from an industrial to an informational economy, India is bound to play a monumental role in the future of the global industry. Socio-Cultural Factors As job opportunities increase in India, money stays in the palms of the Indian consumers enabling them to reinvest in the Indian economy. Attitudes towards money are also changing. The mantra for the average Indian family, as in most of Asia, has always been saving, but young Indians today, inspired by job opportunities, have switched to spending extravagantly. The 13 attitude of the young generation is to enjoy life and spend money. However, India is a tea-based culture. Most of the Indians consumed tea at least twice a day, in the morning and in the afternoon. According to market research studies, coffee was

- 14. mainly consumed in the urban areas (71%) and to a much lesser extent in the rural areas (29%). The people in southern states of India largely consumed coffee. The people in the northern states were generally not coffee drinkers, but drank coffee and experimented with various flavors as a fashion statement. The consumption of instant coffee and filter coffee was almost equal on the national level. But region-wise, filter coffee was more popular in the south and the proportion of instant coffee was very high in the non-south regions. Technological Factors The coffee beans and tea need be bought from local Indian farmers in order to support the local agricultural economy, save money in transportation and tariffs, and gain tax benefits. Indians tend to take more cream in their coffee. The association with the Tata Coffee Ltd for sourcing its Arabica Coffee would surely help in the long run. Further, the skim milk option need not be offered in India because dieting is not a commonly accepted practice in the country. Indians will feel that they are being cheated out of their money if skim milk is put in their beverages. Indians also like spices in their tea and coffee, especially ginger and black clove. One of India’s favorite fruit flavors in mango, and in fact the mango is India’s national fruit. The food segment needs to take care of vegetarians segment as they form the good proportion of the target market. However, Indians specially the affluent and young class will be delighted to have fast and efficient Wi-Fi services at the cafe plus; people here love to be associated with their traditional and rich heritage as well as its blending with modernity and this may be reflected in the stores' ambience. The awareness about how varieties of coffee are sourced, roasted, brewed, etc needed to make people more loyal to coffee specially the Starbuck's. The inventory policy requires keeping the stores stocked but not overstocked to ensure freshness of products. Better gauges of the numerical figures in the inventory policies can be made after observing consumer trends. To begin with policies can be formulated assuming an average of five hundred consumers per day. 14 Environmental Factors Starbucks believe in the importance of caring for our planet and working with and encouraging others to do the same. As a company that relies on an agricultural product, it makes good business sense. It engages itself in recycling, energy management, water conservation,

- 15. green building, and in reducing carbon footprints wherever possible. With these integrated environmental responsibilities, the company will obviously build its image in the eyes of Indian Consumers as well. The ecological concerns regarding the farming of Arabica coffee must also be addressed in order to ensure consistency in productivity. Legal Factors Companies may be public or private but the common public is not allowed to buy shares of the company and there can only be up to fifty shareholders. Import duties are applied to almost all goods entering India. The tariff system is based on the Harmonized System (HS) and tariffs are in the 40 to 60 percent range for basic raw materials, 60 to 100 percent for semi- processed goods, and 100 percent and above on finished and consumer goods. Shipments to India require a commercial invoice, a packing list and bill of lading. A certificate of origin is not required on imports originating in the United States. FDI approval though has come to relaxation. 15

- 16. INDUSTRY ANALYSIS – PORTER’S FIVE FORCES FRAMEWORK One of the widely held assessment tools of an industry’s competitive forces is the five forces model of competition created by Michael Porter. These five forces are: the competitive force of rivalry among sellers, the competitive force of potential new entrants, the competitive force of substitute product, the competitive force of supplier bargaining power, and the competitive force of buyer bargaining power (Porter, 1980). Threat of Substitutes Bargaining Industrial Bargaining Power of Rivalry Power of Buyers Suppliers Threat of New Entrants 16

- 17. Industry Rivalry Major competition for Starbucks in India comes from that of Café coffee day. The abbreviation CCD is known to most of the people in urban parts of India. Their positioning is same as what Starbucks have in US. The other competitors include Barista Lavazza, Quicky's, Barista and Costa Coffee, which are also the multinational brands, and widely recognized. Apart from them, secondary competitors include the Georgia Coffee, served in fast food joints like that of Mc Donald’s and KFC, etc. Potential for New Entrants The entry barriers in the coffee retail industry are relatively low in India, particularly for the foreign players. This is possible owing to the fact that 51 % FDI is allowed in India in retail sector. Any large or well-funded company having the thorough understanding of the market can enter into retail sector in India. Given the fact that Starbucks is a global, it is having its own advantages when it comes to achieving the economies of scale. Starbucks being the global coffee retail chain, they are not going to have any particular capital related problems. Also, they are having MoU being signed with TATA‘s for opening their outlets in their TAJ group of hotels and resorts. India, being the sixth largest producer of coffee in the world is having the largest home grown supply of coffee beans and thus, sourcing coffee in this industry is not going to be much of the problem. Customer or Supplier Loyalty - Indian market is already being captured by the long established brands like Café coffee day, Barista, Barista Lavazza and Costa Coffee. Thus, it is going to be pretty much difficult for any of the new entrant to establish its brand name in the Indian market. However, Starbucks being the international brand will definitely help in attracting the educated Indian crowd. Market Experience - The existing players in the Indian coffee retail industry have been here in the market from last 10 years. Thus, their management must be having greater understanding of the Indian markets and Pallets. Therefore, for Starbucks, it is going to be 17 important to first understand the Indian preferences, before making any major move.

