Here’s how much post-secondary tuition costs in Canada by province

If you’re considering expanding your education, be it through an undergraduate or graduate program, you may have many questions before you hit the books. Not only is it important you find the best school to jet you off into the workforce , but it’s also important to find one you can pay off .

Compared to the last school year, Statistics Canada reports tuition for grad school has increased about 2.2% and 3.0% for undergraduate Canadians enrolled in degree programs.

Depending on which province you prefer or the area of study, the cost of tuition can be below or higher than the national average.

Tuition for undergraduate students

On average, a full-time Canadian undergraduate student will pay $7,076 for a degree program in the 2023/2024 year. Meanwhile, that would cost an international student about $38,081.

Here are the most to least expensive provinces for Canadian undergraduates:

- Nova Scotia with an average of $9,575 (represents 35.3% more than the national average).

- Saskatchewan with an average of $9,232 (represents 30.5% more than the national average).

- New Brunswick with an average of $8,706 (represents 23.0% more than the national average).

- Ontario with an average of $8,190

- Alberta with an average of $7,586

- Prince Edward Island with an average of $7,381

- British Columbia with an average of $6,383

- Manitoba with an average of $5,386

- Yukon with an average of $4,275

- Newfoundland and Labrador with an average of $3,481

- Quebec with an average of $3,461

Tuition for graduate students

A graduate student will pay slightly higher than an undergrad, which is about $7,573 if you’re Canadian and around $22,061 as an international student.

Here are the most to least expensive provinces for Canadian graduate students:

- British Columbia with an average of $10,748 (represents 41.9% more than the national average).

- Nova Scotia with an average of $$10,548 (represents 39.3% more than the national average).

- Ontario with an average of $9,445 (represents 24.7% more than the national average).

- Alberta with an average of $7,879

- New Brunswick with an average of $7,446

- Prince Edward Island with an average of $5,805

- Manitoba with an average of $5,742

- Saskatchewan with an average of $5,276

- Quebec with an average of $3,633

- Newfoundland and Labrador with an average of $3,228

StatCan/Screenshot

Most expensive programs in Canada:

For this school year, the Canadian and international undergraduate students paying the most for their tuition, according to StatCan, are students who enrolled in professional degree programs like dentistry, medicine, veterinary medicine, and optometry.

Undergraduate students studying veterinary medicine in Prince Edward Island and Ontario are the unluckiest this year as their program fees saw the highest year-over-year increases at 6.0% and 7.5%.

For Canadian and international graduate students, on the other hand, the executive MBA and regular MBA have the highest tuition fees.

“ln 2023/2024, the fields of study with the largest tuition fee gap between Canadian and international graduate students in Canada were the executive MBA ($45,596 versus $68,224) and architecture ($6,886 versus $27,575) program,” a StatCan report reads.

- Three Canadian universities rank among top 50 in the world: report

- Kids are expensive: Here's how BC families can save money this fall

- How to start saving for major financial moments in your 30s

- "Don't try to get rich quick": Money mistakes students should avoid

There also continues to be a wider gap when it comes to the fees international and Canadian undergraduate students pay.

“Adjusted for inflation, tuition fees for Canadian undergraduate students have been slightly decreasing since 2018/2019 while they continue to increase for their international counterparts,” StatCan reported.

SUBSCRIBE TO THE HIVE

Get the latest news sent to your inbox and stay in the loop

Language selection

- Français fr

Education planning tools

The following interactive tools can help you save, plan and pay for post-secondary education after high school.

These custom planners and estimators can help you figure out how much school will cost, how much money you could receive in government loans to pay for school, and how much you might have to pay back when you are done.

- Education Savings Calculator

- Student Aid Estimator

- Loan Repayment Estimator

Search tools

Looking for a post-secondary school or program to follow after you graduate from high school? What about scholarships you can apply for, or information about jobs and careers? Our online search tools can help you find the information you are looking for.

- CEGEPs, Colleges and Universities Search

- Program Search

- Scholarship Search

- Explore Careers (Job Bank)

Useful resources

These resources can help you search for designated and certified post-secondary institutions, find a post office where you can submit Canada Student Loans and Grants documents, or learn how to manage your money and achieve your goals.