- 18. Differentiation - Coffee is not the product where there is a great scope for product differentiation. However, it depends on most of the cases on the store ambience, which can act as the point of differentiation. Threat of Substitute Products India has predominantly tea-based culture thus; awareness about coffee need to be created more and more tea-based drinks in association of TATA coffee needs to be included in its offerings. Besides tea, other product substitutes, here, will include other beverages, for example, soda, fruit juices, water, beer or other liquid and/or carbonated beverages. Since Starbucks also sells fast foods, other fast food beverages like burgers, etc. The lower end local coffee houses or other snack shops which are less luxurious will also act as substitutes to Starbucks. These are places which provide people with the place to sit, chat and relax at more affordable rates. Bargaining Power of Suppliers In the case of coffee retail, the suppliers, supplying the retailer with the coffee beans are not having much of the bargaining power. This is particularly because of the fact that coffee retailers like that of Starbucks tend to be very big buyers for any of the supplier to lose as a whole. This also gives the Starbucks to dictate terms to the supplier. However, this sourcing would be done on ethical norms of Starbucks and TATA Coffee. Similarly, suppliers of other resources like that of paper products etc., will not be having much of the bargaining power as there are many sources from which the company can source them. However, this is not valid in the case of the suppliers supplying the technological machinery and equipments as there are not many suppliers here. Bargaining Power of Buyers In the past, buyers in India were not having much of the bargaining power as there were not many food retail giants which were present in the country. However, with the advent of 18 multinational food retail giants in India, like that of Mc Donalds, Barista Lavazza, Café Coffee Day and Costa Coffee, consumer is faced with lots of choices. Thus, it will be difficult for Starbucks to influence the Indian buyers to pay premium for their products. As also the per capita income of Indian Customers is low and their mindset is not so affirmative with coffee

- 19. culture, however it is catching up among youths, the pricing need to be highly competitive and on zonal basis. MARKET ANALYSIS - DAVID AAKER'S 7 DIMENSIONS OF MARKET FORCES Market Size The recent past has witnessed an upward shift in the per capita consumption of coffee in India, with growing preference amongst the young population. With a young population of about 35% below the age group of 40 spending most of their time at work or outside home, the out of home consumption of coffee is spreading rapidly. Moreover, the increasing spending propensity of the young Indians and their changing lifestyle has increased the demand for coffee in India. As compared to FY’2005 a clear growth can be witnessed in FY’2010 in per capita consumption. The per capita consumption in FY’2010 increased to 89.3 grams as compared to 70.9 grams in FY’2005 due to presence of a strong preference towards instant coffee. Market Growth Rate The consumption of coffee in India has grown steadily at a historical CAGR of 6.3% during FY’2005-FY’2010 and is expected to pace at a CAGR of 4.9% in the near future. In FY’2010, the per capita consumption has increased to 89 grams from 85 grams in 2005 at a growth rate of 5%. The Indian coffee market has witnessed a steady growth in the past 5 years due to the growing preference for instant and organic coffee amongst the coffee drinkers. Moreover, rising consumer expenditure and export promotion schemes implemented by government has influenced the growth of the market in India. The coffee market in India has also witnessed a growth in the demand for out-of-home consumption of coffee because to the majority of time spent by the young adults at work or out-of-home. This potential of the market and the preference of the young population have led many global players to foray into the domestic market. 19 Market Profitability The revolution in the Indian coffee market has changed the tastes of the consumers and overwhelmed them with variety of new options. Thus, a change is witnessed in the coffee drinking habits amongst Indians. Today people prefer instant coffee over the traditional coffee,

- 20. because of the busy lifestyle and changes in their tastes and preference towards instant coffee. The Indian coffee market is dominated by big players such as Nescafe who has a share of 68.8% followed by BRU and Tata Coffee with 13.5% and 3.2% respectively. Marketers today see a lot of potential in the instant coffee segment, which is one of the reason many big companies are adopting various strategies to capture it. The out-of-home coffee drinking culture is also gaining pace. Keeping all these in mind that the costs for the coming operating years will reduce and revenues will increase, profit is expected to escalate. After the end of the first fiscal year, the company may determine whether or not it should expand in the country of India. If the first year proves to be a success, Starbucks Coffee can open over 200 location in the subcontinent of India, taking advantage of their international partnerships with Sheraton (Starwood) Inn, and Hyatt Inn. Starbucks will also try to win accounts with local airlines companies, so that they may serve Starbucks drink on flight. In three years profits are expected to exceed one million dollars per annum as per the research conducted. Industry Cost Structure Competitive pricing is necessary for the success of the venture; hence Starbucks must take various costs into consideration. Because of the costs involved in startup, transportation and imported goods, the price need to be set at about USD 1 per drink using the concept of zone pricing to make the coffee affordable to the target audience. Exchanges need to be done in rupees so that would be about 55 rupees. The prices for all goods need to be relative to the others. With the use of this pricing policy, Starbucks prices would be 20% lower than those of the Barista Company. This use of penetration pricing will ease the company’s slide into the market place. Though, it is possible to get a cup of coffee for merely 5 rupees in small stalls on the street, the success of the Barista Coffee Company show that the customers are willing to pay for better quality, service, and environment. 20 Distribution Channel As its distribution strategy, the Starbucks has already started its first store at Mumbai. This flagship store is located at the historic Elphinstone Building, Horniman Circle, Mumbai and marks the beginning of the iconic brand’s India journey. In addition to the flagship store at

- 21. Horniman Circle, Tata Starbucks Limited will launch two more stores in near future at Oberoi Mall and the Taj Mahal Palace Annexe in Mumbai. Subsequently, the other stores will be opened at other metropolitan areas. The urban areas are thus the first choice of Starbucks as its both primary market of youths and secondary market of tourists from other countries are catered here. Market Trends A major part of the country’s foreign exchange earnings come from the Coffee industry. Since the inception of coffee in India, the production has been rising along with changes experienced in the consumption pattern over the years. Increasing Per Capita Consumption - Due to the constant increase in population over the period, the per capita consumption has also increased from 85 grams in 2009 to 89 grams in 2010.This increase in the per capita consumption has influenced the overall growth of the Indian coffee market. Evolving Coffee Retail Chain Concept - The Indian coffee market has been experiencing activities in form of increasing coffee retail shops. This has been the result of the growing trend of out-of-home consumption and increasing propensity of young population to spend. Many coffee parlors or cafes such as Cafe Coffee Day (CCD), Barista and Costa Coffee are spreading their distribution network to cater to coffee drinkers across India. There are 1,503 coffee retail outlets across India to serve the out-of-home coffee drinkers across India. Global players foraying into the Indian market - The increasing disposable income of young Indians and their changing preference towards coffee consumption have led many global players to foray into the domestic market. For example, Britain’s Costa Coffee entered the Indian coffee market in 2005. Moreover, Starbucks, one of the leading global players is planning to enter Indian market in the near future. Increasing preference towards Instant Coffee - After Nestle and HUL launched their product in the Indian coffee market, the popularity of instant coffee has increased gradually. 21 Today, people prefer instant coffee over the traditional coffee because of their changing life style and variety of options available in the instant coffee market. About 23.1% of the market is