- Master List of Designated Educational Institutions

- Master Certification List

- Canada Student Loan Repayment Rates

Page details

Language selection

- Search and menus

Calculate costs of studying in Canada

Step 3 of 5

Now, we’re ready to calculate how much it'll cost you to study in Canada based on the program(s) and institution(s) you’ve chosen. Complete the form below to see your tuition fees and other costs based on your circumstances.

*** Content Goes Here ***

Information about post-secondary institutions’ programs and education costs presented by the EduCanada search tool are drawn from Employment and Social Development Canada’s (ESDC) Canadian Post-Secondary Institution Collection (CPIC) database. This information, including tuition fees, is updated by ESDC on a yearly basis and is subject to change.

- International students : Confirm details regarding programs of study and tuition fees with your institution of interest.

- Canadian institutions : Contact ESDC to update your institution’s information.

Financial Literacy

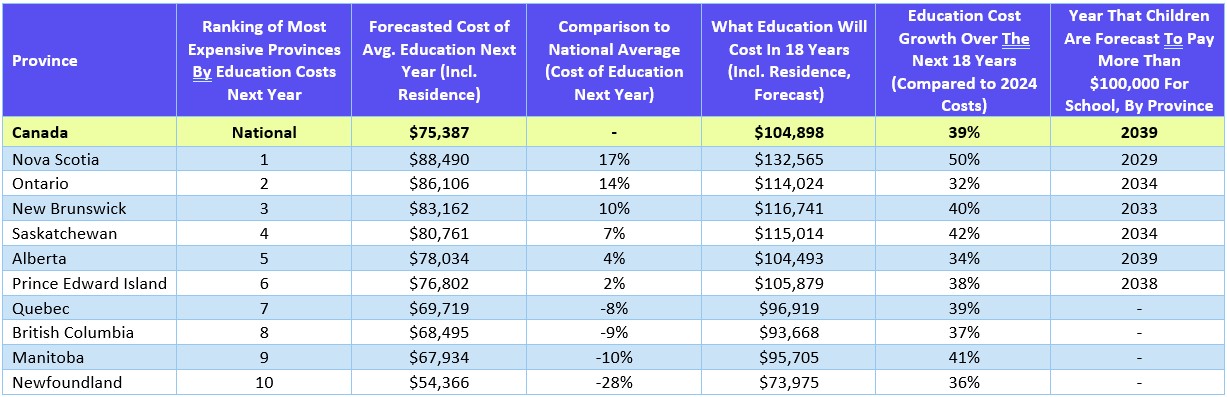

Canadians To Pay An Average Of $75,387 For A University Degree

Nova Scotia and Ontario rank as the two most expensive provinces to get an education. Costs are expected to grow by 39% over the next 18 years, leaving many to pay over $100,000 for a four-year degree and residence.

To shed light on the road ahead, we’ve released a forecast of how much an average four-year university degree will cost Canadian students in each province.

Next year, the average cost of a four-year post-secondary program in Canada will rise to just over $75,000 when factoring in residence costs. This figure is forecast to rise by 39 per cent over the next 18-years, reaching $104,898 by 2041.

For Canadian parents raising generation alpha, this means that they’ll soon be planning and saving for a six-figure education. In fact, children in certain provinces will reach this mark far sooner, with those in Nova Scotia, Ontario, New Brunswick and Saskatchewan estimated to pay over $100,000 for school within the next 11 years.

When looking at the forecasted cost of a 4-year degree and residence for students starting school next year, Canadians in these four provinces are also expected to pay the most, with those in Nova Scotia and Ontario having to pay an average of $88,490 and $86,106, respectively. This is more than $10,000 greater than the national average. On the other end, students in British Columbia ($68,495), Manitoba ($67,934) and Newfoundland ($54,366) are estimated to pay the least.

Cost of a Four-Year University Degree Per Province [1]

Click here for a PDF version of the table found above.

The chart above is ranked from the most to least expensive province for an average four-year university degree and residence. It also projects how much the same education will cost in 18 years, as well as the year that a four-year university degree is expected to exceed $100,000 for each province.

“Post-secondary education is one of the most substantial investments Canadians can make towards their future, but it can also lead to a distressing financial burden,” said Andrew Lo, CEO and President of Embark. “Given that the cost of education has historically outpaced inflation, it is vital for parents and students to not underestimate the associated expenses, and proactively plan for savings at the earliest opportunity to avoid sticker shock when the time comes.”

When asked , 31 per cent of Canadian parents did not know enough to even guess how much an education now costs. When parents did guess, they believed a four-year program cost $62,067 when factoring in all expenses, which is below the estimated average cost for 2024 in nine of the ten provinces – and over $10,000 off from the national average.

What’s more, many Canadian families are leaving government grant money on the table. The Canada Education Savings Grant (CESG) matches 20% of what you contribute to an RESP every year, giving you up to an additional $500 in savings annually and up to $7,200 over the lifetime of your plan. Another grant, called the Canada Learning Bond (CLB) , offers families with modest incomes money for just opening an account – no contributions are required to receive it if you fall within the eligible income requirements. One of the best things about the CLB grant is that it can be received retroactively, as long as you apply.

“In order to maximize education savings, it’s important to leave no stone unturned. We saw that less than half of parents know about the CESG, which means most Canadians are missing out on government money that they are entitled to,” said Lo. “At Embark, we have a strong commitment to ensuring that every possible opportunity and advantage is utilized to assist Canadians in saving for their education. Our unwavering focus is on optimizing education savings and empowering students to achieve their goals without the burden of overwhelming debt.”

Tips for Success when Saving in an RESP.

Embrace the power of time: Starting your savings journey at any age is possible, but the sooner you begin, the more time your money has to grow and flourish. Consider placing your funds in a tax-sheltered savings account, such as an RESP, to benefit from compounding growth. To get an estimate of your potential savings growth, explore our online calculator .

A practical savings strategy, is the best savings strategy: A feasible savings plan is essential for families. Don’t go into debt while preparing for your child’s education. Even small, consistent contributions can add up significantly over time. For example, if both parents start contributing $50 per month to an RESP when their child is born, they could accumulate approximately $37,000 by the time their child turns 18 [2] , when accounting for grants and a 4 percent rate of return.

It takes a village: While times are tough, funding your child’s education savings does not have to fall completely on your shoulders. For instance, the government will boost your contributions through grants, giving you an extra 20 per cent in savings on your first $36,000 contributed, if saved correctly. Beyond grants, using gifted money from birthdays, Christmas, or other special occasions are a great way to add funds to your child’s RESP.

Save proactively and strategically: When asked, 68 per cent of students said they wish that they saved more before going to school. Students should talk to their parents early to see if they will help pay for their education and understand how much will be needed. While it may not seem fun at the time, it will help in the long run to try and save independently. In high school, try putting a portion of a part-time or summer job pay cheque away as education savings. An automatic contribution can make it even simpler and will ensure a certain amount is put away regularly.

For parents, if you want to help your child pay for their education, plan out your savings as soon as possible. Even if it does not seem like you have a lot to save, the more time your money has to grow, the better. Setting up a Registered Education Savings Plan (RESP) is a great way to do this, as you can get an extra boost from the government for contributing.

A little guidance goes a long way: 73 per cent of students wish they had more guidance when planning their post-secondary education. Take time to truly think about what you want to do and talk to people about it. Talk to guidance counselors and experts to learn more about different career paths, whether that is university or a trade school . You can also try to ask someone who is in that field for firsthand insight.

To learn more about how Embark can help parents save more, go to www.embark.ca .

[1] The forecasted figures found within this table are estimates based on data published by the Employment and Social Development Canada’s (ESDC) Canadian Post-Secondary Institution Collection (CPIC) database. This information, including tuition fees, are updated by the ESDC on an annual basis and are subject to change.

[2] This projection is based on assumptions and is for illustrative purposes only. Investment returns and actual future value of your RESP cannot be predicted or guaranteed.

Embark is Canada’s education savings and planning company. The organization aims to help families and students along their post-secondary journeys, giving them innovative tools and advice to take hold of their bright futures and succeed.

Related Articles

Year End Financial Checklist

Cost of University Education Set To Rise To $101,319 in 2025

Q3 2024 Market Recap: Here’s What Happened

Create an account

- Gain access to free articles

- Daily free newsletter(s)

- Ability to comment on most articles

- Build your 3D avatar and gain points

- Everything in the Free plan

- Ad-free reading and browsing

- Unlimited access to all content including AI summaries

- Directly support our local and national reporting and become a Patron

- Cancel anytime.