- 22. captured by instant coffee and is expected to increase further in the near future with a strong preference among the age group of 20-45years. Growing preference towards organic coffee - Organic Coffee is usually considered to be normal coffee beans that are produced without the use of pesticides or herbicides. The growing health concerns and the preference of consumers to consume healthy beverage have led the marketers and producers adapt to organically grown coffee. Key Success Factors The Primary target market for Starbucks Coffee Co. in India is the young both male and female from the ages of 16-38. This market is well educated and comes from middle class to upper middle class population and out-of-home coffee drinking culture is catching up. The international appeal of Starbucks will add up to the promotion of this culture. The highly trained baristas of Starbucks, its technologies and processes by which it sources high quality coffee, roasts, brews and serves to its customers will surely act as Key Success Factors of the Company. Besides its alliance with Tata Coffee to source high quality Arabica Coffee will also help. 22

- 23. COMPETITOR ANALYSIS - PORTER'S 4-CORNER ANALYSIS Drivers Current Strategy Financial Goals How the business creates Corporate Culture value? Organizational Structure Where the business is Leadership team background choosing to invest? External Constraints Relationships and networks Business Philosophy the business has developed COMPETITORS FUTURE STRATEGY Management Assumptions Capabilities Company's perception of its Marketing skills strengths and weaknesses Ability to service channels Cultural traits Skills and training to Organizational value workforce Perceived industry forces Patents and copyrights Belief about competitors’ Financial strength goals Leadership qualities of CEO Market Share of Major Coffee Retail Chains in India, FY’2010 The Indian coffee market is passing through an evolutionary phase where consumers ‘preference towards out-of home consumption is developing. The exceptional growth of out-of - home consumption of coffee in the coffee chains has been triggered by the young adults. The 23 young adults segment of the population spends major time outside home or at work, which has influenced the growth of the coffee chains in India. The retail coffee market in India is majorly dominated by Cafe Coffee Day with 1,134 chains across India followed by Barista with 230

- 24. coffee serving chains and Cost Coffee with 74 chains. It is being observed that almost 96% of the coffee retail market has been held by these three players and the rest 4% being held by other small and new players. Overwhelmed by the response in India, coffee retail giants are expected to expand their network in India in the near future. Café Coffee Day CCD Mission statement - "To be the best café chain in the country by offering a world class coffee experience at affordable prices." Business Overview - CCD, India’s first coffee bar was established in 1996 in Bangalore by the largest exporter of coffee in India, the Amalgamated Bean Coffee Trading Company (ABCTCL).Dominates the market with a share of 75.5% in 2010 with total retail outlets of 1,034 in over 100 cities. Products and Offerings - The company offers numerous options in the product offerings such as cappuccino, Espresso, Café Latte, Cafe Mocha, Irish coffee and Ice tea along with wide variety of eatables such as sandwich, cakes, burger and others. The products are offered to be consumed in the cafe as well as in take away format. The company also offers various merchandise products such as coffee mugs, gift vouchers and others. Geographical Reach - The Company has major presence in Delhi with 121 retail outlets, Bangalore with 172 stores, Maharashtra with 225 stores and AP with 84 stores. Customer Profile at CCD - Other brands are also promoted in a CCD outlet through innovative and interactive use of posters, cards, danglers, leaflets, contest forms, etc. CCD has tied up with popular television serials and also ran promotion contests for many brands. It had also tied up with some popular Indian movies where CCD was featured in some of the scenes. CCD has six café formats; Music Cafés, Book Cafés, Highway Cafés, Lounge Cafés, Garden Cafés & Cyber Cafés. Music Cafés provided customers with the choice of playing their favorite music tracks on the digital audio jukeboxes installed in the café. CCD has been also coming out 24 with more formats like sports Café, singles café, and fashion café. Speaking on competition with other players, Sudipta Sen Gupta, Marketing Head, CCD said: “We don’t have any competition because we are not competing with the others. In fact we

- 25. are aiding each other in creating and growing the coffee culture. All of us have a distinct identity. We sure do!” Barista Business Overview - Founded in 2000, the company is a pioneer of Indian Cafe culture. The company has positioned the brand as a joint where people can indulge in conversations with a cup of coffee. The target segments for the company are the youth and young adults, who are aware about the global lifestyles and enjoy new flavors and taste of coffee. Barista is planning to expand its latest chain of cafes “Barista Creme Lavazza” to more parts of the country. Presently the company owns app. 15 such stores. Products and Offerings - Along with offering coffee, the company also offers fresh salads, sandwiches, pizzas, pastas and desserts. The company offers in -stores promotions from time to time along with other promotions in commercials and films. Geographical Reach - Barista has a pan India presence with more than 230 retail outlets. 45 of the top outlets offer Wi-Fi availability along with 75 outlets offering Blu-Fi for mobile savvy generation. Coffee and other products at Barista were priced high and its target audiences were youth from the upper-middle-class segment. The coffee at Barista was made with high-quality Arabica coffee beans and baristas (brew masters) were invited from Italy to make new blends. Brotin Banerjee, Vice President of Marketing, Barista, said, “Our inspiration was the traditional Italian Espresso bars where the idea is to create a ‘home away from home." In 2001, Barista entered into a strategic alliance with Tata Coffee Ltd. (Tata), the largest coffee producer in India. Tata later acquired a 35% stake in Barista. The alliance allowed Barista to enlarge its distribution network and set up outlets in the Taj Group of hotels owned by Tata and its other allied businesses. In 2004, Amit Judge, its promoter, sold 65.4% stake of the company to an NRI 25 businessman, Sivasankaran (Siva), who later in 2004 bought the remaining stakes from Tata as well. After the acquisition, Siva revamped the chain, opened more Barista outlets in Southern cities, and began franchising its outlets. It started opening up a new outlet every 10 days. A new