Forgot password

Please enter your email and we'll send you a new password request code.

Please complete your profile to unlock commenting and other important features.

This is a Pro feature.

Time to level up your local game with narcity pro..

Here's How Much Post-Secondary Tuition Will Cost You In Each Canadian Province

If you're wondering about the cost of post-secondary tuition in Canada for schools in different provinces, Statistics Canada has some data that might help you pick out your dream school.

The data breaks down the average fees for Canadian students in each province for 2020 and 2021. According to the agency, the average cost in Canada is $6,580 for full-time undergraduate studies and $7,304 for graduate studies.

Editor's Choice: Canada Has Been Named The Best Country In The Entire World For The First Time Ever

Narcity has broken down the prices by province and education level so you can get a feel for how long you'll be paying off your student loans.

- Newfoundland

See on Instagram

The average cost of tuition at post-secondary schools in Newfoundland is $3,036 for undergraduate programs and $2,894 for graduate programs, the lowest out of all the provinces.

- Prince Edward Island

Undergraduate tuition costs an average of $6,878 in P.E.I. and graduate fees are $5,092.

- Nova Scotia

At schools in Nova Scotia, tuition costs $8,757 for undergraduate programs and $9,787 for graduate programs. Both of those are the highest in the country.

- New Brunswick

The average cost for an undergraduate program is $7,829 and $6,646 for graduate studies at post-secondary institutions in New Brunswick.

The average price of undergraduate studies in Quebec is $3,155 and $3,353 for graduate programs.

Ontario isn't the province with the most expensive fees but the cost is still pretty high at $7,938 for an undergraduate program and $9,671 for a graduate program.

The average cost of post-secondary tuition in Manitoba is $4,913 for undergraduate studies and $5,248 for graduate studies.

- Saskatchewan

Saskatchewan has the second-highest average cost for undergraduate tuition in Canada at $8,243, though graduate fees are less expensive at $4,346.

Tuition for undergraduate studies is $6,098 and $6,724 for graduate programs in Alberta.

- British Columbia

The average price of tuition at schools in B.C. is $6,055 for undergraduate programs and $9,528 for graduate studies.

- These Are The Undergraduate Programs In Canada That'll Cost You The Most In Tuition For 2022-23 - Narcity ›

- These Are The Least Educated Provinces & Territories In Canada - Narcity ›

Explore this list 👀

Already have a Milla account? Log in

Create a free or Pro account to keep reading.

1. choose a plan.

Limited access to free articles

Unlimited access to all content, AI summaries, ad-free browsing and directly support our reporting by becoming a Patron 🙏. Cancel anytime.

2. Create your account

Senior writer, the average salaries across canada were revealed — here's which spot earns the most in 2024, here's how much money you need to make to afford a home in every canadian province, here's how much costs to live in vancouver and how it compares to other canadian cities, here's how much it costs to live comfortably in canada's biggest cities in 2024, here's how much you need to make to afford a home in vancouver compared to the rest of canada, these ontario towns and cities are the most affordable spots to buy a home in the province, here's how much money you need to make to afford rent in various cities across canada, new data shows how much canadians make in every province and the difference is huge, the vancouver rental prices were revealed and here's the city's 'cheapest neighbourhood'.

We’ve updated our Personal Terms and Conditions for Financial Services. Learn more

Mail delays expected as Canada Post service resumes Learn more

- Book an Appointment

- Tools and Resources /

- Calculating the cost of post-secondary education

Calculating the cost of post-secondary education

Every student knows that university or college can be expensive. The costs of tuition and textbooks add up quickly!

There are, however, a lot of expenses in addition to tuition that you may forget about when deciding how to pay for your education. If you know the cost of a full year of university or college and living expenses, you can create a plan for financing your education.

Here’s a list of considerations to think about while planning your post-secondary educational journey:

- Which university or college will you attend?

The first step of your educational journey is deciding which university or college you’ll attend.

Based on the 2023/2024 average, a Canadian undergraduate degree* costs $7,076 per year. An international undergraduate degree* in Canada costs $38,081 per year. But remember, this is the average, so you must research and compare the cost of universities and colleges across Canada.

- How many years of education is your program?

Post-secondary education ranges from two-year certificates to multiple degrees, so there is a wide range of tuition costs, also depending on the degree path you choose.

Tuition also increases each year due to inflation, therefore you must account for the increase in tuition when calculating the total cost for your certificate or degree.

- Where will you live?

Although living with family isn’t an option for every student, there are still other easy and affordable choices. If you’re able to live with your guardians, check with them to see if you’ll be required to pay rent or if you’ll need to pay for food/meals.

Living on campus:

- Transportation options - you’re already on campus, so transportation to campus is not required. You may, however, need transportation for other purposes.

- There are meal plan options available.

- You have the option to live with or without a roommate - automatic friends!

Living off campus:

- There’s the choice between renting or buying a place.

- Transportation options to and from school – you may need to purchase a bus pass or a parking spot at the university or college.

- You need to research how much rent/mortgage will cost, and how it will be split between yourself, guardians and possible roommates.

- Will you live alone or have a roommate?

Whether you live on campus or off campus, there will still be an option to live with a roommate. A roommate can be beneficial to split rent, utilities and meals with, however you need to make sure you’re living with someone who fits your lifestyle!

If you choose to live with a roommate, you must consider how you will split rent, utilities and meals. Will it be 50/50 or a different type of arrangement?

- How will you finance your education and expenses?

Financing your education involves exploring options such as a Registered Education Savings Plans (RESPs), scholarships, high-interest savings accounts, and student loans.

Registered Education Savings Plans (RESPs)

- An RESP is a great way to finance your education, however if you don’t have an RESP open you’ll need to investigate other options. Don’t worry, we also have scholarships and loans available to fit your needs!

Scholarships

- Scholarships are available to many students based on a variety of requirements including academics, volunteering and athletics. Look on your university or college website, as well as federal and provincial sites and apply to as many as possible!

High-interest savings account

- Savings accounts are another option to earn a high-interest rate with cash used for financing your education. It’s great for everyday expenses like meals, gas, rent and entertainment, while you use the RESP for tuition.

Student loans

- Another great option for financing your education is to look into a student loan . You can take out a loan with your financial institution or with the government and there are different interest rates and payment methods available. It’s important to research loans to compare interest rates and determine if the loan offers a grace period.

Quick tip: Working part-time during the school year gives you extra money to cover small expenses.

As you can see, there are a lot of options to finance your education!

If you’re interested in learning more about the expenses associated with post-secondary education, please give us a call at 1.866.863.6237 .We’re happy to help!

Book an appointment today

*Tuition average costs are according to Statistics Canada as of February 14, 2024. These averages are for the 2023/2024 school year.

- Youth Chequing

- Student Chequing

- 65+ Chequing

- U.S. Chequing

- ClickSWITCH™

- International Funds Transfer

- Special Offers

- New Member Offer

- New to Canada

- Merchant Payment Services

- Online Banking

- Remote Cheque Deposit for Business

- Payroll and Workforce Management

- Small Business Banking

- Clubs and Teams

- Personal Online Banking

- Business Online Banking

- Interac e-Transfer

- FAQs and Support

- CRA Direct Deposit

- Interac® sign-in service

- Real-Time Alerts

- Browser Security Update

- Deposit Anywhere

- Contact Centre

- Telebanking

- Member Card Debit Cards

- Credit Cards

- Lock'N'Block

- Holiday Hours

- How we're protecting you

- How you can protect yourself

- Security Alerts

- Report an Incident

- Multi-factor Authentication

- Calculators

- Finding your account information

- 5 reasons why credit cards are king

- 6 ways to combat inflation

- Buying a home with Affinity

- First-Time Home Buyer

- Renewing Your Mortgage

- Renovate or Upgrade

- Construction Mortgage

- Mobile Mortgage Specialists

- Mortgage Products

- Mortgage Switch

- Personal Loans

- Education Loans

- Restart Loans

- Credit Builder Loans

- Lines of Credit

- Revolving Credit

- Specialty Financing

- Government Programs

- Small Business Loan

- Ag Financial Advice

- Interac eTransfer

- Verified.Me™ Sign‑In

- Loan Preapproval Application Form

- GIC Products

- Market-Linked GICs

- RRSP Products

- TFSA Products

- FHSA Products

- Education Savings (RESP)

- Disability Savings (RDSP)

- RRIF Products

- NEI Investments

- Golden Opportunities Fund

- SaskWorks Fund

- Qtrade Guided Portfolios®

- Qtrade Direct Investing®

- Affinity Financial Strategies

- Pre-Authorized Contributions

- Retirement Planner Calculator

- How will the Home Buyers’ Plan changes affect me?