- 26. look was given to its outlets by making changes in its seating arrangements, in-store merchandise, and providing a better youthful ambience of the store. The brew masters maintained friendly relations with the customers and called them by their first names. Barista joined with specialty retailers such as the music retailer Planet M, the book retailer Crossword, and the Taj Group of hotels for setting up espresso corners in their premises. It also launched a concept called BanCafe, a coffee shop within the bank premises and joined with the bank ABN AMRO. Costa Coffee Business Overview - Costa Coffee was incorporated in India in 2005 with a tie up with Devyani International Limited, head quartered in New Delhi, the Company serves the coffee lovers across India. Company inaugurated its launch with 4 cafes in Bangalore. The company commands a share of 4.9% in the Indian coffee market in 2010. Products and Offerings - The Company offers different variety of coffee such as Espresso, cappuccino, cafe latte and others. Some of the premium offerings which the company offers are muffins, cakes, desserts, sandwiches, wraps and pastas. The company operates with nearly 74 stores across India. Geographic Reach - The Company is planning to focus on the prominent cities such as Pune, Delhi, Mumbai and Bangalore. The company is planning to predominantly expand in the metros. Quiky's Two software engineers, Shashi Chimala and Shyam, opened the first Qwiky’s outlet in Chennai in 1999. They were inspired by the specialty coffee bars in the United States. The menu at Qwiky’s included varieties in hot Italian coffee, Indian coffee, specialty hot coffee, cold coffee, frappes, milk shakes, tea, other beverages, desserts, and snacks. It targeted youths in the age group of 18 to 30 years. By 2002, the annual revenues of Qwiky’s were 43 million INR. 26 Qwiky’s had three types of formats; Qwiky’s Coffee Pubs were stand-alone coffee bars, Qwiky’s Coffee Islands were outlets within big stores, multiplexes, and movie theatres, and Qwiky’s Coffee Xpress were coffee kiosks. By 2006 it had over 20 outlets in nine cities in India

- 27. and one franchise in Sri Lanka. Qwiky’s had plans to open more outlets in metropolitan and large cities in India and abroad through franchising its business. It had joined with retailers such as Lifestyle, Music World, and Ebony to open store-in-store outlets. EXECUTIVE SUMMARY Starbucks is another industry stalwart to enter the Indian markets due to vast potential and the huge untapped market. Indian market is always influenced by the traditions followed in the Western counterparts hence the success of Mc Donald’s, KFC, etc to name a few. With access to Hollywood movies where these brands are flashed quite often, the aura surrounding brands such as Starbucks scale new heights. Indian consumers have always welcomed change when it comes to their taste buds. Cappuccinos, Latte have eclipsed the traditional Espresso filter coffee. Filter coffee seems like an archaic notion, only restricted to the elderly people. In fact the coffee shops have itself undergone a tremendous transformation, with them replacing a hang-out joint for the teenagers. The timing of their entry could not have been better. With Barista, Café Coffee Day and Costa coffee almost losing their sheen, Starbucks comes in like a breath of fresh air. The future outlook of any company is not complete without an analysis of the industry in which it operates. The coffee industry of India is the sixth largest producer of coffee in the world, accounting for over four percent of world coffee production, with the bulk of all production taking place in its Southern states. India is most noted for its Monsooned Malabar variety. It is believed that coffee has been cultivated in India longer than anywhere outside of the Arabian Peninsula. Tata Starbucks Limited, the 50/50 joint venture between Starbucks Coffee Company (Nasdaq: SBUX) and Tata Global Beverages Limited is bringing an unparalleled experience to Indian customers. Both companies have a history of delivering product innovation and the 27 highest quality experience to customers around the globe. They are delighted to come together today and transform the coffee experience for consumers across India, while providing a

- 28. community gathering place to connect with family and friends. Thus, Coffee culture is poised to be deeply in-grained into Indian culture in the near future, if this strategic alliance succeeds. REFERENCES Vrushali Paunikar, 2011, "International Business Plan Starbucks India", A proposal Ruchi Mankad and Joel Sarosh Thadamalla, 2011, "Case: Starbucks Coffee Company, The Indian Dilemma", Strategic Management and Business Policy, 13th Edition, Thomas L. Wheelen, J. David Hunger Herve R., Dec 21, 2004, "The Starbucks Corporation: Past, Present and Future", Auch-Roy-Pen: 1207HA Harold Brown, 2011, "External Environmental Analysis of Starbucks and the Coffee Industry" Flight, Georgia. “Grinding Out Success Next to Starbucks” Business 2.0, Oct. 2006. Vol. 7, Issue-9 Ryan C. Larson, 2008, "Starbucks a Strategic Analysis - Past Decisions and Future Options", Brown University Economics Department http://news.starbucks.com/article_display.cfm?article_id=707 accessed on Oct 15, 2012 http://news.starbucks.com/article_display.cfm?article_id=703 accessed on Oct 15, 2012 http://www.starbucks.in/about-us/company-information/mission-statement accessed on Oct 15, 2012 http://www.starbucks.in/responsibility accessed on Oct 15, 2012 http://www.tatacoffee.com/corporate/company_profile.htm accessed on Oct 15, 2012 http://www.indiacoffee.org/indiacoffee.php?page=CoffeeData accessed on Oct 17, 2012 http://www.indiacoffee.org/userfiles/RFP-FINAL-SEP12.pdf Oct 17, 2012 http://www.cafecoffeeday.com/company-mission.php?mnid=3&lmids=3 accessed on Oct 17, 2012 http://www.cafecoffeeday.com/our-business.php?mnid=3&lmids=1 accessed on Oct 17, 2012 28

- Starbucks Coffee in Indian Market

- External and Internal Analysis of Starbucks

- International Strategies of Starbucks Company

- Starbucks Company’ Decline and Transformation

- Starbucks’ Success: Mission and Stakeholders

- Global Strategy for the Starbucks Company

- Starbucks Company’ Transformation and Impact on Community

- Starbucks Company Marketing in Italy

- Starbucks as a Leading Coffee and Coffeehouse Company

- Case Study by Ariff Katchra on Starbucks Coffee Company

- Starbucks Company’s Reliability

Tata Starbucks Joint Venture Case Study

Factors that enabled the company to deliver strong performance in the past, important issues confronting the company, actions addressing tata starbucks’ issues.

In 2012, American company Starbucks and Indian Tata Global Beverages began their joint venture in the Indian coffee market. The companies’ alliance was successful, and Tata Starbucks became a profitable business by 2019. However, the company is still far from being financially stable in the Indian market and is exploring further improvement opportunities. This paper analyzes aspects that led to the company’s past success and its actions and external factors that caused challenges. It examines issues from the CEO’s perspective and suggests how Tata Starbucks could improve in the future.