- Member Perks

- Affinity First in Line

- Our Leaders

- Shared Stories

- Choose Affinity

- Financial Literacy

- Engagement in the Community

- Community Stories

- Sponsorship and Donations

- Community Development Funding

- Elwood Harvey Co‑operative Leadership Award

- Build a Better World Scholarship

- Our Board of Directors

- Our Member Councils

- Nominations

- Annual General Meeting

- Annual Reports and Bylaws

- News and Features

- Chequing and Savings Account Rates

- RRSP and RRIF Rates

- Mortgage Rates

- Career Opportunities

- Working Here

- Report a Lost or Stolen Card

- Meet a Mobile Mortgage Specialist

- Complaint Handling

- Electronic Banking and Mobile Banking Services Agreement

- Debit Card Mobile Payment PIN Service Agreement

- Customer Automated Funds Transfer (CAFT) Agreements

- Declarations of Trust

- Terms and Conditions

- Disclaimers

- Market Code

- Privacy Policy

- Website Privacy Policy

IMAGES

COMMENTS

The costs of post-secondary education. All post-secondary schools charge tuition fees for their programs. For Canadian citizens and permanent residents, tuition fees are between $2,500 and $11,400 a year, depending on the school and program you’ve chosen. Tuition fees can be much higher for international students. Students will also have to ...

Canada’s post-secondary tuition fees are generally lower than colleges and universities in Australia, the U.K. and the U.S. (QS Top Universities, 2022). All costs are in Canadian dollars. Find exchange rates with the currency converter from the Bank of Canada. On this page. Primary and secondary school; Language school; College and vocational ...

Depending on which province you prefer or the area of study, the cost of tuition can be below or higher than the national average. Tuition for undergraduate students. On average, a full-time Canadian undergraduate student will pay $7,076 for a degree program in the 2023/2024 year. Meanwhile, that would cost an international student about $38,081.

The cost of post-secondary education in Canada RBC Dominion Securities Inc. Post-secondary education can be one of the most valuable investments you make for the future, but the costs can be significant if you haven’t planned for the expense. Tuition1 $5,959 $17,359 Student residence 2 $8,000 Books and course materials 2 $1,000 Technology3 $1,600

Nov 6, 2024 · The following interactive tools can help you save, plan and pay for post-secondary education after high school. Estimators. These custom planners and estimators can help you figure out how much school will cost, how much money you could receive in government loans to pay for school, and how much you might have to pay back when you are done.

Mar 20, 2024 · Information about post-secondary institutions’ programs and education costs presented by the EduCanada search tool are drawn from Employment and Social Development Canada’s (ESDC) Canadian Post-Secondary Institution Collection (CPIC) database. This information, including tuition fees, is updated by ESDC on a yearly basis and is subject to ...

Nov 8, 2023 · Next year, the average cost of a four-year post-secondary program in Canada will rise to just over $75,000 when factoring in residence costs. This figure is forecast to rise by 39 per cent over the next 18-years, reaching $104,898 by 2041.

Apr 14, 2021 · If you're wondering about the cost of post-secondary tuition in Canada for schools in different provinces, Statistics Canada has some data that might help you pick out your dream school. The data breaks down the average fees for Canadian students in each province for 2020 and 2021.

A typical apprenticeship program may cost approximately $1,500 but apprenticeship grants and incentives have the potential to absorb much of those costs. With so many costs to consider, careful financial planning is key to ensuring that students and families feel confident and comfortable managing the costs of their post-secondary education.

If you’re interested in learning more about the expenses associated with post-secondary education, please give us a call at 1.866.863.6237.We’re happy to help! Book an appointment today *Tuition average costs are according to Statistics Canada as of February 14, 2024.