Starbucks is a globally famous company with an exceptional reputation. It is a responsible employer providing its workers with healthcare coverage and other benefits. Apart from excellent working conditions, Starbucks is recognized for hiring refugees and buying ethically-produced coffee beans only. Therefore, the company’s name and reputation are one of the primary reasons for its success in India as people recognize Starbucks’ achievements, bringing loyal customers worldwide. Another reason for the company’s strong performance is its choice of the international expansion strategy. The company chose a multi-domestic strategy characterized by “customizing products and marketing strategies to specific national conditions” (Jones & George, 2022, p. 233). Tata Starbucks customized its menu to local demands and culture. Indian population prefers drinking tea over coffee, so the company introduced “18 diverse varieties of tea to serve the Indian market” (Dess et al., 2021, p. 114). They also found that their prices are above the local average coffee prices, and citizens are not willing to pay more. Therefore, the company focused on serving clients with above-average income, selecting locations in premium places visited by tourists and wealthy, westernized part of the population.

However, Tata Starbucks faces external challenges due to high competition and the consequences of its wrong internal actions. Indians are a tea-drinking nation as “for every cup of coffee, an Indian drinks 30 cups of tea” (Dess et al., 2021, p.120). Local tea is also cheaper than Starbucks coffee and citizens are much more willing to buy tea, preventing Starbucks coffee from bringing expected revenues. The company overlooked or did not consider local preferences before coming to the region and is currently facing a challenge due to this internal action. Meanwhile, the main external threats are such competitors as Chai point or MacDonalds. Both places offer beverages for a lesser price than Tata Starbucks and have the relatively same quality, which is more appealing to the customers.

As a company CEO, I would suggest improving advertising and opening more branches in places popular among travelers and the wealthier part of the population. Currently, Tata Starbucks target middle-aged citizens, so they could invest in advertising their coffee to teenagers and young adults by using popular platforms like TikTok or Instagram. Advertising beverages to the younger population would attract more customers and allow the company to expand. However, there is a risk that younger people will not be able to afford Starbucks coffee, and money spent on advertising is wasted. Opening more outlets in premium places would allow the company to get more clients from its target audience. Tata Starbucks can open new branches in airports as many tourists and wealthy citizens visit it. The company has already announced its plan to open 40-50 more outlets (Roy & Kalra, 2021). The potential risk of this action is that the company overestimates the need for new branches, and some do not attract enough customers.

Tata Starbucks is a promising company that can continue its expansion in the future. The company was successful due to its brand name, premium locations, and Indian-specific strategy. The company is facing challenges associated with high competition and local preferences. However, these issues can be addressed by improved advertising and opening more outlets. Tata Starbucks has much potential and can succeed in the Indian market in the following years.

Dess, G. G., McNamara, G., Eisner, A. B., Lee, S.-H., & Sauerwald, S. (2021). Strategic management: Text & Cases (10th ed.). McGraw-Hill Education.

Jones, G. R., & George, J. M. (2022). Contemporary Management (12th ed.). McGraw-Hill Education.

Roy, A., & Kalra, A. (2021). Starbucks Eyes Faster India expansion with new store formats . Web.

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2023, June 28). Tata Starbucks Joint Venture. https://ivypanda.com/essays/tata-starbucks-expansion-to-india-case-study/

"Tata Starbucks Joint Venture." IvyPanda , 28 June 2023, ivypanda.com/essays/tata-starbucks-expansion-to-india-case-study/.

IvyPanda . (2023) 'Tata Starbucks Joint Venture'. 28 June.

IvyPanda . 2023. "Tata Starbucks Joint Venture." June 28, 2023. https://ivypanda.com/essays/tata-starbucks-expansion-to-india-case-study/.

1. IvyPanda . "Tata Starbucks Joint Venture." June 28, 2023. https://ivypanda.com/essays/tata-starbucks-expansion-to-india-case-study/.

Bibliography

IvyPanda . "Tata Starbucks Joint Venture." June 28, 2023. https://ivypanda.com/essays/tata-starbucks-expansion-to-india-case-study/.

- To find inspiration for your paper and overcome writer’s block

- As a source of information (ensure proper referencing)

- As a template for you assignment

- < Previous

Home > Faculty Works > Departments > School of Business > 126

School of Business

Tata starbucks: how to brew a sustainable blend for india.

Dev Das , Pace University Alan B. Eisner , Pace University Follow Helaine J. Korn , Baruch College

Document Type

This case is primarily intended for use in the corporate strategy section of a business policy or competitive strategy course. It can be used as an overview of the many decisions and actions that an organization has to undertake to sustain a competitive advantage. This case can also be used to augment discussions of strategic analysis, specifically both internal and external environmental analysis and strategic formulation. The case is rich enough for advanced and graduate students, and has been developed in a manner that will allow students to diagnose the root(s) of the company’s issue(s) as detailed in the case, and then form opinions and suggestions for any strategy that the company should pursue. In doing this, students should consider the activities, history, and goals of the company as presented. It would be effective at the business strategy level, especially, to discuss the implications of industry life cycles, and at the corporate strategy level to discuss implications of diversification. The case also lends itself to discussions of strategic implementation and the effect of leadership on innovation, especially when trying to maintain a mature brand.

Publication Title

Journal of the International Academy for Case Studies

Publication Date

business strategy, competitiveness, competitive advantage, Starbucks, Tata

Repository Citation

Das, Dev; Eisner, Alan B.; and Korn, Helaine J., "Tata starbucks: How to brew a sustainable blend for India" (2015). School of Business . 126. https://commons.clarku.edu/faculty_school_of_management/126

Since April 27, 2023

Help on using Search

- Notify me via email or RSS

- Collections

- Disciplines

Participate

- Submit an Item

- Clark University

- Goddard Library

Home | About | FAQ | My Account | Accessibility Statement

Privacy Copyright

No internet connection.

All search filters on the page have been cleared., your search has been saved..

- Sign in to my profile My Profile

The Starbucks Joint Venture in India: Making Expansion in India as Successful as It Was in China

- By: Adam Kramer , Lauren Chell , Brian Vargo , Kristy Fletcher Williams , Sharon Wilson & Amanda Bullough

- Publisher: SAGE Publications: SAGE Business Cases Originals

- Series: Global Marketing

- Publication year: 2020

- Online pub date: June 24, 2020

- Discipline: International Business & Management (general) , Cross-Cultural Leadership , International Strategic Management

- DOI: https:// doi. org/10.4135/9781529740721

- Contains: Supplementary Resources | Teaching Notes | Video Length: 2,582 words Region: Eastern Asia , Northern America , Southern Asia Country: China , India , United States of America Industry: Food and beverage service activities Type: Indirect case info Organization: Starbucks | Tata Global Beverages Organization Size: Large info Online ISBN: 9781529740721 Copyright: © Adam Kramer, Lauren Chell, Brian Vargo, Kristy Fletcher Williams, Sharon Wilson, and Amanda Bullough 2020 More information Less information

Teaching Notes

This case study examines Starbucks’ expansion into India and the new Tata-Starbucks joint venture. Because of its success in China, Starbucks leadership was excited about expansion in India. However, the company has struggled to get a foothold and quickly become profitable in India. In this case, students are first put in the position of a Starbucks executive in India. To provide helpful context, students are then provided with background information about the Starbucks expansion into China and India and then presented with the particular challenges that the leaders at Starbucks faced in India. Students are asked to consider the leadership decisions that must be made and come up with some appropriate next steps.

Learning Outcomes

By the end of this case study, student should be able to:

- evaluate an example of global expansion and the strategy chosen to implement the expansion, and compare this example to other strategies used previously;

- understand the challenges of global product and retail store expansion;

- appreciate the leadership challenges that arise from expansion into a new market and the difficulty involved in deciding the appropriate next steps.

The Leadership Challenge

James Fansdale just concluded a teleconference with the Starbucks executive team in the United States. James was feeling disheartened and pessimistic. As the country executive for Starbucks India, he took the majority of the blame for another year of disappointing performance. Four years ago, when James began in this position, he and his colleagues were extremely confident that India would be a top five global market for Starbucks. The Chinese developing country economy and population were used as somewhat of a prototype for Starbucks’ success in other international markets. The initial plan was to replicate the joint venture strategy used in China. By coupling a joint venture with a profitable product line, Starbucks India was bound for immediate success, or so they envisioned. This optimistic vision is now looking improbable, though James and his team still have a glimmer of hope. They were asked to present a recommended strategy for Starbucks India to executives in the coming weeks. But first, James and his team must revisit the path that got them to this point

Starbucks Expansion Into China and India

Starbucks was founded in 1971 and currently employs 254,000 people. They are known for being a premium roaster, marketer, and retailer of specialty coffee around the world. Starbucks currently has headquarters in Seattle, Washington, United States, and now operates in 75 countries. In 2017, its revenues were USD 22.4 billion, a 5% increase on its 2016 revenues of USD 21.3 billion. A large part of this increase is due to the addition of 1.4 million active rewards members, bringing the total to 14.2 million—an 11% increase. In 2018, revenues are expected to climb to USD 24 billion (Jurevicius, 2018).

As competition from high- and low-end rivals intensifies, there has been decreased foot traffic in larger U.S. chains, which should cause the large chain to be cautious about opening too many stores (Franck, 2017). As a result, Starbucks may be reaching saturation point in the United States, to the point where future growth in the company lies in its growing international presence.

Starbucks’ expansion into China has been the fastest growing market outside the United States. Company leadership has deemed this a tremendous success and used the same model to expand into other emerging markets (Ramakrishnan, 2017). Starbucks owns an estimated 1,300 stores in Shanghai, Jiangsu, and Zhejiang provinces, and is projected to nearly quadruple to 5,000 stores by 2021 (Ramakrishnan, 2017). Starbucks was able to leverage success in China to charge a 20% premium in those stores compared to the rest of the world (Whitten, 2018). Much of the favorable consumer perception of the brand and acceptance of the price premium in China is due to an interest among Chinese consumers in Western goods, services, cultural icons, and status symbols (DeVault, 2018).

Given the success in China, India was naturally a good expansion opportunity to explore in Asia by Starbucks. Starbucks entered the India market through a partnership with Tata Global Beverages in 2012. The two companies formed a 50:50 joint venture known as Tata Starbucks Private Limited (TSPL). The focus of this joint venture originally was to expand retail café distribution across India and source Indian-grown coffee (Associated Press, 2012).

Starbucks experienced its slowest sales growth and a net loss of USD 4.9 million in India during 2017 (Malviya, 2017). Despite this, Starbucks is confident that India will be a top five global market (The Basis Point, 2018). Because of the economic and population similarities between China and India, Starbucks believes its China joint venture strategy will successfully translate to the Indian market. To turn these optimistic viewpoints into reality, there must be a shift in strategy for Starbucks to become profitable in India.

Starbucks Problems in India

There are some Indian market characteristics that are making it difficult for Starbucks to be as successful as they wish to be. For one, Starbucks is currently very expensive in the price-sensitive Indian market (Jain, 2014). As a result, coffee and cafés in general are an urban, middle-class niche. When coupling this with costly retail space, it is hard to become profitable (Singh, 2017).

Tea and Coffee

Traditionally India is a tea-drinking culture, and while the number of coffee drinkers is increasing, coffee drinkers are still vastly outnumbered by tea drinkers. In the past 10 years, per capita consumption of coffee in India has increased 40%. Per capita, Indians still drink more than eight times as much tea as coffee. Although the consumption of coffee is increasing, the more common cultural custom for citizens is to start their day with tea, like that of their ancestors (Ahuja, 2016). In 2017, Tata Starbucks introduced 18 different varieties of tea across its outlets in India through the Starbucks new tea brand, Teavana, including the India Spice Majesty Blend, which was specifically developed for the Indian market (Tata Global Beverages, 2017).

Channel Opportunities

The preferred method of purchasing and consuming hot beverages in the Indian market is either at home or in a café (Jain, 2014). While quick-service restaurants in India are not as traditional or preferred, they are expected to grow at a compound annual growth rate (CAGR) of 22% between 2016 and 2021 (Singh, 2017). Essentially, this means that the quick-service industry will have an average rate of growth of 22% during the five-year period mentioned. Other opportunities, by way of the joint-venture partnership with Tata, would be to look at market distribution as well as different packaging options to fulfill the spectrum of price points.

Competition

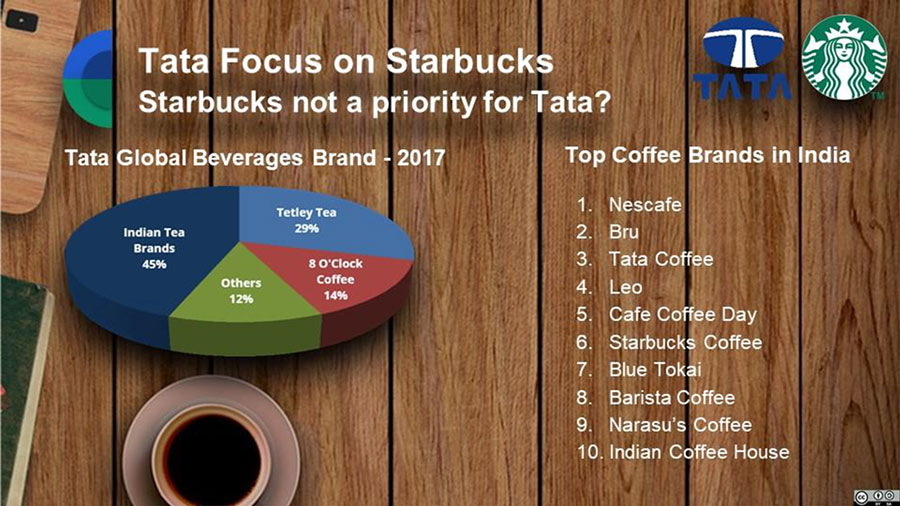

Starbucks did not have first mover advantage in the Indian market (Aiyer, 2014). Cafe Coffee Day (CCD) and Barista Lavazza are big players in the middle-class market. In the premium space, Starbucks competes with Costa Coffee as well as with Coffee Bean and Tea Leaf (CBTL). In a 2017 study of the top 10 coffee brands in India, Starbucks was ranked as number six. Nescafe (#1) and Bru (#2) topped the list, mainly due to their instant coffee offerings (Dhiman, 2018) (see Figure 1 ). In addition to these competitive brands, Tata also owns several other coffee and tea brands including Eight O’Clock Coffee. Although Tata owns the bulk of the market share for tea and coffee brands in India, there is a conflict of interest by entering a joint venture with Starbucks. The Starbucks brand in India is now faced with competing against their own joint venture partner.

The text on the top of the image reads:

“Tata Focus on Starbucks

Starbucks not a priority for Tata?”

On the text’s right is a logo of TATA, which is followed by a logo of Starbucks. Below the text is a pie chart labeled “Tata Global Beverages Brand – 2017.” Data shown by the pie chart are as follows:

- Indian Tea Brands (45%)

- Tetley Tea (29%)

- 8 O’Clock Coffee (14%)

- Others (12%)

On right of the pie chart is a list titled “Top Coffee Brands in India.” Data shown by the list are as follows:

- 3. Tata Coffee

- 5. Cafe Coffee Day

- 6. Starbucks Coffee

- 7. Blue Tokai

- 8. Barista Coffee

- 9. Narasu’s Coffee

- 10. Indian Coffee House

Figure 1. Top Coffee Brands in India

Source : http://www.tataglobalbeverages.com/docs/default-source/default-document-library/analyst-ppt-roadshow_final---september-2017-v2.pdf?sfvrsn=0 and https://scoophub.in/top-8-best-coffee-brands-in-india/

To combat similar challenges in the Chinese market, Starbucks performed diligent market research. This enabled a deeper understanding of the Chinese markets. Starbucks employed a strategy to address dominant Chinese markets and was designed to be as respectful to the Chinese culture as possible. Instead of taking the conventional approach to advertising and promotions, which may have been seen by potential Chinese consumers as attacking their culture of drinking tea, they positioned stores in high-traffic and high-visibility locations. Furthermore, Starbucks deliberately began to bridge the gap between the tea-drinking and coffee-drinking cultures by introducing beverages in Chinese stores that included local tea-based ingredients (DeVault, 2018).

Store Format

Many of Starbucks’ competitors diversify the format of their stores based on location. Also, competitors have begun installing kiosk and vending machine technology. In contrast, Starbucks has decided to maintain its same store format approach regardless of location, in order to give customers the comfort of receiving the same ‘Starbucks’ ambience wherever they are in the world, creating customer pull, and creating economies of scale with its suppliers (Aiyer, 2014). However, this approach may pose challenges in the wave of Indian consumers who are looking for product innovation (Singh, 2017).

Tata Starbucks has created the STRIVE program, which combines job skills training and Starbucks expertise in retail operations. Over the next five years, Tata Starbucks has committed to training 3,000 young people who are lacking sufficient labor skills and facing barriers to employment. Tata Starbucks therefore plans to focus particular attention on women, by boosting the proportion of women in its workforce to 40% by 2022, up from 25% today (BW Online Bureau, 2017).

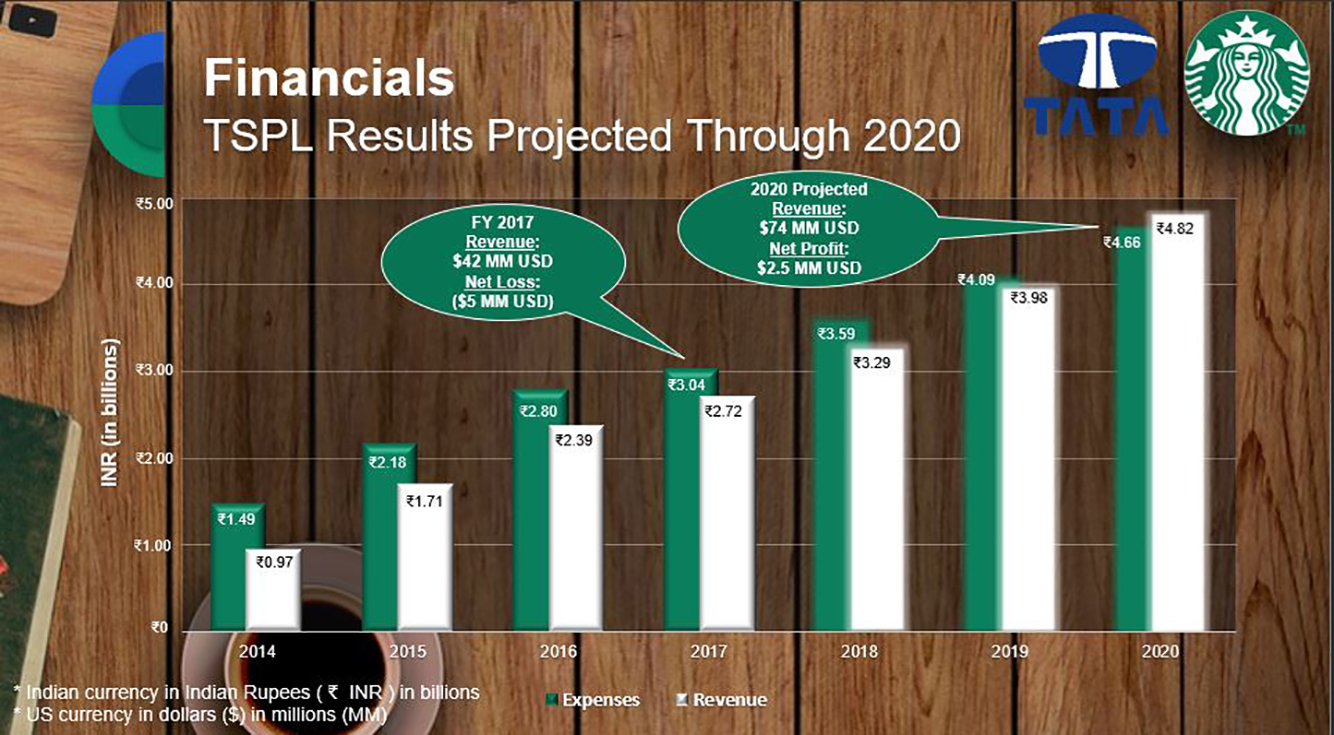

Since Tata Starbucks launched in 2014, it has been difficult for them to turn a profit. Much of this is due to the heavy up-front cost of expensive store fronts (Singh, 2017). In 2017 there were revenues of INR 2.72 billion and expenses of more than INR 3.04 billion (Malviya, 2017). In US dollars, this equates to USD 42 million in revenue, but a USD 5 million net loss. In looking at the projected financials, it is not until 2020 when Tata Starbucks will start to see a net profit—Starbucks projects INR 4.82 billion in revenue and INR 4.66 billion in expenses, which equates to USD 2.5 million of profit (see Figure 2 ). It is important to note that with all of the success in China with Starbucks’ expansion there, they too did not see net profits for many years after the launch (DeVault, 2018).

In the graph, the x-axis is scaled from 2014 to 2020 with an interval of 1 year and y-axis is scaled from 0 to 500 with an interval of 100 units and labeled as “INR (in billions).” Data shown on the graph are tabulated as follows:

A dialog box on the 2017 bar reads “FY 2017; Revenue: USD 42 MM; Net Loss: (USD 5 MM).” Another dialog box on the 2017 bar also reads: “FY 2017; Revenue: $42 MM USD; Net Loss: $5 MM USD.” A dialog box on the 2020 bar reads “2020 Projected; Revenue: USD 74 MM; Net Profit: USD 2.5 MM.”

Figure 2. Starbucks Profitability in India

Source : Malviya (2017): https://economictimes.indiatimes.com/industry/cons-products/food/starbucks-posts-slowest-sales-growth-in-india-in-last-fiscal/articleshow/60916606.cms

Video 1. Author Lauren Chell on Key Takeaways

Download transcript

What should James Fansdale do now? Starbucks believes there is opportunity in the Indian market and they invested heavily in this opportunity. Despite this opportunity, Starbucks has not been successful in its venture thus far. Consider the following three options available to James Fansdale:

- 1. Should James and his team devise a new, more open-minded strategy to capitalize on the Indian market? If they should adopt a new, tailored strategy, what might it look like?

- 2. Should he double down on their current strategy and hope it turns around?

- 3. Should he propose that Starbucks pulls out of the Indian market altogether, to avoid continued losses?

This case was originally developed by graduate students in a fully online global leadership course at the University of Delaware. Under the direction of their professor, Dr. Amanda Bullough, the student team worked to revise the case after the semester was over, and develop the teaching note.

This case was prepared for inclusion in Sage Business Cases primarily as a basis for classroom discussion or self-study, and is not meant to illustrate either effective or ineffective management styles. Nothing herein shall be deemed to be an endorsement of any kind. This case is for scholarly, educational, or personal use only within your university, and cannot be forwarded outside the university or used for other commercial purposes.

2024 Sage Publications, Inc. All Rights Reserved

Sign in to access this content

Get a 30 day free trial, more like this, sage recommends.

We found other relevant content for you on other Sage platforms.

Have you created a personal profile? Login or create a profile so that you can save clips, playlists and searches

- Sign in/register

Navigating away from this page will delete your results

Please save your results to "My Self-Assessments" in your profile before navigating away from this page.

Sign in to my profile

Please sign into your institution before accessing your profile

Sign up for a free trial and experience all Sage Learning Resources have to offer.

You must have a valid academic email address to sign up.

Get off-campus access

- View or download all content my institution has access to.

Sign up for a free trial and experience all Sage Learning Resources has to offer.

- view my profile

- view my lists

IMAGES

COMMENTS

Journal of the International Academy for Case Studies, Volume 21, Number 3, 2015 TATA STARBUCKS: HOW TO BREW A SUSTAINABLE BLEND FOR INDIA Dev Das, Pace University Alan B. Eisner, Pace University Helaine J. Korn, Baruch College, CUNY CASE DESCRIPTION This case is primarily intended for use in the corporate strategy section of a business policy or

Dec 1, 2016 · Tata customized Starbucks’ menu by adding pastries and ice cream, helped modify the store layout to include locally sourced furniture and interior decorations, helped solve logistical problems ...

Nov 10, 2012 · John Culver, president, Starbucks China and Asia Pacific on opening up of the first store in India at Mumbai states, “This is the first step Starbucks and Tata Coffee Limited are taking toward developing and improving the profile of Indian-grown Arabica coffees around the world by elevating the stature of Indian coffee, as well as improving ...

Jun 28, 2023 · Tata Starbucks can open new branches in airports as many tourists and wealthy citizens visit it. The company has already announced its plan to open 40-50 more outlets (Roy & Kalra, 2021). The potential risk of this action is that the company overestimates the need for new branches, and some do not attract enough customers.

In January 2012, Starbucks Coffee was negotiating with Tata Global Beverages, a subsidiary of India’s flagship Tata group, to enter the Indian market through a joint venture. The two case sets the stage for a negotiation between the two parties, giving them an overall context, history and the specific issues each party is particular about.

Sep 15, 2024 · The collaboration between Starbucks and Tata Group provides a compelling case study in this domain, exemplifying how strategic partnerships can be effectively managed and evaluated. Strategic ...